Austin, Oct. 22, 2025 (GLOBE NEWSWIRE) -- Pharmaceutical Isolator Market Size & Growth Analysis:

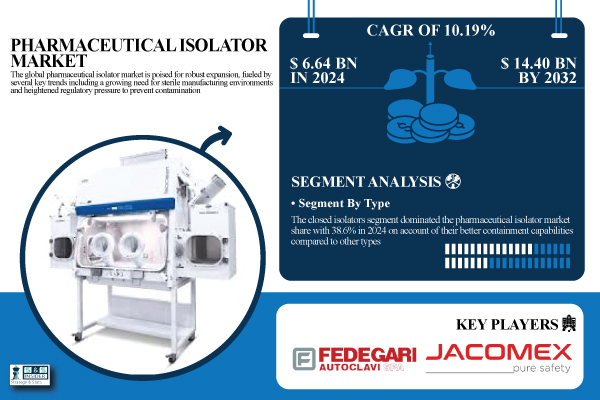

According to SNS Insider, the Pharmaceutical Isolator Market size was valued at USD 6.64 billion in 2024 and is expected to reach USD 14.40 billion by 2032, growing at a CAGR of 10.19% over 2025-2032.

Due to established pharmaceutical manufacturing facilities and strict adherence to regulations, the U.S. accounts for over two-thirds of the pharmaceutical isolator market in North America, making it the largest market in the region.

The U.S. pharmaceutical isolator market size was valued at USD 1.95 billion in 2024 and is expected to reach USD 4.16 billion by 2032, growing at a CAGR of 9.96% over 2025-2032.

Get free Sample Report of Pharmaceutical Isolator Market: https://www.snsinsider.com/sample-request/8104

Stringent Regulatory Requirements for Sterile Manufacturing Boost Market Growth

To ensure the safety and effectiveness of pharmaceuticals, regulatory bodies strictly control their manufacturing. The World Health Organization (WHO), European Medicines Agency (EMA), and the U.S. Food and Drug Administration (FDA) have all set strict rules, which makes aseptic processing, especially for sterile injectable drugs, a crucial area of concern. Pharmaceutical isolators are made to meet these regulations by offering a controlled, physically separated space that minimizes human contact and gets rid of contamination. They are becoming more and more in demand throughout the industry since they provide the ideal option for compliance sterile medication manufacture by maintaining the interior atmosphere within the isolator chamber at Grade A standards.

Major Players Analysis Listed in the Pharmaceutical Isolator Market Report are

- SKAN AG

- Getinge AB

- Azbil Telstar S.L.

- Comecer S.p.A.

- Esco Micro Pte. Ltd.

- Fedegari Autoclavi S.p.A.

- Germfree Laboratories Inc.

- Hosokawa Micron Group

- Jacomex

- Syntegon Technology GmbH

- Tema Sinergie S.p.A.

- Bioquell (An Ecolab Solution)

- Extract Technology Ltd.

- IsoTech Design

- Block Engineering

- Air Science USA LLC

- Telstar Life Science Solutions

- Weber Scientific

- Labconco Corporation

- NuAire Inc.

Segmentation Analysis:

By Type

The closed isolators segment dominated the pharmaceutical isolator market share with 38.6% in 2024 on account of their better containment capabilities compared to other types. The bio isolators segment is projected to be the fastest-growing segment in the forecast years, owing to the growing need for sterility in biopharmaceutical production and research.

By Application

The aseptic processing segment dominated the pharmaceutical isolator market, primarily due to its critical step in maintaining sterility of the product when drug manufacturing. Sterility testing is estimated to be the fastest-growing segment in the forecast period, owing to increasing requirements regarding quality control in the manufacturing of pharmaceutical and biopharmaceutical products.

By System Type

The modular systems segment held the largest share in the pharmaceutical isolator market with around 55.4% in 2024, and this is attributed to its high adaptability, scalability, and ease of integration in existing cleanroom environments. Skid-mounted systems segment is expected to see the fastest growth through 2032, propelled by an upsurge in demand for plug-and-play, compact, and transportable systems for pharmaceutical manufacturing setups.

By End-User

Based on end-user, the pharmaceutical & biotechnology companies segment held the largest share of 54.4% in 2024 owing to high demand for maintaining aseptic conditions in drug manufacturing, particularly in sterile injectable production and biologics. The contract manufacturing organizations (CMOs) segment is expected to experience the fastest growth during the forecast period, owing to the trend towards cost-saving of outsourcing of pharmaceutical production, allowing for better scale-up scenarios.

Buy the Pharmaceutical Isolator Market Report Now: https://www.snsinsider.com/checkout/8104

By Region

The North American region dominated the pharmaceutical isolator market trend with a 38.6% market share in 2024, owing to the solid pharma and biopharma industry and strict regulatory frameworks imposed by agencies, such as the FDA.

Asia Pacific is expected to be the fastest-growing region due to growing pharmaceutical production, increasing investment in healthcare infrastructure, and a rising emphasis on compliance with regulations.

Recent News:

- Telstar launched a dual-mode isolator system in March 2024 at Pharma Congress, Wiesbaden, which could perform both containment and aseptic mode. This versatile design responds to post-pandemic needs for flexible systems, allowing pharmaceutical companies to process multiple sterile operations with one single unit, reducing footprint, capital investment, and operating expense.

- Getinge announced the launch of ISOPRIME, a low-cost rigid-wall isolator made especially for common aseptic procedures, on October 6, 2023. With key aseptic processing features, such as a four-glove setup, integrated Steritrace hydrogen peroxide decontamination, and FDA 21 CFR Part 11 compliance, ISOPRIME is positioned as an entry-level option that preserves traceability and ease of maintenance.

Exclusive Sections of the Report (The USPs):

- INSTALLATION & OPERATIONAL BENCHMARKS – helps you evaluate the global and regional footprint of pharmaceutical isolators, including facility adoption rates and installation growth trends from 2020–2024.

- APPLICATION UTILIZATION MATRIX – helps you understand isolator usage across key pharmaceutical operations such as aseptic processing, API manufacturing, and sterility testing to identify demand concentrations.

- CAPEX & INVESTMENT ANALYTICS – helps you track regional and scale-based capital expenditure trends, procurement costs, and spending patterns for containment and sterile production systems.

- REGULATORY COMPLIANCE INSIGHTS – helps you analyze FDA, EMA, and GMP validation benchmarks to assess the increasing focus on containment compliance and inspection readiness.

- END-USER ADOPTION DYNAMICS – helps you compare isolator usage among pharmaceutical, biopharma, and CDMO facilities, highlighting preferences for integrated versus modular systems.

- TECHNOLOGY PENETRATION INDEX – helps you uncover innovation trends such as gloveless, robotic, and AI-integrated isolators, and the transition from RABS to advanced containment technologies.

Pharmaceutical Isolator Market Report Scope

| Report Attributes | Details |

| Market Size in 2024 | USD 6.64 Billion |

| Market Size by 2032 | USD 14.40 Billion |

| CAGR | CAGR of 10.19% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Key Segments | • By Type (Open Isolators, Closed Isolators, Glovebox Isolators, Containment Isolators, Bio Isolators, Sterility Test Isolators, Aseptic Isolators) • By Application (Aseptic Processing, Sterility Testing, Containment, Mixing & Blending, Sampling & Dispensing) • By System Type (Modular Systems, Skid-Mounted Systems, Floor-Mounted Systems) • By End User (Pharmaceutical & Biotechnology Companies, Research Laboratories, Contract Manufacturing Organizations (CMOs), Academic & Research Institutes, Hospitals and Clinics) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

Access Complete Report Details of Pharmaceutical Isolator Market Analysis & Outlook: https://www.snsinsider.com/reports/pharmaceutical-isolator-market-8104

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.