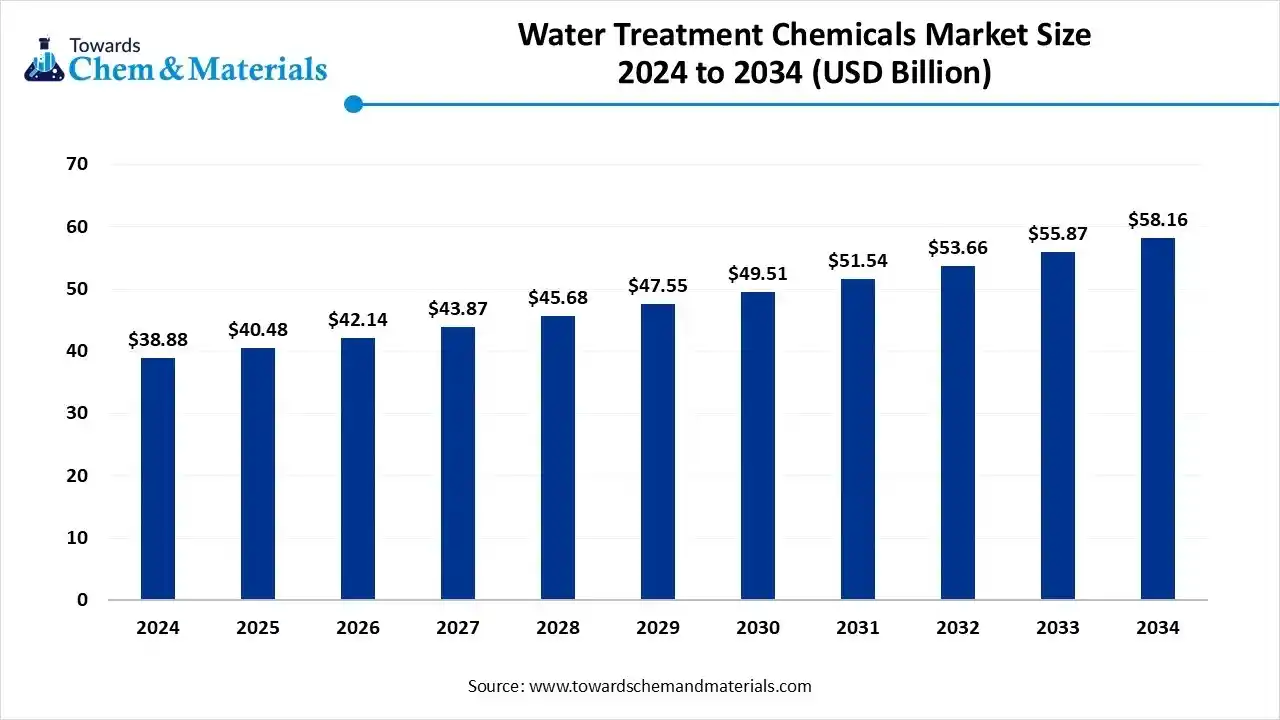

Ottawa, Nov. 04, 2025 (GLOBE NEWSWIRE) -- The global water treatment chemicals market size was valued at USD 38.88 billion in 2024 and is anticipated to reach around USD 58.16 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.11% over the forecast period from 2025 to 2034. North America dominated the water treatment chemicals market with a market share of 33% in 2024. Increasing demand for clean and safe drinking water due to rapid urbanization and industrialization is driving the growth of the water treatment chemicals market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5936

Water Treatment Chemicals Overview

The global water treatment chemicals market is experiencing steady expansion, driven by the escalating need for clean drinking water, rising water scarcity concerns, and the growing focus on wastewater treatment and reuse across municipal and industrial segments. Aging water infrastructure, increasing industrialization, and stricter environmental regulations are pushing utilities and industrial operators to adopt chemical-based solutions for managing corrosion, scaling, microbiological growth, and contaminant removal.

Advances in technology, such as AI-enabled dosing, bio-based chemistries, and smarter monitoring systems, are reshaping how chemicals are formulated and used in water treatment processes. Regionally, mature markets are being supported by regulatory upgrades and infrastructure renovation, while margining markets are seeing rapid growth in industrial water needs and municipal treatment investment.

Water Treatment Chemicals Market Report Highlights

- North America dominated the market and accounted for the largest revenue share of 33% in 2024.

- By product, the coagulants & flocculants segment accounted for the largest revenue share of 42% in 2024.

- By application, the raw water treatment segment held the largest revenue share of 51% in 2024.

- By end-use, the municipal segment accounted for the largest revenue share of around 45% in 2024.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5936

Top 10 Water Treatment chemicals Market and How They Work

The secret behind clean, safe water? It’s all about these essential chemicals! Discover how they protect your systems and improve efficiency.

Water treatment chemicals are essential for safeguarding both public health and the environment. These chemicals help ensure that drinking water is safe, free from harmful contaminants, and properly balanced. They also play a key role in maintaining the integrity of industrial water systems by preventing issues like corrosion in pipelines and cooling systems, which can damage equipment and reduce efficiency. Whether for municipal water supplies or industrial operations, using the right water treatment chemicals is crucial for promoting public health, protecting resources, and fostering sustainability. As a UK-based distributor, we provide a variety of water treatment products that help meet these critical needs while ensuring the health and safety of communities.

1. Citric Acid

Role: Scale remover

How It Works: Citric acid is widely used in water systems to remove scale and mineral deposits, which can reduce efficiency in piping and machinery. It chelates (binds) with metal ions, breaking down and dissolving scale build-up, ensuring smooth water flow and system longevity.

2. Ferric Chloride

Role: Coagulation

How It Works: Ferric chloride is a powerful coagulant that helps bind fine particles in water into larger clumps (flocs). These flocs can then be easily removed through sedimentation or filtration. It is particularly effective in wastewater treatment for removing phosphates and suspended solids.

3. Ferric Sulphate

Role: Coagulant

How It Works: Similar to ferric chloride, ferric sulphate acts as a coagulant, making suspended solids stick together, allowing them to settle more easily. It is especially effective in the removal of colloidal particles and for treating industrial wastewater.

4. Hydrochloric Acid

Role: pH Adjustment & Descaling

How It Works: Hydrochloric acid (HCl) is commonly used in water treatment to lower the pH of alkaline water. It also serves as a descaling agent, breaking down lime scale and other deposits that form in boilers, heat exchangers, and pipes, maintaining system efficiency.

5. Hydrogen Peroxide

Role: Oxidizing Agent

How It Works: Hydrogen peroxide is a powerful oxidizing agent used to disinfect water by breaking down organic matter, bacteria, and other harmful contaminants. It decomposes into oxygen and water, leaving no toxic residues, making it a greener alternative to some other disinfectants.

6. Phosphoric Acid

Role: Corrosion Inhibitor

How It Works: Phosphoric acid is used to prevent corrosion in metal pipes and tanks by forming a protective layer of phosphate salts. It is particularly beneficial in systems where water is highly corrosive, extending the lifespan of the infrastructure.

7. Poly Aluminium Chloride (PAC)

Role: Coagulant

How It Works: PAC is one of the most efficient coagulants for water treatment. It helps remove suspended solids and organic materials by promoting the formation of larger flocs, which can then be filtered out. It works over a wide pH range, making it versatile for different water conditions.

8. Sodium Chlorite

Role: Precursor for Chlorine Dioxide

How It Works: Sodium chlorite is used to generate chlorine dioxide, an effective disinfectant. Chlorine dioxide is ideal for killing bacteria and viruses, and is often used in municipal water treatment for its powerful oxidizing properties without forming harmful chlorination by-products.

9. Sodium Hypochlorite

Role: Disinfectant

How It Works: Sodium hypochlorite, commonly known as bleach, is one of the most common water disinfectants. It releases chlorine, which eliminates bacteria, viruses, and other harmful pathogens, ensuring water is safe for use.

10. Sodium Molybdate

Role: Corrosion Inhibitor

How It Works: Sodium molybdate is used to prevent corrosion in water systems by forming a protective layer over metal surfaces. This helps avoid rust and corrosion, particularly in cooling towers and boilers, improving the longevity of water treatment equipment.

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5936

Water Treatment Chemicals Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 42.14 billion |

| Revenue forecast in 2034 | USD 58.16 billion |

| Growth rate | CAGR of 4.11% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2020 - 2024 |

| Forecast period | 2025 - 2034 |

| Segments covered | Product, end-use, application, region |

| Regional scope | North America, Europe, Asia Pacific, Central & South America, MEA |

| Key companies profiled | SUEZ; BASF SE; Ecolab; Solenis; Nouryon; Kemira; Baker Hughes Company; Dow; SNF; Cortec Corporation , SNF, Veolia, Solvay S.A., Cortec Corporation, Bosch Somicon ME FZC, Johnson Matthey , |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What Are the Major Trends In The Water Treatment Chemicals Market?

- Increased adoption of bio-based and green chemical solutions as sustainability becomes central to water treatment strategies, with emphasis on lower residual toxicity and compliance with tighter environmental regulations.

- Integration of digital technologies such as AI, real-time monitoring, and smart dosing platforms to optimize chemical usage, improve control of water quality parameters, and reduce operational wastage.

- A growing focus on water reuse, recycling, and zero liquid discharge (ZLD) frameworks is driving demand for specialized chemicals tailored to high recovery and low wastage systems.

- Expansion of treatment needs in industrial water applications as well as in municipal infrastructure upgrades, creating broader demand profiles for water treatment chemicals.

- Rising regulatory pressure and infrastructure modernisation are pushing the adoption of advanced chemical formulations, hybrid treatment methods, and legacy system replacement.

How Does AI Influence the Growth Of The Water Treatment Chemicals Market In 2025?

In 2025, the integration of artificial intelligence (AI) into the water treatment chemicals sector is catalysing a transformation of operational practices by enabling treatment plants to analyse real-time data on parameters such as chemical concentration, pH, and turbidity, thereby optimising dosing regimens and reducing waste of chemicals. This increased precision supports more consistent water quality standards and lowers the cost footprint of chemical usage, which in turn enhances the appeal of chemical solutions in both municipal and industrial applications.

Simultaneously, AI-driven predictive maintenance and anomaly detection are empowering plant operators to foresee equipment faults and shifts in water system behaviour before they escalate, allowing chemical suppliers to collaborate more closely on outcome-based services rather than just product sales.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5936

Water Treatment Chemicals Market Dynamics

Growth Factors

Is Rising Urban Water Scarcity Fuelling Chemical Demand?

Rapid urbanisation and heightened water scarcity are placing intense pressure on municipal and industrial water sources, which in turn drives greater demand for water treatment solutions to preserve and reuse available supplies. As cities grow and land use shifts increase runoff and pollution, water quality declines, and treatment needs multiply, creating new opportunities for chemical-based treatment approaches.

Is The Circular Economy Trend Boosting Chemicals for Reuse And Recycling?

As businesses and utilities embrace circular economy models, the push for water reuse and internal recycling is growing, encouraging investment in advanced chemical treatments that enable high-quality discharge or reuse. This shift from linear “use-and-dispose” patterns to closed-loop water management elevates demand for specialty treatment chemistries that handle complex wastewater streams and support resource recovery.

Market Opportunity

Could Water Reuse Open Fresh Chemical Treatment Pathways?

As industries and municipalities pursue greater reuse of treated water, there’s increasing demand for tailor-made chemical solutions that support high-quality recycling and closed-loop water systems. For example, new technologies being adopted for water reuse highlight an opportunity for chemical suppliers to develop formulations suited for secondary or tertiary treatment. With more emphasis on circular economy water management, treatment chemicals that enable reuse in cooling towers, boilers, or irrigation are gaining traction. Additionally, the shift from single-pass use towards multiple-use water streams encourages the development of more robust and adaptive chemical programs.

Can Emerging Contaminants Create Novel Chemical Treatment Niches?

The rise of “forever chemicals” like PFAS and increasing complex industrial effluents is creating demand for advanced treatment chemistries and targeted removal agents beyond traditional coagulants and disinfectants. This trend opens a niche for chemical innovations tailored to emerging contaminants, trace-level organics, and high-purity reuse regimes.

Limitations in The Water Treatment Chemicals Market

- The market faces rising regulatory burdens and shifting compliance standards for treatment chemicals, increasing formulation complexity, and rising costs for both producers and users.

- The adoption of alternative non-chemical treatment technologies, such as advanced membranes or UV systems, is dampening demand for traditional chemical-based solutions.

Water Treatment Chemicals Market Segmentation Insights

Product Insights:

Why Is the Coagulants and Flocculants Segment Dominating the Water Treatment Chemicals Market?

The coagulants and flocculants segment maintained a leading position in the market in 2024. It retained a large share by virtue of being a key component in primary water clarification processes across both municipal and industrial sectors. The widespread need to remove suspended solids, turbidity, and colloidal impurities makes this segment foundational in treatment systems. As infrastructures age and require upgrades, demand for these chemicals continues steadily due to their well-established efficacy and broad application scope.

The biocides and disinfectants segment is projected to experience the highest growth rate in the market during the forecast period of 2025 to 2034. This growth is driven by rising concerns over microbial contamination, stricter hygiene standards, and increasing reuse of treated water where sterilisation is critical. The trend toward circular water systems and stricter discharge norms is elevating the importance of chemical disinfectants and biocidal additives. As treatment regimens become more complex and demand higher purity, this segment is poised to expand rapidly within the chemical treatment landscape.

End -Use Insights:

Why IS The Municipal End-Use Segment Dominating the Water Treatment Chemicals Market?

The municipal segment captured the largest market share in 2024. It draws strength from the large-scale deployment of chemical treatments for drinking water systems, wastewater collection, and public infrastructure renewal programmes. Because municipal systems serve entire populations and must meet regulatory-driven quality thresholds, chemical demand remains substantial and stable. The retirement of ongoing operations, maintenance, and upgrades in urban centres reinforces the dominance of municipal applications in the chemical treatment market.

The oil and gas segment is projected to grow with the highest growth rate in the market between 2025 and 2034. Growth in this segment arises from the intensive water treatment needs in exploration, production, and refining operations, including injection water, produced water treatment, and ZLD (zero-liquid discharge) systems. As upstream and downstream operations in oil and gas face water scarcity pressures, contamination challenges, and stricter effluent norms, the chemical treatment demand in this domain escalates. Consequently, suppliers are increasingly targeting specialized chemistries for the oil and gas sector to capture this opportunity.

Application Insights:

Why Is the Raw Water Treatment Application Dominating the Water Treatment Chemicals Market?

The raw water treatment segment registered its dominance over the market in 2024. Initial clarification, coagulation, flocculation, and sedimentation steps apply broadly across municipal and industrial settings and form the critical foundation of treatment chains. Because incoming water streams frequently contain suspended matter and turbidity, chemicals catering to the raw water treatment stage across treatment facilities sustain their market-dominant status.

The boiler segment is expected to experience the fastest rate of market growth from 2025 to 2034. Increased use of boiler systems in power generation, industrial heating, and steam production, combined with the need for highly treated feed water, makes this application ripe for growth. Chemical treatments that prevent scale, corrosion, and contamination in boiler feed systems are gaining traction as uptime demands increase and maintenance costs rise. As organisations pursue efficiency and water reuse strategies, the demand for treatment chemicals in the boiler application niche is set to expand rapidly.

Regional Insights

Why Is North America Dominating in Water Treatment Chemicals Market?

The North America water treatment chemicals market size was valued at USD 12.83 billion in 2024 and is anticipated to reach USD 19.23 billion by 2034, growing at a CAGR of 4.13% from 2025 to 2035.

In the global water treatment chemicals market, the North American region holds the dominant position thanks to a mature industrial base, extensive municipal water treatment infrastructure, and strict environmental regulations that drive chemical usage for water purification and reuse. According to the report, North America’s share in 2024 was the highest among all regions, reflecting the combined effect of aging infrastructure upgrades, large-scale industrial activity, including power generation and oil and gas, and heightened awareness of water scarcity issues. These factors converge to sustain strong demand for coagulants, disinfectants, corrosion inhibitors, and other water treatment chemistries in the region.

Within North America, the United States stands out as a major contributor to the water treatment chemicals market due to its extensive and well-established water infrastructure, high industrial water usage, and stringent regulation of water quality and discharge standards. The report highlights that the US market is driven by regulatory mandates and industrial demand, particularly from sectors such as oil and gas, power generation, and agriculture, necessitating advanced chemical treatment solutions.

Why Is Asia Pacific the Fastest Growing Demand in Water Treatment Chemicals Market?

In the global market, the Asia Pacific region is projected to follow the fastest growth trajectory, driven by urbanization, increased industrial water use, rising wastewater treatment capacity, and investment in infrastructure. The report highlights that many economies in this region are scaling up municipal and industrial water treatment systems, which in turn fuels demand for treatment chemicals.

Additionally, regulatory pressures and water scarcity trends in this region are creating an environment where chemical treatments are becoming more integral to both new plants and retrofit projects. This combination is underpinning the rapid uptake of coagulants, disinfectants, and specialty chemical solutions in the Asia Pacific. Market Segmentation

Within Asia Pacific, China stands out as a dominant national market for water treatment chemicals, due to its scale of industrial activity, large municipal water treatment systems and strong regulatory push on water quality management and reuse. The report indicates that chemical suppliers are focusing on China to meet upgrading of ageing infrastructure and increasing industrial effluent treatment requirements. Moreover, China’s policy environment favouring wastewater recycling, zero-liquid discharge systems and stricter discharge norms is creating demand for advanced chemical formulations tailored to high volume and complex treatment scenarios, further reinforcing its leading role in the region.

More Insights in Towards Chemical and Materials:

- Water and Wastewater Treatment Market : The global water & wastewater treatment market size is calculated at USD 348.19 billion in 2024, grew to USD 371.00 billion in 2025, and is projected to reach around USD 656.68 billion by 2034. The market is expanding at a CAGR of 6.55% between 2025 and 2034.

- Industrial Water Treatment Chemical Market : The global industrial water treatment chemicals market is projected to grow from USD 18.84 billion in 2025 to USD 32.34 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.55% over the forecast period from 2025 to 2035.

- Wastewater Treatment Services Market : the global wastewater treatment services market size is estimated at USD 67.56 billion in 2025 and is expected to hit around USD 131.78 billion by 2035, growing at a compound annual growth rate (CAGR) of 6.91% over the forecast period from 2025 to 2035.

- Boiler Water Treatment Chemicals Market : The global boiler water treatment chemicals market size was reached at USD 5.52 billion in 2024 and is expected to be worth around USD 15.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.85% over the forecast period 2025 to 2034.

- Water Treatment Polymers Market : The global water treatment polymers market volume was valued at 8,323.10 kilotons in 2024 and is estimated to reach around 15,477.50 kilotons by 2034, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period 2025 to 2034.

- Sludge Treatment Chemicals Market : The global sludge treatment chemicals market size accounted for USD 7.85 billion in 2024 and is predicted to increase from USD 8.30 billion in 2025 to approximately USD 13.65 billion by 2034, expanding at a CAGR of 6.55% from 2025 to 2034.

- Plastic Waste Management Market : The global plastic waste management market size was reached at USD 38.19 Billion in 2024 and is expected to be worth around USD 54.66 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.65% over the forecast period 2025 to 2034.

- Plastics Market : The global plastics market size was reached at USD 651.55 billion in 2024 and is expected to be worth around USD 984.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.21% over the forecast period 2025 to 2034.

- PFAS Waste Management Market : The PFAS waste management market size is calculated at USD 2.11 billion in 2024, grew to USD 2.23 billion in 2025, and is projected to reach around USD 3.72 billion by 2034. The market is expanding at a CAGR of 5.84% between 2025 and 2034.

- Chemical Distribution Market : The global chemical distribution market volume was reached at 239.32 million tons in 2024 and is expected to be worth around 440.18 million tons by 2034, exhibiting at a compound annual growth rate (CAGR) of 6.28% over the forecast period 2025 to 2034.

- Chemical Intermediate Market : The global chemical intermediate market size is calculated at USD 118.19 billion in 2024, grew to USD 127.18 billion in 2025 and is predicted to hit around USD 246.1 billion by 2034, expanding at healthy CAGR of 7.61% between 2025 and 2034.

- Green Chemicals Market : The global green chemicals market size was estimated at USD 14.94 billion in 2025 and is predicted to increase from USD 16.11 billion in 2026 to approximately USD 29.49 billion by 2034, expanding at a CAGR of 7.85% from 2025 to 2034.

- Crop Protection Chemicals Market : The global crop protection chemicals market size accounted for USD 79.44 billion in 2024 and is predicted to increase from USD 83.95 billion in 2025 to approximately USD 138.03 billion by 2034, expanding at a CAGR of 5.68% from 2025 to 2034.

- Waterproofing Chemicals Market : The global waterproofing chemicals market size accounted for USD 7.85 billion in 2024 and is predicted to increase from USD 8.39 billion in 2025 to approximately USD 15.23 billion by 2034, expanding at a CAGR of 6.85% from 2025 to 2034.

- Commodity Chemicals Market : The global commodity chemicals market size was valued at USD 813.85 billion in 2024, grew to USD 867.97 billion in 2025, and is expected to hit around USD 1,549.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period from 2025 to 2034.

- Lithium Chemicals Market : The global lithium chemicals market size was reached at USD 33.19 billion in 2024 and is expected to be worth around USD 196.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 50% over the forecast period 2025 to 2034.

- U.S. Water and Wastewater Treatment Market : The U.S. water and wastewater treatment market size accounted for USD 121.85 billion in 2024 and is predicted to increase from USD 130.31 billion in 2025 to approximately USD 238.36 billion by 2034, expanding at a CAGR of 6.94% from 2025 to 2034.

Water Treatment Chemicals Market Top Key Companies:

- Kemira

- Baker Hughes Company

- Dow

- SNF

- Cortec Corporation

- Johnson Matthey

- Green Water Treatment Solutions

- Bosch Somicon ME FZC

- Veolia

- Kurita Europe GmbH

- Solvay S.A.

- Cortec Corporation

Recent Development

- In October 2025, a notable development in the water treatment chemicals market in the acquisition of Water Engineering, Inc. by Kemira Oyj, a global provider of chemical solutions for water intensive industries. This transaction is expected to bolster Kemira’s footprint in the U.S. and enhance its product portfolio tailored to industrial water treatment needs.

- In October 2025, in another move indicating increasing attention to specialised water treatment solutions, WaterTectonics and Cleavale Capital have launched a new joint venture, WT Oil and Gas, aimed at the upstream and mid-stream oil and gas sector’s evolving water reuse and treatment demands. The initiate signals heighted focus on niche industrial segments for chemical treatment technologies.

- In March 2025, DuPont Water Solutions today launched WAVE PRO, a powerful online modeling tool for a variety of ultrafiltration (UF) water treatment applications, including drinking water, industrial utility water, wastewater, and seawater desalination. This next generation of the Water Application Value Engine (WAVE), WAVE PRO for UF, guides water professionals through the water treatment design process for ultrafiltration.

- In March 2025, Whitewater Management, a market-leading fluid management company, announced its purchase of Orion Water Solutions, a pioneer in advanced wastewater treatment solutions. The acquisition strategically positions Whitewater and its production chemical company, Catalyst Production Services, for continued growth while enhancing their ability to provide sophisticated water treatment solutions across a range of industries.

Water Treatment Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Water Treatment Chemicals Market

By Product

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH & Adjuster & Softener

- Scale & Corrosion Inhibitor

- Others

By End-Use

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Municipal

- Food & Beverage

- Pulp & Paper

- Others

By Application

- Raw Water Treatment

- Water Desalination

- Cooling

- Boiler

- Effluent Water Treatment

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5936

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/