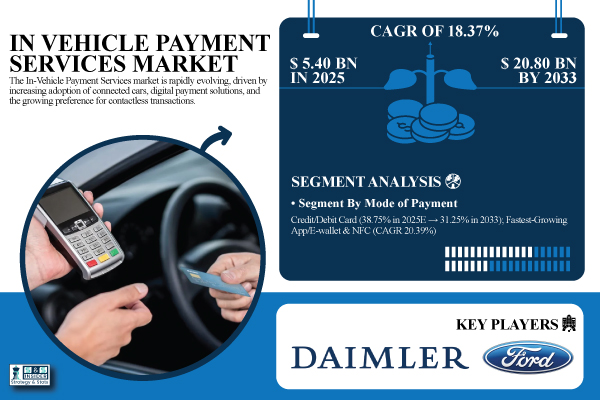

Austin, Oct. 22, 2025 (GLOBE NEWSWIRE) -- The In Vehicle Payment Services Market size was worth USD 5.40 Billion in 2025E and is projected to reach USD 20.80 Billion by 2033, growing at a CAGR of 18.37% during 2026–2033.

The market for in-vehicle payment services is expanding quickly due to the growing popularity of contactless transactions, digital payment methods, and connected cars. Solutions, services, professional, and managed models are among the main products offered, which include light and heavy-duty vehicles and applications, such as parking, shopping, fueling, and toll payments.

Download PDF Sample of In Vehicle Payment Services Market @ https://www.snsinsider.com/sample-request/8712

The U.S. In Vehicle Payment Services Market size was valued at USD 1.57 Billion in 2025E and is projected to reach USD 5.46 Billion by 2033, growing at a CAGR of 16.88% over 2026–2033.

Increased consumer demand for easy and convenient payment options in cars, the quick uptake of connected auto technologies, the development of contactless and digital payment infrastructure, and the expanding integration of smart mobility services are the main drivers of the U.S. market growth.

Key Players:

- BMW AG

- Daimler AG

- Ford Motor Co.

- General Motors Co.

- Honda Motor Co. Ltd.

- Hyundai Motor Co.

- Jaguar Land Rover Automotive PLC

- Volkswagen AG

- ZF Friedrichshafen AG

- Qualcomm

- Amazon

- Visa

- MasterCard

- PayPal

- Tesla Inc.

- Intel Corporation

- Apple Inc.

- Continental AG

- IBM Corporation

In Vehicle Payment Services Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025E | USD 5.40 Billion |

| Market Size by 2033 | USD 20.80 Billion |

| CAGR | CAGR of 18.37% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Mode of Payment (App/e-wallet, Credit/Debit card, NFC, QR Code/RFID) • By Offering (Solution, Service, Professional, Managed) • By Vehicle Type (Light Duty Vehicle AND Heavy Duty Vehicle) • By Application (Shopping, Food/Coffee, Parking, Gas/charging stations, Toll Collection and Others) |

| Customization Scope | Available upon request |

| Pricing | Available upon request |

If You Need Any Customization on In Vehicle Payment Services Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8712

Segmentation Analysis:

By Mode of Payment – Credit/Debit Card & App/E-wallet/NFC

Credit/Debit Cards remain dominant with a 38.75% share in 2025 due to widespread acceptance, consumer familiarity, and seamless integration with loyalty programs. App-based wallets and NFC payments are the fastest-growing segment at a CAGR of 20.39% driven by rising smartphone penetration, contactless transaction preferences, and the convenience of in-app payment solutions across retail, fuel, and mobility services.

By Offering – Solution vs Service

Solutions dominate with a 34.25% share in 2025 as enterprises and consumers prefer ready-to-use, integrated payment solutions that simplify transaction management and reporting. Over time, Services are expected to grow fastest at a CAGR of 19.62% as demand rises for subscription-based payment management, on-demand transaction analytics, and consulting services that provide flexibility, customization, and value-added features to businesses.

By Vehicle Type – Light Duty Vehicle & Heavy Duty Vehicle

Light Duty Vehicles (LDVs) dominate with 69.38% share in 2025 due to the high volume of passenger cars and small commercial vehicles using payment terminals for fuel, parking, and tolls. Heavy Duty Vehicles (HDVs) are projected to grow fastest at a CAGR of 20.08% due to the increasing logistics and freight operations, fleet electrification, and adoption of smart payment systems for fueling, tolling, and fleet management. Rising e-commerce and goods transport demand further support HDV payment solution growth.

By Application – Shopping & Gas/Charging Stations

Shopping remains the largest application with 29.75% share in 2025 as retail and e-commerce continue to be primary drivers for payment volume. Gas and Charging Stations are expected to be the fastest-growing application at a CAGR 22.83% as electric vehicle adoption accelerates, fueling infrastructure expands, and drivers increasingly prefer digital and contactless payments for fueling, recharging, and related services.

Regional Insights:

North America leads the In Vehicle Payment Services market, holding the largest share of 43.84% in 2025E due to advanced automotive infrastructure, high adoption of connected vehicles, and strong digital payment penetration.

Asia Pacific is the fastest-growing region in the In Vehicle Payment Services market at a CAGR of 28.63%, driven by rapid adoption of connected and electric vehicles, expanding digital payment infrastructure, and rising consumer demand for convenient in-car transactions.

Recent Developments:

- In September 2024, BMW launches In-Car Payment in Germany, enabling drivers to pay for fuel and parking digitally from their vehicles; rollout to other countries planned.

- In August 2025, Daimler Truck Financial Services launches eService Leasing in Germany, offering bundled leasing, service contracts, and optional services to simplify electric truck adoption for fleet operators.

Buy Full Research Report on In Vehicle Payment Services Market 2026-2033 @ https://www.snsinsider.com/checkout/8712

Exclusive Sections of the Report (The USPs):

- Technology & Innovation Metrics – helps you track adoption of advanced in-vehicle payment technologies (NFC, QR, RFID, connected apps), R&D investments in secure gateways, biometrics, and blockchain-enabled systems, patent activity, and annual innovation index reflecting new features and payment solutions launched.

- Operational Performance & Reliability Metrics – helps you benchmark system efficiency by analyzing transaction speeds, uptime, fraud prevention adoption (encryption, multi-factor authentication), and integration performance across OEMs, fuel stations, tolls, parking, and retail services.

- Production & Supply Chain Readiness – helps you assess deployment feasibility by monitoring lead times for hardware/software modules, integration efficiency, dependency on cloud/payment partners, and regional infrastructure readiness for in-vehicle payment adoption.

- Pricing & Cost Analysis – helps you evaluate financial viability by studying service subscription fees, transaction cost structures, and total cost of ownership including software updates, maintenance, and integration expenses.

- Regulatory & Compliance Metrics – helps you ensure market readiness by tracking adherence to financial, data security, and vehicle safety standards (PCI DSS, GDPR, ISO 27001), certification rates, and audit or regulatory approval statistics.

- Competitive Landscape – helps you gauge the strategic strength of leading players based on innovation portfolio, platform adoption, partnerships, service coverage, and recent product launches in the in-vehicle payment ecosystem.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.