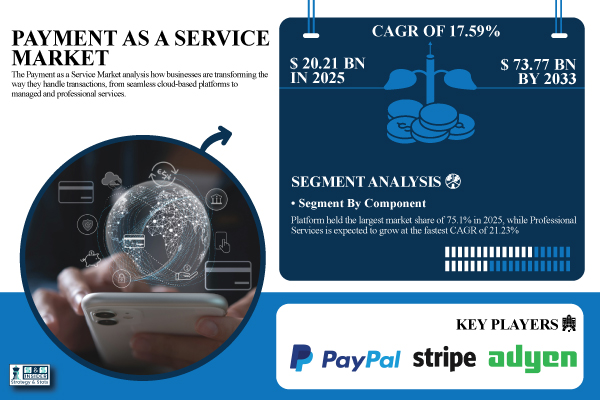

Austin, Nov. 04, 2025 (GLOBE NEWSWIRE) -- The Payment as a Service Market size was valued at USD 20.21 Billion in 2025E and is projected to reach USD 73.77 Billion by 2033, growing at a CAGR of 17.59% over 2026–2033.

The rapid take-up of mobile and digital wallet services, as consumers seek super-fast, convenient transaction experiences is boosting the growth of the Payment as a Service Market growth globally.

Download PDF Sample of Payment as a Service Market @ https://www.snsinsider.com/sample-request/8671

The U.S. Payment as a Service Market reached USD 6.03 Billion in 2025E and is projected to hit USD 21.42 Billion by 2033 at a CAGR of 17.18%.

The U.S. market growth is accelerated by cloud platforms, digital wallets, increasing e-commerce penetration and need for frictionless, secure and contact-less payments services.

Segmentation Analysis:

By Component

The Platform segment, holding a 75.1% share in 2025, dominates the market due to the growing adoption of integrated digital payment ecosystems that streamline transaction management, analytics, and security. Professional Services, projected to grow at a CAGR of 21.23%, are driven by the need for expert-led system integration, customization, compliance consulting, and managed services supporting digital transformation.

By Deployment Mode

The Cloud segment, with a 58.3% share in 2025, leads the market as organizations shift toward SaaS-based payment platforms that offer scalability, flexibility, and cost efficiency. On-Premises deployment, expected to grow steadily at a CAGR of 19.12%, appeals to firms prioritizing data sovereignty, customization, and compliance with internal or regulatory standards.

By Organization Size

Large Enterprises, accounting for 69.4% of the market in 2025, dominate due to their ability to invest in advanced digital payment platforms, AI-driven fraud prevention, and large-scale integration systems. SMEs, expanding at a CAGR of 21.23%, benefit from affordable cloud-based solutions, government-led digitalization programs, and increasing acceptance of contactless payments.

By Industry Vertical

The BFSI segment, with a dominant 35.02% market share in 2025, continues to lead owing to high transaction volumes, fintech collaborations, and growing demand for secure, instant payment solutions. Healthcare segment is expected to witness the fastest growth at a CAGR of 20.1%, driven by the need for digital billing, patient payment portals, and automation in reimbursement processes.

By Payment Method

Digital Wallets, holding 50.07% of the market in 2025, remain the preferred payment option due to convenience, mobile integration, and contactless payment adoption. Bank Transfers, projected to grow at the fastest CAGR of 23.41%, are gaining traction with the rise of instant payment networks, open banking initiatives, and enhanced transaction security measures.

If You Need Any Customization on Payment as a Service Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8671

Regional Insights:

In 2025, North America accounted for 41.23% of the global Payment as a Service market, serving over 420,000 enterprises. The region’s growth in the market is projected to expand at a moderate pace through 2033, supported by continued fintech advancements and e-commerce growth.

The Asia Pacific Payment as a Service market, the fastest-growing region, is projected to expand at a CAGR of 18.80% through 2033. Digital payments are rapidly expanding across the region, prompted by increasing e-commerce sales, fintech innovation and mobile payment uptake.

Key Players:

- PayPal

- Stripe

- Square (Block, Inc.)

- Adyen

- Worldpay (Global Payments)

- FIS

- Visa

- Mastercard

- American Express

- Apple Pay

- Google Pay

- Alipay

- WeChat Pay

- Klarna

- Affirm

- Braintree (a PayPal service)

- Toast

- Remitly

- ACI Worldwide

- Paysafe

Payment as a Service Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025 | USD 20.21 Billion |

| Market Size by 2033 | USD 73.77 Billion |

| CAGR | CAGR of 17.59% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Platform, Professional Services, Managed Services, Others) • By Deployment Mode (Cloud, On-Premises, Others) • By Organization Size (Large Enterprises, SMEs, Others) • By Industry Vertical (BFSI, Retail & E-commerce, Healthcare, Travel & Hospitality, Government, Others) • By Payment Method (Credit/Debit Cards, Digital Wallets, Bank Transfers, Others) |

| Customization Scope | Available upon request |

| Pricing | Available upon request |

Buy Full Research Report on Payment as a Service Market 2026-2033 @ https://www.snsinsider.com/checkout/8671

Recent Developments:

- In September 2025, in a deal with Google, PayPal will add AI and analytics to payment services. It also rolled out “PayPal World” to make cross-border transactions easier, integrating with domestic systems, such as India’s UPI for more efficient international payments.

- In July 2025, Stripe launched Managed Payments to power tax, dispute and global checkout features for sellers. And it rolled out AI-powered dispute tools and 25 new payment methods to access global payments.

Exclusive Sections of the Report (The USPs):

- Market Trend Indicators – highlights key trends such as the surge in cross-border payments via PaaS and the expanding share of PaaS-enabled e-commerce transactions, helping you track evolving digital payment behaviors across regions.

- Investment & Funding Metrics – provides insights into annual funding flows, venture capital participation, and the growing number of M&A activities in the PaaS ecosystem, allowing you to identify where capital and consolidation are shaping the market.

- Risk & Regulatory Metrics – helps you assess the percentage of enterprises facing compliance and security challenges, along with data on breaches and regulatory impacts, enabling proactive risk mitigation strategies.

- Innovation & Product Metrics – explores the adoption of AI, blockchain, and API-driven technologies in PaaS platforms, helping you uncover innovation hotspots and the rate of new platform launches shaping market competitiveness.

- Technological Adoption Index – quantifies the pace at which next-generation technologies are integrated within PaaS solutions, guiding stakeholders on where automation and intelligence are driving differentiation.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.