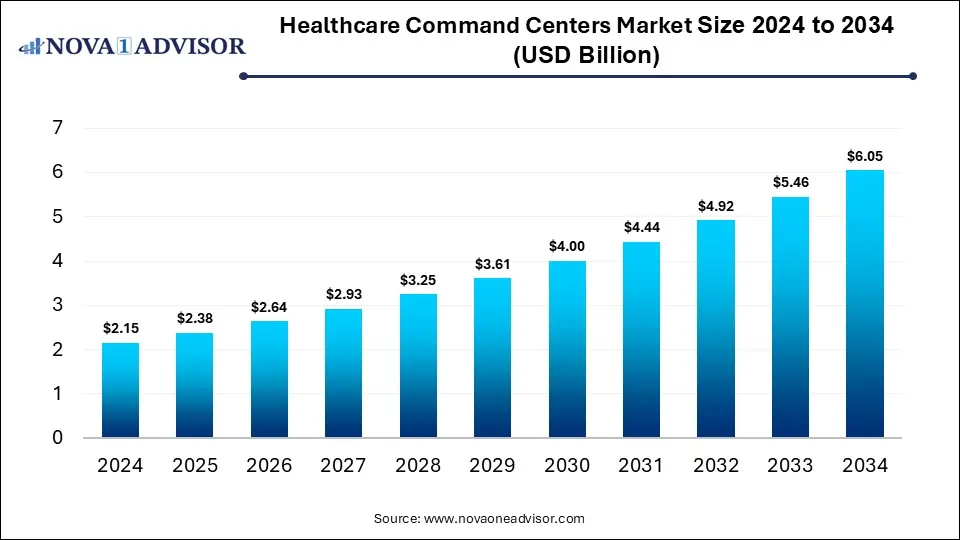

Ottawa, Nov. 04, 2025 (GLOBE NEWSWIRE) -- The global healthcare command centers market size is calculated at USD 2.15 billion in 2024, grows to USD 2.38 billion in 2025, and is projected to hit around USD 6.05 billion by 2034. The market is projected to expand at a CAGR of 10.9% between 2025 and 2034. The market is growing due to increasing demand for real-time integration and operational efficiency in hospitals. Rising adoption of AI, IoT, and analytics to enhance patient care and resource management is further driving market expansion.

Healthcare Command Centers Market Key Takeaways

- North America dominated the healthcare command centers market with a revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By type, the patient flow command centers segment led the market with the largest revenue share in 2024.

- By type, the integrated/enterprise-wide command centers segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By component, the software segment held the largest market share in 2024.

- By component, the services segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the patient flow & capacity management segment held the highest market share in 2024.

- By application, the telehealth & remote care coordination segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the hospitals segment dominated the market with a major revenue share.

- By end user, the multi-hospital health systems segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By deployment mode, the on-premise segment led the market with the largest revenue share in 2024.

- By deployment mode, the cloud-based segment is expected to grow at the fastest CAGR in the market during the forecast period.

Download a Sample Report Here@ https://www.novaoneadvisor.com/report/sample/9255

What is Healthcare Command Centers?

Healthcare command centers are centralized digital hubs that use real-time data, analytics, and AI to monitor hospital operations, coordinate patient flow, and improve clinical and operational efficiency. The healthcare command center market I growing due to the rising demand for real-time data integration, improved patient flow management, and operational efficiency in hospitals. Increasing adoption of AI and predictive analytics enhances decision-making and resource utilization. Moreover, the growing focus on patient safety, reduced waiting times, and cost-effective healthcare delivery, along with digital transformation initiatives by healthcare providers, further drive market expansion during the forecast period.

- For Instance, In October 2024, GE HealthCare launched “Hospital Pulse,” an advanced feature in its Command Center Software that consolidates real-time data from various hospital departments, allowing administrators to instantly view and monitor key operational metrics for better decision-making and efficiency.

For more information, visit the Nova One Advisor website or email the team at sales@novaoneadvisor.com | Call us : +1 804 420 9370

Healthcare Command Centers Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 2.38 Billion |

| Revenue forecast in 2034 | USD 6.05 Billion |

| Growth rate | CAGR of 10.9% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Type, By Component, By Application, By End User, By Deployment Mode, By Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

| Customization scope | Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

What are the Major Drivers in the Healthcare Command Centers Market?

The increasing demand for real-time operational visibility and data-driven decision-making in hospitals. These centers enhance patient flow, resource allocation, and care coordination, reducing waiting times and improving efficiency. Additionally, the rise of telehealth and digital health technologies further fuels market growth.

- For Instance, In October 2024, Medically Home partnered with SCP Health to deliver clinical command center services supporting hospital-at-home initiatives. This collaboration integrates Medically Home’s decentralized care model with SCP’s clinical expertise, enabling healthcare systems to expand inpatient capacity and meet the growing demand for home-based care through scalable, efficient solutions.

What are the Key trends in the Healthcare Command Centers Market in 2024?

- In July 2025, GE HealthCare enhanced its Command Center with AI-driven census forecasting and staffing tools. Hospitals like Duke Health using this platform achieved around 95% accuracy in predicting workforce requirements up to two weeks ahead, effectively lowering reliance on temporary staff and cutting labor costs.

- In April 2025, GE HealthCare strengthened its partnership with FPT Software to advance AI-powered healthcare innovations. The initiative includes setting up an FPT Competency Center in Vietnam to boost operational efficiency and enhance patient outcomes through cutting-edge digital technologies.

What is the Emerging Challenge in the Healthcare Command Centers Market?

Integration of diverse data systems across hospitals and care networks. Ensuring interoperability, data accuracy, and cybersecurity while managing real-time information flow remains complex. Additionally, high implementation costs and staff training requirements further hinder seamless adoption and scalability of these systems.

Immediate Delivery Available | Buy This Premium Research (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/9255

Segmental Insights

By Type Insights

What made the Patient Flow Command Centers Segment Dominant in the Healthcare Command Centers Market in 2024?

The patient flow command center segment held the largest share in 2024 due to its vital role in improving hospital efficiency and patient management. These systems enable real-time tracking of admissions, discharges, and bed availability, reducing delays and optimizing resource use. Increasing adoption of AI and data analytics for predictive patient flow and operational decision-making further supported the segment's dominance in the market.

The integrated/enterprise-wide command centers segment is projected to grow at the fastest CAGR during the forecast period due to increasing demand for centralized coordination and data-driven insights across hospital networks. These systems enhance operational efficiency, optimize resource allocation, and improve patient outcomes. Moreover, the integration of AI, IoT, and predictive analytics further their adoption, supporting seamless hospital-wide decision-making and performance improvements.

- For Instance, In May 2025, AdventHealth’s Mission Control functioned as a centralized hub leveraging real-time data and AI to oversee patient flow and hospital capacity across its network. It tracked bed availability, managed patient transfers, and redirected ambulances when needed, ensuring efficient patient placement and improved care delivery.

By Component Insights

How did Software Segment Dominate the Healthcare Command Centers Market in 2024?

The software segment held the largest market share in 2024 due to its critical role in enabling real-time data integration, predictive analytics, and automation within healthcare command centers. These solutions streamline hospital operations, improve patient flow, and optimize staffing and resource allocation. Additionally, the increasing use of AI and cloud-based platforms has further driven demand for advanced, interoperable software systems that enhance overall healthcare efficiency.

- For Instance, In June 2025, GE HealthCare’s MIM Software launched LesionID Pro, an AI-based tool that automates preprocessing tasks to reduce manual segmentation. The solution enables comprehensive whole-body imaging analysis, helping physicians enhance theranostics and develop more personalized treatment plans efficiently.

The service segment is expected to grow at a faster CAGR during the forecast period, driven by the rising need for system integration, maintenance, and staff training in healthcare command centers. As hospitals adopt advanced digital and AI-driven platforms, demand for consulting, implementation, and technical support services continues to rise. These services ensure smooth deployment, optimized performance, and ongoing upgrades, enhancing operational efficiency and decision-making across healthcare systems.

- For Instance, In July 2025, GE HealthCare entered a strategic partnership with Ascension to enhance technological efficiency and strengthen integrated care delivery across Ascension’s nationwide healthcare network, aiming to improve operational performance and patient outcomes.

By Application Insights

Why the Patient Flow & Capacity Management Segment Dominated the Healthcare Command Centers Market in 2024?

The patient flow & capacity management segment held the highest market share in 2024 due to its vital role in optimizing hospital operations and improving patient experience. These solutions enable real-time tracking of bed availability, admissions, and discharges, ensuring efficient utilization of resources. The growing adoption of AI and data analytics to predict patient demand, reduce wait times, and enhance overall care coordination further contributed to this segment’s dominance in the healthcare command center market.

The telehealth & remote care coordination segment is projected to grow at the fastest CAGR during the forecast period, driven by the rising demand for virtual care, remote patient monitoring, and real-time communication tools. Increasing adoption of digital health technologies and AI-powered platforms enables seamless coordination between healthcare providers and patients. Additionally, the expansion of home-based care models and the need for continuous monitoring of chronic conditions further fuel this segment’s rapid growth globally.

By End User Insights

Why do the Hospitals Segment dominate the Healthcare Command Centers Market in 2024?

The hospitals segment dominated the market with the largest revenue share in 2024 due to the growing need for real-time operational visibility, efficient patient management, and improved resource utilization. Hospitals are increasingly adopting command center solutions to streamline workflows, reduce wait times, and enhance care coordination. The integration of AI and predictive analytics further supports data-driven decision-making, enabling hospitals to optimize staffing, bed allocation, and patient flow, thereby improving overall efficiency and patient outcomes.

The multi-hospital health system segment is expected to grow at the fastest CAGR during the forecast period due to the increasing need for centralized command centers that enable coordination across multiple facilities. These systems provide unified visibility into operations, resource utilization, and patient flow, enhancing decision-making and efficiency. The growing adoption of AI, cloud technologies, and data integration tools further supports scalability, interoperability, and improved care delivery across large healthcare networks.

- For Instance, Duke Health achieved cost savings of around USD 40 million by minimizing dependence on temporary staff, utilizing GE HealthCare’s Command Center software to enhance workforce management and operational efficiency across its facilities.

By Deployment Mode Insights

How does the On-premise Segment dominate the Healthcare Command Centers Market in 2024?

The on-premise segment led the market with the largest revenue share in 2024 due to the high preference for secure and controlled data management within healthcare organizations. Many hospitals and health systems opted for on-premise solutions to ensure data privacy, regulatory compliance, and uninterrupted access to critical information. Additionally, the integration of advanced analytics and AI tools within in-house infrastructures supported efficient decision-making and enhanced operational reliability, further strengthening the segment’s market dominance.

The cloud-based segment is expected to grow at the fastest CAGR during the forecast period due to its scalability, flexibility, and cost-effectiveness in managing healthcare operations. Cloud solutions enable real-time data access, remote monitoring, and seamless collaboration across multiple healthcare facilities. Additionally, the growing adoption of AI, data analytics, and interoperability standards supports efficient resource utilization, faster decision-making, and enhanced patient care, driving the widespread shift toward cloud-based healthcare command center solutions.

- For Instance, In August 2025, the University of Texas at Austin’s Dell Medical School collaborated with Rackspace Technology to manage and host its healthcare data infrastructure, including the Epic Electronic Health Record system, enhancing data management efficiency and system reliability.

By Regional Analysis

How is North America contributing to the Expansion of the Healthcare Command Centers Market?

North America dominated the healthcare command center market with the largest revenue share in 2024, driven by the strong presence of advanced healthcare infrastructure, high adoption of digital health technologies, and growing investments in AI-driven operational platforms. Leading market players, such as GE HealthCare and Medically Home, are actively deploying innovative command center solutions across hospitals and health systems, further enhancing care coordination, efficiency, and patient management across the region.

How is Asia-Pacific Accelerating the Healthcare Command Centers Market?

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period due to increasing investments in healthcare digitalization, expanding hospital networks, and rising demand for real-time operational management systems. Governments in countries like India, China, and Japan are promoting smart healthcare initiatives and AI integration to enhance efficiency and patient outcomes. Additionally, growing awareness of data-driven hospital management and rapid adoption of cloud-based solutions further drive market growth across the region.

- For Instance,In October 2023, Singapore's National Healthcare Group (NHG) launched a Command, Control, and Communications (C3) system at its flagship Tan Tock Seng Hospital (TTSH).

Healthcare Command Centers Market Companies

- GE HealthCare

GE HealthCare is a leading provider of command center platforms, offering advanced real-time analytics and AI-powered tools to improve hospital operations and patient flow. Their command centers are widely implemented in major health systems like Johns Hopkins to drive efficiently, reduce wait times, and enhance care coordination.

- Philips Healthcare

Philips provides integrated command center solutions that focus on enterprise monitoring, clinical workflow optimization, and telehealth integration. Their technology helps healthcare providers improve patient outcomes through better decision support and system-wide operational visibility.

- TeleTracking Technologies

TeleTracking specializes in operational command centers, offering solutions for patient flow, capacity management, and resource utilization. Their platform is widely used in large hospitals and multi-facility health systems to reduce bottlenecks and improve patient throughput.

- Cerner Corporation (now Oracle Health)

Cerner, now part of Oracle Health, provides health IT systems that integrate with command centers for real-time data sharing and operational decision-making. Their expertise in electronic health records (EHRs) and cloud infrastructure enhances the functionality and interoperability of command centers.

- Siemens Healthineers

Siemens Healthineers supports command centers with solutions focused on diagnostics integration, imaging workflow, and enterprise-wide data insights. Their technologies contribute to clinical efficiency and patient safety, particularly in radiology and acute care coordination.

- Epic Systems

Epic Systems contributes through its integrated EHR platform, which forms a critical backbone for many command center operations. By enabling real-time clinical data access and workflow alignment, Epic enhances communication and decision-making in high-acuity care settings.

- IBM Watson Health (now Merative)

Previously IBM Watson Health, Merative offers AI-driven analytics and cognitive computing capabilities to enhance the intelligence of healthcare command centers. Their solutions enable predictive insights and population health management, supporting proactive care strategies.

Recent Developments in the Healthcare Command Centers Market

- In November 2024, Medically Home joined forces with SCP Health to establish a new command center in Dallas, Texas. The facility provides centralized staffing support for hospital-at-home programs, helping healthcare systems expand services efficiently without the need for separate operational hubs.

- In October 2024, GE HealthCare introduced the AI-powered Hospital Pulse Tile, a dashboard designed to provide real-time operational insights. The tool helps hospital administrators analyze ER admission trends and optimize patient flow and resource allocation. Duke Health became the first healthcare system to adopt this new feature within its GE Command Center.

More Insights in Nova One Advisor:

- Healthcare Contract Research Organization Market - The global healthcare contract research organization market size is calculated at USD 56.15 billion in 2024, grows to USD 60.33 billion in 2025, and is projected to reach around USD 115.08 billion by 2034, growing at a CAGR of 7.44% from 2025 to 2034.

- Artificial Intelligence for Healthcare Payer Market - The global artificial intelligence for healthcare payer market size was estimated at USD 2.55 billion in 2024 and is expected to reach USD 10.57 billion in 2034, expanding at a CAGR of 15.28% during the forecast period of 2025 and 2034.

- Cleanroom Robots in Healthcare Market - The global cleanroom robots in healthcare market size was valued at USD 674.25 million in 2024 and is predicted to be worth around USD 6,634.81 billion by 2034, registering a CAGR of 25.69% during the forecast period 2025 to 2034.

- U.S. Healthcare Staffing And Scheduling Software Market - The U.S. healthcare staffing and scheduling software market size was calculated at USD 1.85 billion in 2024 and is expected to reach USD 5.68 billion by 2034, expanding at a CAGR of 11.88% during the forecast period 2025 to 2034.

- Healthcare Business Intelligence Market - The global healthcare business intelligence market size was estimated at USD 10.55 billion in 2024 and is expected to reach USD 37.56 billion in 2034, expanding at a CAGR of 13.54% during the forecast period of 2025 to 2034.

- Remote Healthcare Market - The global Remote Healthcare market gathered revenue around USD 83.35 Billion in 2024 and market is set to grow USD 584.34 Billion by the end of 2034 and is estimated to expand at a modest CAGR of 21.5% during the prediction period 2025 to 2034.

- Healthcare Customer Data Platform Market - The global Healthcare Customer Data Platform market gathered revenue around USD 484.16 million in 2024 and market is set to grow USD 5.45 Billion by the end of 2034 and is estimated to expand at a modest CAGR of 27.4% during the prediction period 2025 to 2034.

- Middle East Healthcare IT Market - The Middle East healthcare IT market size was valued at USD 53.65 billion in 2024 and is projected to hit around USD 251.35 billion by 2034, growing at a CAGR of 16.7% during the forecast period 2025 to 2034.

- U.S. Artificial Intelligence In Healthcare Market - The U.S. artificial intelligence in healthcare market size was exhibited at USD 13.75 billion in 2024 and is projected to hit around USD 315.16 billion by 2034, growing at a CAGR of 36.78% during the forecast period 2025 to 2034.

- Switzerland Healthcare & Medical Tourism Market - The Switzerland healthcare & medical tourism market size was exhibited at USD 72.11 billion in 2024 and is projected to hit around USD 148.62 billion by 2034, growing at a CAGR of 7.5% during the forecast period 2025 to 2034.

- Healthcare Digital Twins Market - The healthcare digital twins market size was exhibited at USD 902.75 million in 2024 and is projected to hit around USD 8481.79 million by 2034, growing at a CAGR of 25.11% during the forecast period 2024 to 2034.

- Healthcare Digital Content Creation Market - The healthcare digital content creation market size was exhibited at USD 10.15 billion in 2024 and is projected to hit around USD 75.43 billion by 2034, growing at a CAGR of 22.21% during the forecast period 2025 to 2034.

- AI Voice Agents In Healthcare Market - The AI Voice Agents In Healthcare Market size was exhibited at USD 468.25 million in 2024 and is projected to hit around USD 11,568.71 million by 2034, growing at a CAGR of 37.87% during the forecast period 2025 to 2034.

- Home Healthcare Market - The home healthcare market size was exhibited at USD 421.34 billion in 2024 and is projected to hit around USD 907.12 billion by 2034, growing at a CAGR of 7.97% during the forecast period 2025 to 2034.

- AI In Healthcare Market - The AI in healthcare market size was exhibited at USD 26.75 billion in 2024 and is projected to hit around USD 701.79 billion by 2034, growing at a CAGR of 38.64% during the forecast period 2025 to 2034.

Healthcare Command Centers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Nova One Advisor has segmented the global Healthcare Command Centers Market

By Type

- Operational Command Centers

- Clinical Command Centers

- Patient Flow Command Centers

- Emergency & Disaster Response Command Centers

- Integrated/Enterprise-Wide Command Centers

By Component

- Software

- Hardware

- Services

- Implementation Services

- Support & Maintenance

- Consulting & Integration Services

By Application

- Patient Flow & Capacity Management

- Bed Management

- Staff Allocation & Scheduling

- Emergency Response & Crisis Management

- Real-Time Decision Support

- Telehealth & Remote Care Coordination

By End User

- Hospitals

- Multi-Hospital Health Systems

- Ambulatory Surgical Centers

- Specialty Clinics

- Government & Military Health Facilities

By Deployment Mode

- On-Premise

- Cloud-Based

- Hybrid

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/9255

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Our Trusted Data Partners

Towards Chemical and Materials | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | Towards Chem and Material

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 420 9370

Email: sales@novaoneadvisor.com

For Latest Update Follow Us: LinkedIn