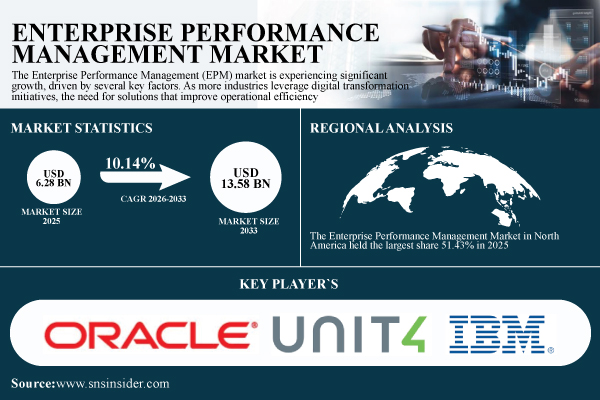

Austin, Oct. 20, 2025 (GLOBE NEWSWIRE) -- The Enterprise Performance Management Market Size was valued at USD 6.28 Billion in 2025E and is expected to reach USD 13.58 Billion by 2033 and grow at a CAGR of 10.14% over 2026-2033.

The market for enterprise performance management (EPM) is expanding significantly as a result of the demand for analytical skills, which enable businesses to obtain actionable insights and make more accurate forecasts as corporate data is becoming more complicated and abundant.

Download PDF Sample of Enterprise Performance Management Market @ https://www.snsinsider.com/sample-request/8764

The U.S. Enterprise Performance Management Market size was worth USD 2.33 Billion in 2025E and is expected to reach USD 4.96 Billion by 2033, growing at a CAGR of 9.94% during 2026-2033.

The demand for real-time analytics, cloud-based and AI-enabled solutions, advanced digital transformation adoption, integration with ERP/CRM systems, and a strong emphasis on data-driven decision-making and regulatory compliance across the manufacturing, IT, and finance sectors are the main factors propelling the growth of the U.S. market.

Key Players:

- Oracle

- SAP

- IBM

- Anaplan

- Workday

- Infor

- Board International

- Unit4

- OneStream Software

- Wolters Kluwer (CCH Tagetik)

- Epicor

- Prophix

- Solver

- Kepion

- Vena Solutions

- Planful

- Jedox

- Broadcom

- Lucanet

- Corporater

Enterprise Performance Management Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025E | USD 6.28 Billion |

| Market Size by 2033 | USD 13.58 Billion |

| CAGR | CAGR of 10.14% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Solution, Services) • By Function (Finance, Human Resources, Supply Chain, Sales and Marketing, Others) • By Deployment (On-Premises, Cloud) • By End Use (BFSI, Retail, Healthcare, IT & Telecom, Government & Education, Manufacturing, Others) |

| Customization Scope | Available upon request |

| Pricing | Available upon request |

If You Need Any Customization on Enterprise Performance Management Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8764

Segmentation Analysis:

By Component, Software Segment Led the Market with a Share of 70.04%, while Services are the Fastest-growing Segment with a CAGR of 11.50%

The Software component is dominating the Enterprise Performance Management (EPM) market due to its widespread adoption for budgeting, forecasting, and performance monitoring across industry verticals. Services segment is experiencing the highest growth due to the increasing need for consulting services, implementation, and support for EPM deployment.

By Deployment, in 2025, On-premise Segment Held the Largest Market Share of 55.20%, while Cloud is the Fastest-growing Segment with a CAGR 12.34%

On-Premises segment will lead the market in Enterprise Performance Management (EPM) market as majority of large enterprises still prefer deploying the system internally largely to have better control, security and compliance to internal IT policies. Cloud deployment is growing rapidly due to its scalability, lower initial cost, availability from remote locations and real-time analytics.

By Function, in 2025, Finance Segment Led the Market with a Share of 40.14%, while Supply Chain is the Fastest-growing Segment with a CAGR of 12.20%

Finance function dominated the Enterprise Performance Management (EPM) market as enterprises are focused on budgeting, forecasting, and monitoring of financial performance in order to comply with regulations and manage the limited resources optimally. The fastest-growing function is the Supply Chain one, supported by the growing trend for integrated planning, inventory management, and operational efficiency across verticals.

By Industry, in 2025, BFSI Segment Dominated the Market with a Share of 27.56%, while Healthcare is the Fastest-growing Segment with a CAGR of 12.30%

the BFSI (Banking, Financial Services, and Insurance) industry occupies a distinctive market share as it is focused toward regulatory compliance, risk portfolio management and exuberance in aesthetic financial performance. Healthcare is the fastest growing industry since it requires efficient allocation of human and non-human resources to be cost-sensitive and monitor overall patient performance.

Regional Insights:

The Enterprise Performance Management Market in North America held the largest share 51.43% in 2025, owing the to the availability of advanced IT infrastructure, high adoption of digital transformation initiatives and adoption of cloud based and AI powered solution.

In 2025, Asia Pacific is the fastest-growing region in the Enterprise Performance Management Market, is projected to expand at a CAGR of 11.67%, due to the ongoing digital transformation, growing cloud adoption, and industrialization taking place in China, India, Japan and several other countries.

Recent Developments:

- In May 2025: Oracle released updates to its EPM Cloud platform, introducing new capabilities across Planning, Financial Close, Reporting, and AI functionalities.

- In December 2024: SAP announced plans to phase out SAP ECC by December 2027, urging customers to adopt S/4HANA for future ERP needs.

Buy Full Research Report on Enterprise Performance Management Market 2026-2033 @ https://www.snsinsider.com/checkout/8764

Exclusive Sections of the Report (The USPs):

- DIGITAL TRANSFORMATION & TECH READINESS – helps you assess how rapidly enterprises are modernizing EPM systems through AI/ML integration, cloud migration timelines, and multi-system connectivity across ERP, CRM, and BI tools.

- RISK, SECURITY & COMPLIANCE INDEX – helps you evaluate the maturity of data governance frameworks, frequency of cybersecurity incidents, and audit efficiency improvements achieved through automated EPM reporting.

- CUSTOMER ENGAGEMENT & UTILIZATION METRICS – helps you track how effectively end-users leverage EPM functionalities, including adoption of predictive analytics, active license utilization, and vendor retention performance.

- VALUE & ROI BENCHMARKS – helps you measure financial performance impact through ROI timelines, ownership costs across enterprise sizes, and reductions in manual errors and reconciliation efforts.

- AI-ENABLED PERFORMANCE INSIGHTS – helps you identify opportunities in predictive planning and forecasting, driven by increasing adoption of AI/ML within EPM solutions to enhance accuracy and agility.

- TECHNOLOGICAL ADOPTION OUTLOOK – helps you uncover future growth drivers by analyzing trends in cloud migration speed, integration density, and enterprise readiness for next-gen performance management ecosystems.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.