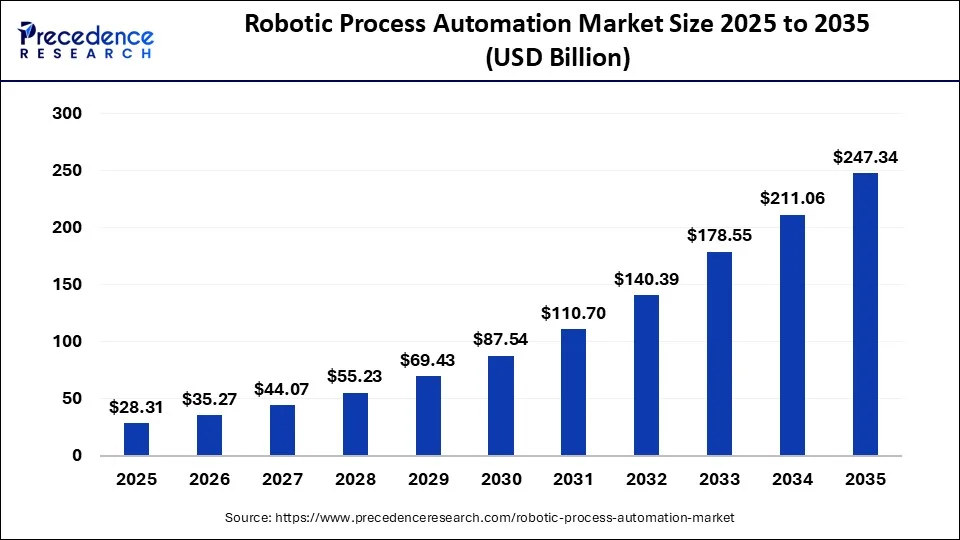

Ottawa, Dec. 16, 2025 (GLOBE NEWSWIRE) -- According to Precedence Research, the global robotic process automation (RPA) market size is valued at USD 28.31 billion in 2025 and is estimated to grow from USD 35.27 billion in 2026 to approximately USD 247.34 billion by 2035, expanding at a strong CAGR of 24.20% from 2026 to 2035. This robust growth is driven by accelerating digital transformation initiatives, rising adoption of AI-powered and cloud-based RPA solutions, and increasing demand for process efficiency, cost reduction, and compliance automation across key industries such as BFSI, healthcare, manufacturing, and retail.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1348

Robotic Process Automation Market Highlights:

- North America led the global market, accounting for 38.92% of total revenue in 2025, supported by advanced digital infrastructure and early adoption of automation technologies.

- By Type, the services segment dominated the market with a substantial 77.21% revenue share in 2025, driven by strong demand for consulting, implementation, and ongoing support services.

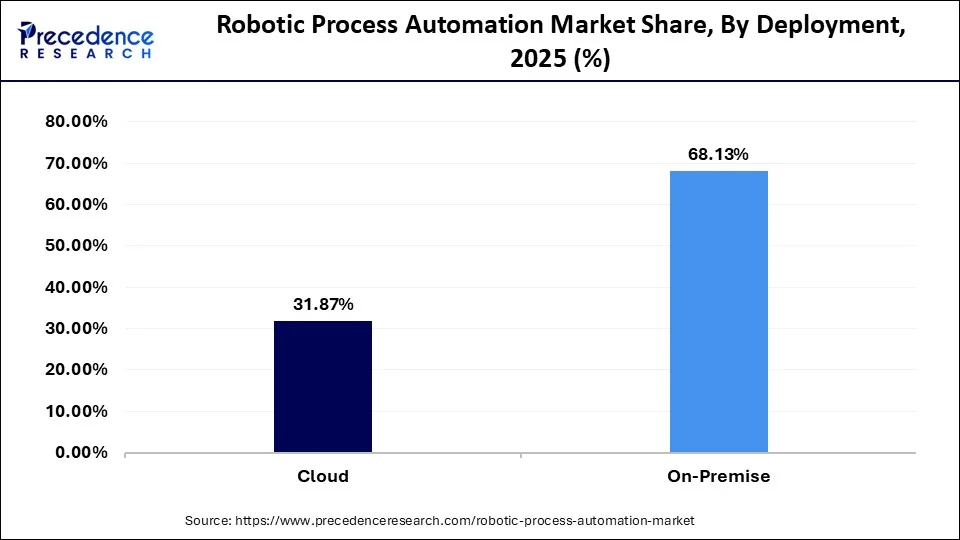

- By Deployment, on-premises solutions held a significant share, capturing over 68.13% of revenue in 2025, reflecting enterprises’ preference for enhanced data security and regulatory compliance.

- By Industry, the BFSI sector emerged as the largest contributor, generating 36.52% of market revenue in 2025, owing to widespread automation of banking operations, compliance, and transaction processing.

- By Component, software solutions dominated the market with a 67.80% share in 2025, supported by increasing adoption of RPA platforms for workflow automation.

- The services segment is expected to register the highest CAGR of 17.20% over the forecast period, fueled by rising demand for customization and managed automation services.

- By Deployment Model, on-premises RPA accounted for 58.40% of the market share in 2025, while cloud/SaaS-based RPA solutions are projected to grow at the fastest CAGR, driven by scalability, flexibility, and cost efficiency.

- By Application, finance & accounting dominated with a 22.80% market share in 2025, as organizations increasingly automate AP/AR, reconciliation, and reporting processes.

- The human resources segment is expected to grow at the highest CAGR of 17.90%, supported by rising automation of onboarding, payroll, and workforce management.

- By End-User Industry, BFSI remained the leading segment with a 29.40% share in 2025, while healthcare & pharmaceuticals are anticipated to witness the fastest growth at a CAGR of 18.80%, driven by the need for operational efficiency and improved patient-centric workflows.

➡️ Become a valued research partner with us https://www.precedenceresearch.com/schedule-meeting

What is Robotic Process Automation?

The robotic process automation market growth is driven by a strong focus on customer experience, expansion of the BFSI sector, increasing work complexity, digitalization of business, growing healthcare sector, rise in remote work, and a strong focus on addressing workforce gaps.

Robotic process automation (RPA) is a business automation process technology that uses software to perform repetitive tasks. RPA performs tasks like generating reports, data entry, handling customer service inquiries, and transaction processing using software robots. It consists of user-friendly interfaces and reduces errors.

RPA offers benefits like increased productivity, eliminating human error, managing compliance risk, increasing process transparency, automating workflows, lowering labor costs, and improving business agility. RPA integrates with various systems like user portals, websites, and other platforms. RPA is widely used across various applications like customer service, supply chain management, finance, and human resources.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Robotic Process Automation Market-Value Chain Analysis

- Quality Testing and Certifications

The quality testing involves testing of properties like data integrity, security, business workflows, bot performance, reliability, exception handling, & task accuracy, and certifications like NASSCOM, GSDC, & ISA CAP.

-

- Key Players:- Blue Prism, KiwiQA, Robiquity, UiPath, Automation Anywhere, Microsoft Power Automate

- Key Players:- Blue Prism, KiwiQA, Robiquity, UiPath, Automation Anywhere, Microsoft Power Automate

- Regulatory Compliance and Safety Monitoring

The key regulatory compliance involves industry-specific rules, data privacy, financial regulations, & data security and safety monitoring includes access control, audit trails, activity monitoring, & security frameworks.

-

- Key Players:- Automation Anywhere, Akitra, Terranoha, UiPath, Mindfire Solutions, Microsoft Power Automate, SynapseIndia

- Key Players:- Automation Anywhere, Akitra, Terranoha, UiPath, Mindfire Solutions, Microsoft Power Automate, SynapseIndia

➤ Get the Full Report @ https://www.precedenceresearch.com/robotic-process-automation-market

What are the Popular Robotic Process Automation Tools?

| RPA Tools | Features | Applications |

| SolveXia |

|

|

| Blue Prism |

|

|

| Automation Anywhere |

|

|

| UiPath |

|

|

| Pega |

|

|

Private Industry Investments in Robotic Process Automation:

- UiPath: This company raised a substantial $750 million in a Series F funding round in February 2021, with investments from firms like Coatue and Alkeon Capital Management, highlighting major private backing before its IPO.

- Automation Anywhere: A key player in the RPA market, Automation Anywhere has secured significant private funding, including investments from major entities like the SoftBank Vision Fund.

- Blue Prism (Acquisition by Vista Equity Partners): In 2021, the private equity firm Vista Equity Partners acquired Blue Prism Group for approximately $1.5 billion, with plans to merge it with Tibco Software.

- Nintex (Investment by TPG Capital): Private equity firm TPG Capital acquired Nintex (which has RPA capabilities) in 2021, with Thoma Bravo retaining a significant minority interest, to further an investment theme in enterprise automation.

- HyperScience: This AI-based RPA platform raised $100 million in a Series E round in December 2021, with investments from firms including Tiger Global Management, to advance its document processing and data extraction capabilities.

Key Trends of the Robotic Process Automation Market

- Integration of AI and Machine Learning (Intelligent Automation): RPA bots are no longer limited to basic, rule-based tasks but are integrating with artificial intelligence (AI) and machine learning (ML) to handle complex, data-driven processes that require cognitive abilities like natural language processing (NLP) and predictive analytics.

- Shift to Cloud-Based RPA Solutions: Organizations are increasingly adopting cloud-native RPA platforms due to their enhanced scalability, faster deployment times, and lower upfront infrastructure costs compared to on-premise systems.

- Rise of Hyperautomation: Businesses are pursuing hyperautomation strategies, which combine RPA with a mix of other technologies such as process mining, analytics, and AI, to achieve end-to-end automation of complex business workflows across entire enterprises.

✚ Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

Robotic Process Automation Market Opportunity

What is an Opportunity for the Robotic Process Automation Market?

Growing Finance Sector Surges Demand for Robotic Process Automation

The growing finance sector and increasing demand for automating repetitive tasks increase the adoption of RPA. Tasks like report generation, data entry, and invoice processing in the financial industry increase demand for RPA. The focus on enhancing customer experiences, like account opening, customer onboarding, and others, increases demand for RPA.

The increasing demand for account setup and document verification increases the adoption of RPA. The increasing demand for automating transaction processes like transfers, payments, and others increases the adoption of RPA. The generation of financial reports and other reports needs RPA. Processes like accounts payable management and loan processing increase demand for RPA. The growing financial sector creates an opportunity for market.

What is the Limitation of the Robotic Process Automation Market?

High Implementation Cost Limits Expansion of the Market

Despite several benefits of robotic process automation in various industries, the high implementation cost restricts the market growth. Factors like high investment in software, complexity of bots, integration with existing systems, vendor pricing, maintenance, and initial process analysis are responsible for high implementation costs. The high investment in implementation, software licenses, and hardware infrastructure directly affects the market.

The complexity of the development of RPA solutions and the need for SDLC increase the cost. The complexity of bonds and the increasing number of bots increase the implementation cost. The ongoing RPA integration with the existing infrastructure and software increases the cost. The need for support, maintenance, and monitoring increases the implementation cost. The high implementation cost hampers the growth of the market.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Robotic Process Automation Market Report Coverage

| Report Highlights | Details |

| Growth Rate (2026–2035) | CAGR of 24.20% |

| Market Size in 2025 | USD 28.31 Billion |

| Market Size in 2026 | USD 35.27 Billion |

| Market Size by 2035 | USD 247.34 Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Largest Regional Market | North America, driven by advanced IT infrastructure, early adoption of automation, and strong enterprise demand |

| Fastest-Growing Regional Market | Asia Pacific, supported by rapid digital transformation, expanding SME adoption, and government-led automation initiatives |

| Key Market Drivers | - Rising adoption of AI-powered and intelligent automation - Growing need for operational efficiency and cost optimization - Increasing automation demand across BFSI, healthcare, IT, and manufacturing |

| Technology Trends | - Integration of AI, ML, OCR, and NLP into RPA platforms - Growing shift toward cloud-based and SaaS RPA solutions |

| Segments Covered | Type, Deployment Model, Component, Application, End-User Industry, Region |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Enterprise Adoption Focus | - Large enterprises for complex, high-volume automation - SMEs increasingly adopting cloud and managed RPA solutions |

Case Study: AI-Powered Robotic Process Automation Transforming BFSI Operations

Client Profile

A leading North America–based multinational banking and financial services institution with operations across retail banking, corporate banking, and insurance, serving millions of customers globally.

Business Challenge

The organization faced growing operational challenges due to:

- High volumes of manual, repetitive processes across KYC verification, loan processing, account reconciliation, and compliance reporting

- Rising regulatory pressure requiring accurate audit trails and faster reporting

- Increasing operational costs and error rates caused by manual data entry

- Demand for faster customer onboarding and improved service turnaround times

These challenges were further intensified by workforce constraints and the need to scale operations without significantly increasing headcount.

RPA Solution Implemented

The bank deployed an AI-enabled Robotic Process Automation (RPA) platform integrated with existing core banking, CRM, and ERP systems. The solution included:

- Unattended bots for KYC document verification, transaction reconciliation, and regulatory reporting

- AI and OCR integration to process unstructured documents such as identity proofs and financial statements

- Workflow orchestration and analytics dashboards for real-time monitoring and compliance tracking

- Hybrid deployment model, combining on-premises infrastructure for sensitive data and cloud-based scalability for non-critical processes

Key Automation Use Cases

- Automated customer onboarding and KYC validation

- Loan application processing, including credit checks and document verification

- Accounts payable and receivable (AP/AR) automation

- Regulatory compliance reporting and audit trail generation

- Fraud detection support through rule-based and AI-assisted bots

Business Impact & Measurable Outcomes

Within 12 months of implementation, the organization achieved:

- 60–70% reduction in processing time for KYC and loan approval workflows

- Over 45% reduction in operational costs related to manual processing

- Near-zero data entry errors, improving regulatory compliance and audit readiness

- Improved customer experience, with onboarding timelines reduced from days to hours

- Scalable automation framework, enabling rapid deployment of new bots across departments

Strategic Value

- Enabled the bank to scale automation enterprise-wide without disrupting legacy systems

- Strengthened regulatory compliance and risk management capabilities

- Freed employees to focus on higher-value, customer-centric activities

- Positioned the organization for hyperautomation, integrating AI, analytics, and process mining

Industry Insight

This case study reflects a broader trend highlighted in the Robotic Process Automation market, where BFSI remains the leading adopter, driven by compliance needs, cost efficiency, and digital-first customer expectations. As AI-powered and cloud-based RPA solutions mature, similar institutions globally are accelerating adoption to remain competitive and resilient.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1348

Robotic Process Automation Market Segmentation Insights:

Type Insights

Why did the Service Segment Dominate the Robotic Process Automation Market?

The service segment dominated the market in 2024. The growing optimization of processes like support, maintenance, and training increases demand for RPA services. The focus on bridging the gap between new technologies and legacy systems increases the adoption of RPA services. The increasing demand for customized solutions in industries and organizations increases the adoption of RPA services. The growing demand for various RPA services like strategy, support, assessment, maintenance, and deployment drives the overall growth of the market.

The software segment is the fastest-growing in the market during the forecast period. The increasing need for automating tasks like customer service, data entry, and invoice processing increases demand for RPA software.

The growing businesses' demand for improving productivity, optimizing operations, and reducing costs increases the adoption of RPA software. The growing integration of ML & AI in RPA software helps market growth. The growing adoption of RPA software in healthcare, manufacturing, finance, and retail supports the market growth.

Deployment Insights

How On-Premises Segment hold the Largest Share in the Robotic Process Automation Market?

The on-premises segment held the largest revenue share in the market in 2024. The growing demand for data security and control in RPA infrastructure increases the demand for on-premises solutions. The stricter regulatory compliance financial sector increases adoption of on-premises. The increasing integration of RPA with existing legacy systems and the need for customization increase demand for on-premises solutions, supporting the overall growth of the market.

The cloud segment is experiencing the fastest growth in the market during the forecast period. The focus on scaling automation processes and the availability of subscription models increase the adoption of cloud-based solutions. The ease of implementation of cloud-based RPA solutions helps market growth. The increased access to advanced features like analytics & AI, and growing adoption of Software-as-a-Service in businesses support the overall growth of the market.

End-User Industry Insights

Which End-User Dominated the Robotic Process Automation Market?

The BFSI segment dominated the market in 2024. The increasing need for automating the KYC process and opening new banking accounts increases the adoption of RPA. The increasing demand for automating loan processing and credit card processing increases the demand for RPA. The growing anti-money laundering and fraud detection problems increase the adoption of RPA, driving the overall growth of the market.

The healthcare segment is the fastest-growing in the market during the forecast period. The increasing demand for automating tasks in healthcare facilities, like appointment scheduling, claims processing, patient registration, data entry, and billing, increases the adoption of RPA. The focus on improving patient care and increasing the need for personalised care increases the adoption of RPA. The increasing popularity of telehealth services and demand for faster diagnosis of diseases increases the adoption of RPA, supporting the overall growth of the market.

Robotic Process Automation Market Regional Outlook

How North America Dominated the Robotic Process Automation Market?

North America dominated the market in 2024. The well-developed technological infrastructure, like AI & cloud computing, increases the development of robotic process automation. The growing digital transformation and the need to automate routine tasks increase demand for robotic process automation.

The strong government support for the adoption of RPA and the growing adoption of RPA across various industries like retail, BFSI, and healthcare help the market growth. The strong presence of major RPA players like IBM, UiPath, and Automation Anywhere drives the overall growth of the market.

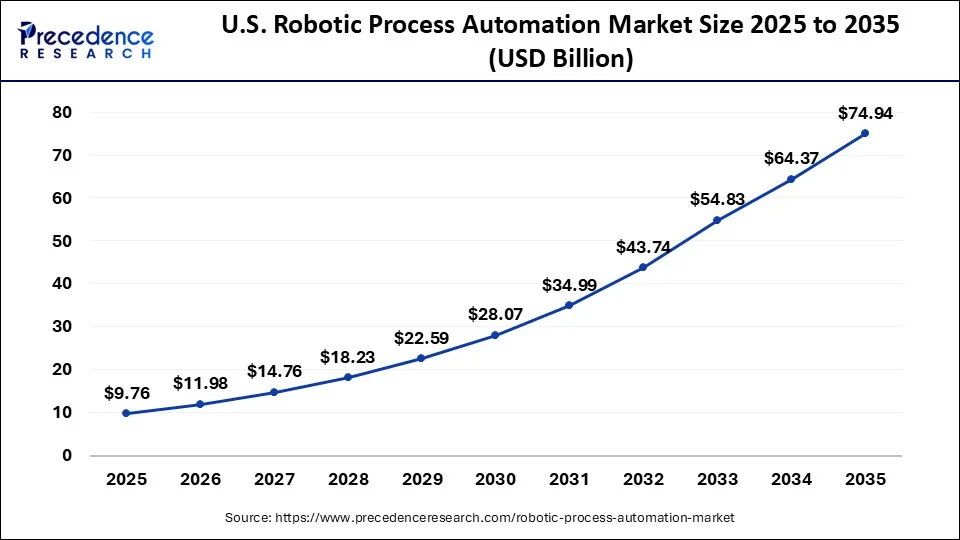

How Big is the U.S. Robotic Process Automation Market Size and Growth?

According to Precedence Research, The U.S. robotic process automation market size is expected to be worth USD 74.94 billion by 2035, up from USD 9.76 billion in 2025. The market is poised to grow at a solid CAGR of 22.61% from 2026 to 2035.

U.S. Robotic Process Automation Market Trends

The U.S. is a major contributor to the market. The well-established technological infrastructure in cities like NYC & San Fransico and growing artificial intelligence are increasing the development of RPA. The increasing use of RPA in sectors like healthcare, government, BFSI, and retail helps market growth. The increasing investment in digital transformation and the presence of major players like IBM, UiPath, & Automation Anywhere drive the market growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/checkout/1348

Canada’s Innovations in Robotic Process Automation

Canada is substantially growing in the market. The strong government support for digital transformation and focus on automating repetitive tasks increases demand for RPA. The growing sectors like healthcare, retail, and BFSI increase demand for RPA. The growing labor cost and focus on faster data analysis require RPA. The integration of analytics, AI, and ML with RPA supports the overall market growth.

Why is the Asia Pacific Region Experiencing the Fastest Growth in the Robotic Process Automation Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The ongoing digital transformation and strong government support for the adoption of RPA are increasing the development of RPA solutions. The growing integration of machine learning & AI with RPA solutions and increasing adoption of RPA in medium-sized & small enterprises help the market growth. The growing adoption of RPA in sectors like manufacturing, retail, BFSI, and healthcare supports the overall growth of the market.

China Robotic Process Automation Market Trends

China is a key contributor to the market. The increasing need for managing complex operations and the rise in labor costs increase demand for RPA. The generation of a vast amount of data and national support for upgrading manufacturing increases demand for RPA. The well-established technological infrastructure and growing domestic production of robotics components drive the overall market growth.

India’s in Innovations Robotic Process Automation

India is significantly growing in the market. The strong focus on lowering errors and the well-established IT infrastructure increases demand for RPA. The digital India program and the rise in AI-powered chatbots increase demand for RPA. The growing sectors like IT, retail, BFSI, & healthcare, and focus on automating repetitive tasks, increase demand for RPA, supporting the overall market growth.

Europe Robotic Process Automation Market Trends

Europe is growing at a notable rate in the market. The rapid growth of industries like insurance, manufacturing, and BFSI increases demand for RPA. The high expenses of labor and focus on lowering manual dependency increase the adoption of RPA. The strong government support for digital transformation and technological innovations like IoT, AI, & ML increases demand for RPA. The increasing use of cloud-based RPA and strong regulatory environments drives the market growth.

✚ Related Topics You May Find Useful:

➡️ Robotic Process Automation in Healthcare Market: Explore how intelligent automation is streamlining clinical workflows, revenue cycle management, and patient data handling

➡️ Robotic Process Automation in Legal Service Market: Discover how law firms and legal departments are leveraging automation to accelerate document review, compliance, and case management

➡️ Robotic Platform Market: Analyze the rise of unified robotic platforms enabling scalable, AI-integrated automation across industrial and service applications

➡️ Robotics Technology Market: Gain insights into core robotics technologies shaping next-generation automation, including AI, sensors, and machine vision

➡️ Industrial Automation Market: Understand how smart factories, Industry 4.0, and connected systems are transforming manufacturing efficiency and productivity

➡️ Advanced Robotics Market: Track innovations in autonomous, collaborative, and intelligent robots driving adoption across healthcare, logistics, and manufacturing

➡️ Service Delivery Automation Market: See how enterprises are automating IT, HR, and customer service operations to improve service quality and reduce costs

➡️ Robotic Arm Market: Explore growing demand for high-precision robotic arms across automotive, electronics, and industrial assembly applications

Top Companies in the Robotic Process Automation Market & Their Offerings:

- UiPath UiPath provides an end-to-end automation platform that uses AI-powered software robots to manage the entire automation lifecycle.

- Automation Anywhere Automation Anywhere offers a cloud-native, AI-driven intelligent automation platform that uses various types of software bots to automate complex business processes.

- Blue Prism Blue Prism provides an enterprise-grade RPA platform featuring a scalable and secure "digital workforce" designed to automate complex back-office operations.

- NICE NICE offers automation solutions (including NEVA) that specialize in both attended real-time employee assistance and unattended back-office task automation.

- Pegasystems Pegasystems offers RPA as part of its unified low-code platform, known for seamless integration and supporting natural language processing for automation tasks.

- Celaton Ltd. Celaton provides the inSTREAM intelligent automation platform that leverages AI and machine learning specifically to process and automate tasks involving unstructured content like emails and documents.

- KOFAX, Inc. Kofax offers an intelligent automation platform that combines RPA with cognitive capture and business process management (BPM) for end-to-end process automation.

- NTT Advanced Technology Corp. NTT Advanced Technology offers the "WinActor" RPA tool, a popular solution in Japan that automates operations by mimicking human actions across various Windows applications.

- EdgeVerve Systems Ltd. EdgeVerve provides the "AssistEdge" RPA platform, which offers comprehensive tools for process discovery, bot management, and implementing both attended and unattended automation.

- FPT Software FPT Software offers the "akaBot" platform, an enterprise-grade RPA solution designed to automate repetitive tasks and optimize operational efficiency with AI integration.

- OnviSource, Inc. OnviSource offers an RPA solution focused on automating tasks within the contact center and general enterprise operations, leveraging a suite of workforce optimization tools.

- HelpSystems HelpSystems (Fortra) provides the "Automate" platform, which offers an easy-to-use solution for automating a wide range of IT and business processes without extensive coding.

- Xerox Corporation Xerox leverages RPA as part of its broader business process automation services, offering solutions that streamline document processing and data entry within existing organizational systems.

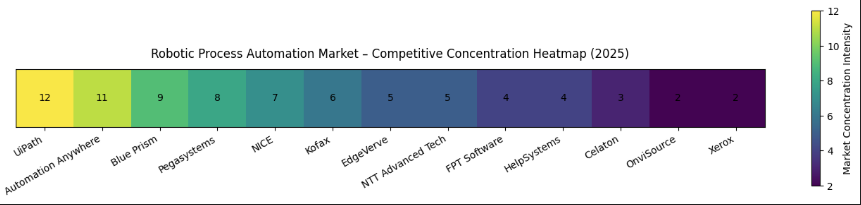

Robotic Process Automation Market Concentration

Tier 1: Market Leaders (High Concentration – ~45–55% Combined Share)

These players dominate due to global presence, strong enterprise adoption, and continuous AI innovation:

- UiPath

- Automation Anywhere

- Blue Prism

- Pegasystems

- NICE

Key Characteristics

- End-to-end automation platforms

- Strong AI, ML, NLP, and orchestration capabilities

- Deep penetration in BFSI, healthcare, manufacturing, and government

- High share of large-enterprise deployments

Tier 2: Established & Fast-Growing Vendors (~25–30% Combined Share)

These players strengthen competition through niche specialization, regional dominance, or industry-specific solutions:

- KOFAX, Inc.

- EdgeVerve Systems Ltd.

- NTT Advanced Technology Corp.

- FPT Software

- HelpSystems (Fortra)

Key Characteristics

- Strong presence in document automation, BPM, and attended RPA

- Growing adoption in Asia Pacific and Europe

- Competitive pricing and faster customization for enterprises

Tier 3: Niche & Emerging Specialists (~15–20% Combined Share)

Focused on specialized use cases such as unstructured data, contact centers, and document-heavy workflows:

- Celaton Ltd.

- OnviSource, Inc.

- Xerox Corporation

Key Characteristics

- High-value niche automation solutions

- Strong use cases in contact centers, document processing, and content automation

- Increasing relevance through AI-driven specialization

Market Concentration

| Metric | Insight |

| Market Type | Moderately concentrated |

| Top 5 Players Share | ~45–55% |

| Competitive Intensity | High |

| Entry Barriers | Medium (technology, integration complexity, enterprise trust) |

| Growth Strategy | AI integration, cloud RPA, hyperautomation, partnerships |

Strategic Implications

- Market leaders are strengthening dominance through AI-powered intelligent automation and cloud-native platforms

- Tier-2 players are gaining ground via regional expansion and vertical-specific offerings

- Niche players are becoming acquisition targets as hyperautomation accelerates

- Enterprises benefit from vendor diversity, pricing competition, and rapid innovation

Recent Developments in the Robotic Process Automation Industry:

- In July 2025, Deloitte collaborated with UiPath to launch agentic GBS for enterprise automation. The automation solution integrates technologies like generative AI, workflow orchestration, robotic process automation, and machine learning. The solution coordinates across platforms, performs an end-to-end process, and makes context-aware decisions. The solution is applicable in industries like HR, supply chain, finance, and IT. (Source: https://www.techcircle.in)

Segments Covered in the Report

By Component

- Software

- RPA Development Tools

- RPA Runtime Tools (Bot Execution Engines)

- RPA Orchestration/Control Center

- RPA Analytics & Dashboard Tools

- Pre-built Bots/Bot Marketplace Platforms

- Integration Middleware/API Gateways

- Services

- Consulting

- Process Identification & Prioritization

- ROI & Feasibility Analysis

- Implementation & Deployment

- Workflow Mapping & Bot Configuration

- Integration with Legacy & ERP Systems

- Support & Maintenance

- Bot Lifecycle Management

- Version Control & Updates

- Training

- User Training (Non-technical)

- Bot Developer Training (Low-code/No-code or Advanced)

- RPA-as-a-Service (RPAaaS)

- Fully Managed Services

- Pay-per-bot / Pay-per-process models

- Consulting

By Deployment Model

- On-Premises

- Cloud / SaaS

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Technology Type / Operation

- By Intelligence Level

- Rule-Based RPA (Traditional)

- Static rules

- Structured data

- Intelligent/Cognitive RPA

- Natural Language Processing (NLP)

- Optical Character Recognition (OCR)

- Machine Learning (ML)

- Computer Vision

- Conversational AI Integration (e.g., chatbots)

- Rule-Based RPA (Traditional)

- By Bot Type

- Attended RPA

- Desktop Assistance Bots

- Trigger-Based Execution

- Attended RPA

- Unattended RPA

- Batch Processing Bots

- Scheduled or Triggered by System Events

- Hybrid RPA

By Application / Process

- Administration & Reporting

- Data Entry & Validation

- Report Generation & Distribution

- Data Migration & Capture Extraction

- Legacy System Data Migration

- Invoice & Document Data Capture

- Customer Support

- Ticket Management

- Customer Data Update

- FAQ Automation

- Analysis & Decision Support

- Data Aggregation

- Pre-analytics Reporting

- Compliance & Risk

- Audit Trail Creation

- Regulatory Reporting

- Finance & Accounting

- AP/AR Automation

- Bank Reconciliation

- Expense Processing

- Human Resources

- Onboarding & Offboarding

- Payroll Processing

- Leave & Attendance Management

- Procurement

- PO Creation & Approval Workflows

- Vendor Contract Management

- IT Operations

- Password Resets

- Software Installations & Monitoring

- Others

- Marketing Campaign Management

- Product Catalog Updates

By End-User Industry

- BFSI (Banking, Financial Services, and Insurance)

- IT & Telecommunication

- Healthcare & Pharmaceuticals

- Manufacturing & Logistics

- Retail & Consumer Goods

- Government & Defense

- Energy & Utilities

- Others

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1348

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

✚ Explore More Market Intelligence from Precedence Research:

➡️ Generative AI in Life Sciences: Explore how AI innovations are revolutionizing drug discovery, research efficiency, and precision medicine.

➡️ Biopharmaceuticals Growth: Understand the accelerating expansion of biologics, therapeutic proteins, and cutting-edge pharma pipelines.

➡️ Digital Therapeutics: Discover how technology-driven treatments are reshaping patient care and improving clinical outcomes.

➡️ Life Sciences Growth: Gain insights into emerging opportunities, market expansion, and innovation trends in the life sciences sector.

➡️ Viral Vector & Gene Therapy Manufacturing: Analyze the production advancements powering next-generation gene therapies and precision medicine.

➡️ Wellness Transformation: See how consumer wellness trends are shaping supplements, functional foods, and lifestyle-driven markets.

➡️ Generative AI in Healthcare: Unlocking Novel Innovations in Medical and Patient Care: Explore AI applications enhancing diagnostics, treatment personalization, and patient engagement.

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter