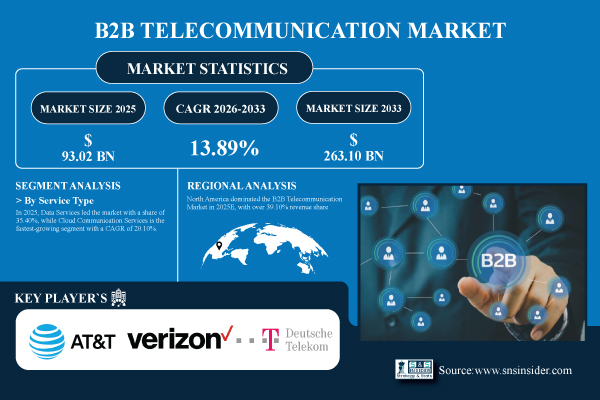

Austin, Oct. 29, 2025 (GLOBE NEWSWIRE) -- The B2B Telecommunication Market size was valued at USD 93.02 Billion in 2025E and is expected to reach USD 263.10 Billion by 2033 and grow at a CAGR of 13.89% over 2026-2033.

The growing need for dependable, fast connectivity among businesses across industries is fueling the expansion of the B2B telecommunications market. Strong telecom infrastructure is now more important than ever due to the growing use of cloud computing, managed network services, and unified communication platforms.

Download PDF Sample of B2B Telecommunication Market @ https://www.snsinsider.com/sample-request/8677

The U.S. B2B Telecommunication Market size was USD 26.20 Billion in 2025E and is expected to reach USD 72.57 Billion by 2033, growing at a CAGR of 13.60% over 2026-2033.

The adoption of cloud-based services, 5G infrastructure, and AI-driven solutions across industries is propelling the growth of the U.S. market. Through strategic agreements and acquisitions, major firms, such as AT&T, Verizon, and T-Mobile are increasing the scope of their enterprise products.

Key Players:

- AT&T Inc.

- Verizon Communications Inc.

- Deutsche Telekom AG

- Telefonica S.A.

- Vodafone Group PLC

- Orange Business Services

- BT Group

- Tata Communications

- NTT Communications Corporation

- Telstra Corporation Limited

- Singtel

- Reliance Jio Infocomm

- Comcast Business

- Lumen Technologies (formerly CenturyLink)

- Masergy

- Huawei Technologies Co., Ltd.

- Amdocs Ltd.

- Cisco Systems, Inc.

- Comarch S.A.

- Bharti Airtel

B2B Telecommunication Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025E | USD 93.02 Billion |

| Market Size by 2033 | USD 263.10 Billion |

| CAGR | CAGR of 13.89% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Voice Services, Data Services, Messaging Services, Managed Network Services, Cloud Communication Services) • By Deployment Model (On-Premises Deployment, Cloud-Based Deployment, Hybrid Deployment) • By Enterprise Size (Small Enterprises, Medium Enterprises, Large Enterprises) • By Connectivity Solutions (Internet Protocol (IP) Telephony, Private Branch Exchange (PBX), Virtual Private Network (VPN), Leased Line Services, Wireless Communication) • By Industry Verticals (Healthcare, Financial Services, Retail, Manufacturing, IT and Technology) |

| Customization Scope | Available upon request |

| Pricing | Available upon request |

If You Need Any Customization on B2B Telecommunication Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8677

Segmentation Analysis:

By Service Type, in 2025, Data Services Dominated the Market with a Share of 35.40%; Cloud Communication Services is the Fastest-growing Segment with a CAGR of 20.10%

Data Services lead the market due to their critical role in enabling enterprises to transmit, store, and analyze large volumes of business data efficiently. Cloud Communication Services represent the fastest-growing segment, driven by the rising adoption of remote work, hybrid work models, and AI-enabled collaboration tools.

By Deployment Model, in 2025, Cloud-Based Deployment Led the Market with a Share of 48.60%, while it is also the Fastest-growing Segment with a CAGR of 18.50%

Cloud-Based Deployment leads the market as enterprises increasingly shift from traditional on-premises systems to scalable, flexible cloud infrastructure. Cloud-Based Deployment is also the fastest-growing segment, fueled by the adoption of remote and hybrid work models, AI-driven communication tools, and managed network services.

By Enterprise Size, in 2025, Large Enterprises Segment Dominated with a Share of 52.40%, while Small Enterprises is the Fastest-growing Segment with a CAGR of 16.80%

Large Enterprises lead the market due to their extensive communication needs, multi-location operations, and higher IT budgets that enable them to adopt advanced telecom solutions. Small Enterprises represent the fastest-growing segment, driven by increasing digital adoption, affordable cloud-based solutions, and scalable telecom services.

By Connectivity Solutions, in 2025, IP Telephony Led the Market with a Share of 34.10%, while Wireless Communication is the Fastest-growing Segment with a CAGR of 15.30%

Internet Protocol (IP) Telephony leads the market as it enables enterprises to streamline voice communication, reduce operational costs, and integrate with unified communication platforms across multiple locations. Wireless Communication represents the fastest-growing segment, driven by the increasing adoption of mobile devices, remote work, and IoT-enabled enterprise applications.

By Industry Verticals, in 2025, IT and Technology Segment Held the Largest Share of 29.40%, while it is also the Fastest-growing Segment with a CAGR of 14.80%

The IT and Technology vertical leads the market due to its high demand for advanced communication solutions, cloud-based services, and secure, high-speed connectivity to support global operations, data-intensive applications, and real-time collaboration. IT and Technology vertical is the fastest-growing segment, driven by the continuous adoption of digital transformation initiatives, hybrid work models, and IoT-enabled devices.

Regional Insights:

North America dominated the B2B Telecommunication Market in 2025E, with over 39.10% revenue share, due to its advanced infrastructure, high enterprise adoption of cloud-based services, and widespread 5G network deployment.

Asia Pacific region is expected to have the fastest-growing CAGR 15.22%, driven by rapid digital adoption, rising enterprise investments in cloud-based communication, and expanding 5G infrastructure.

Recent Developments:

- In September 2025, Amdocs announced that Optimum, a leading provider of fiber internet, mobile, and TV services, signed a multi-year agreement to deepen their managed transformation initiative using Amdocs’ AI offerings.

- In January 2025, Cisco introduced a cloud-native, open 5G network architecture aimed at simplifying and securing mobile networks. The architecture unifies multivendor mobile solutions into a cost-efficient, simplified, and trustworthy framework, enabling enterprises to deploy services that customers want, when and where they need them.

Buy Full Research Report on B2B Telecommunication Market 2026-2033 @ https://www.snsinsider.com/checkout/8677

Exclusive Sections of the Report (The USPs):

- Network Performance & Reliability Index – helps you evaluate service uptime, latency, and packet loss across leading providers, enabling enterprises to benchmark network efficiency and identify vendors with superior SLA compliance and redundancy readiness.

- Enterprise Communication Behavior Analytics – helps you uncover usage trends such as peak traffic hours, data loads, and multi-service integration rates, supporting optimization of bandwidth allocation and unified communication strategies across industries.

- Digital Transformation & Technology Adoption Scorecard – helps you assess enterprise adoption of AI-driven communication tools, IoT connectivity, SD-WAN, and edge computing, highlighting innovation maturity levels and investment opportunities in next-gen telecom technologies.

- Network Virtualization & Infrastructure Modernization Tracker – helps you identify the pace of virtualization and cloud-based infrastructure deployment, providing visibility into how enterprises are transitioning toward software-defined, scalable communication networks.

- Customer Experience & Retention Metrics – helps you understand client satisfaction and loyalty dynamics through Net Promoter Scores (NPS), support response times, and churn rates, offering insights for improving service quality and contract renewal strategies.

- Data Center Utilization & Capacity Monitoring Dashboard – helps you measure overall infrastructure efficiency by tracking data center utilization rates, redundancy systems, and failover capacity, assisting in forecasting future network investment needs and expansion planning.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.