Austin, Oct. 20, 2025 (GLOBE NEWSWIRE) -- Interventional Cardiology Devices Market Size & Growth Analysis

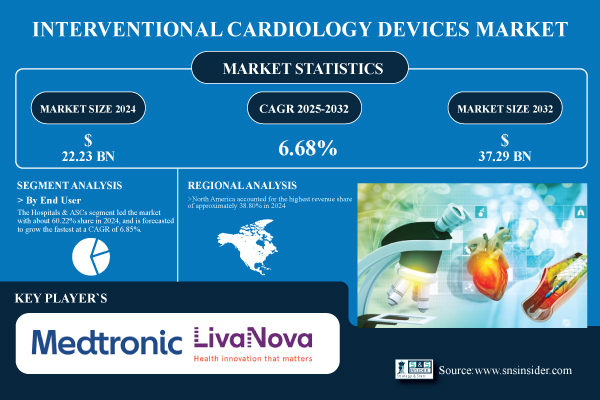

According to SNS Insider, the global Interventional Cardiology Devices Market was valued at USD 22.23 billion in 2024 and is projected to reach USD 37.29 billion by 2032, growing at a CAGR of 6.68% during the forecast period of 2025–2032. The U.S. continues to dominate the market with USD 5.69 billion in 2024, expected to climb to USD 9.38 billion by 2032. This strong trajectory is driven by increasing demand for minimally invasive procedures, technological innovations in stents and catheters, and rising prevalence of cardiovascular diseases (CVDs).

Rapid adoption of precision-guided, imaging-assisted, and robotic interventions is transforming patient care by reducing recovery times, shortening hospital stays, and improving procedural outcomes. Expansion of cardiac catheterization labs across Asia-Pacific and Latin America, along with rising healthcare investments, is further fueling global market growth.

Get free Sample Report of Interventional Cardiology Devices Market: https://www.snsinsider.com/sample-request/8393

Major Players in the Interventional Cardiology Devices Market Include:

- Boston Scientific Corporation

- Medtronic plc

- Abbott Laboratories

- Edwards Lifesciences Corporation

- Terumo Corporation

- Siemens Healthineers

- Philips Healthcare

- Johnson & Johnson

- Cook Medical

- Becton Dickinson

- Cardinal Health

- MicroPort Scientific Corporation

- LivaNova PLC

- Merit Medical Systems, Inc.

- Sorin Group

- ABIOMED, Inc.

- Terumo Interventional Systems

- Claret Medical, Inc.

- Neovasc Inc.

- Boston Scientific

Interventional Cardiology Devices Market Segment Insights

By Product

In 2024, the coronary stents segment held a demanding revenue of around 35.32% in the interventional cardiology devices market share and is expected to continue its dominance, owing to their large application in PCI, the great power of inhibiting restenosis, and the huge acceptance of drug-eluting stents.

By Procedure Type

The interventional cardiology devices industry was dominated by the percutaneous coronary intervention (PCI) segment with a revenue share of over 55.76% in 2024, driven by its efficacy for coronary artery disease, high global volumes, and high usage of stents and balloons. Peripheral vascular intervention (PVI) segment is anticipated to record the fastest CAGR of 7.33% during the forecast period of 2024-2032, due to increasing peripheral artery disease population, diabetes, and geriatric population.

By Technology

The drug-eluting segment led the interventional cardiology devices industry with the highest revenue market share of about 60.52% in 2024, owing to its demonstrable potential for lowering rates of restenosis and enhancing long-term results. The biodegradable segment is likely to register the fastest CAGR of approximately 7.75% over the forecast years 2024-2032, due to greater use of provisional scaffolding, bioresorbable material progress, and lower long-term complications.

By End-User

The hospitals & clinics segment was the dominant segment with a revenue share of around 60.22% in 2024, owing to developed healthcare infrastructure, trained cardiologists, a large number of procedures, a favorable reimbursement scenario, and the adoption of integrated imaging devices.

Buy the Interventional Cardiology Devices Market Report Now: https://www.snsinsider.com/checkout/8393

By Region

The Asia Pacific segment is projected to witness the fastest CAGR of 7.07% during the forecast period of 2024–2032, as there is an increasing prevalence of cardiovascular diseases, a geriatric population, and the incidence of diabetes and obesity.

North America accounted for the highest revenue share of approximately 38.80% in 2024 of the interventional cardiology devices Market, owing to the well-established medical facilities, high incidence of CVDs, and heavy uptake of non-invasive techniques, comprising connections among PCI and TAVR.

Recent News:

- In February 2025, Boston Scientific launched the SYNERGY XD drug-eluting stent in Europe and expanded TAVR/MitraClip structural heart devices in the Asia-Pacific, enhancing coronary and minimally invasive procedure outcomes.

- In March 2025, Medtronic introduced the IN. PACT Admiral drug-coated balloon in the U.S. and expanded robotic-assisted PCI systems across Europe and Latin America for precise cardiovascular interventions.

Exclusive Sections of the Report (The USPs):

- PROCEDURE VOLUME TRENDS – helps you analyze global and regional interventional cardiology procedure volumes (PCI, angioplasty, stenting), assess growth differences between coronary and peripheral interventions, and understand the shift between elective and emergency cardiac procedures.

- PATIENT DEMOGRAPHICS AND UTILIZATION – helps you evaluate patient segmentation by age and gender, identify urban vs. rural utilization disparities, and examine trends in insurance coverage for interventional cardiology procedures.

- HOSPITAL AND CARDIAC CENTER INFRASTRUCTURE TRENDS – helps you understand the distribution of interventional cardiology facilities (hospital-owned, standalone, corporate), track annual launches of new cath labs by region, and assess operational capacity including OR counts and staff-to-patient ratios.

- REIMBURSEMENT AND PAYER MIX ANALYSIS – helps you compare reimbursement shares across Medicare, Medicaid, private insurers, and out-of-pocket payments, analyze rate variations between cath labs and hospitals, and evaluate the impact of bundled payments and value-based care models.

- COST SAVINGS AND DEVICE PRICING – helps you determine average cost savings achieved through minimally invasive devices, compare pricing across stents, balloons, and guidewires, and identify market trends in pricing transparency and preference for cost-effective alternatives.

Interventional Cardiology Devices Market Report Scope

| Report Attributes | Details |

| Market Size in 2024 | USD 22.23 billion |

| Market Size by 2032 | USD 37.29 billion |

| CAGR | CAGR of 6.68% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Key Segments | • By Product (Coronary Stents, Structural Heart Devices, Angioplasty Balloons, Catheters, Embolic Protection Devices, PTCA Balloon Catheters, Others) • By Procedure Type (Percutaneous Coronary Intervention (PCI), Peripheral Vascular Intervention, Structural Heart Procedures) • By Technology (Drug-Eluting, Biodegradable, Advanced Imaging) • By End User (Hospitals & ASCs, Catheterization Labs & Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

Access Complete Report Details of Interventional Cardiology Devices Market Analysis & Outlook: https://www.snsinsider.com/reports/interventional-cardiology-devices-market-8393

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.