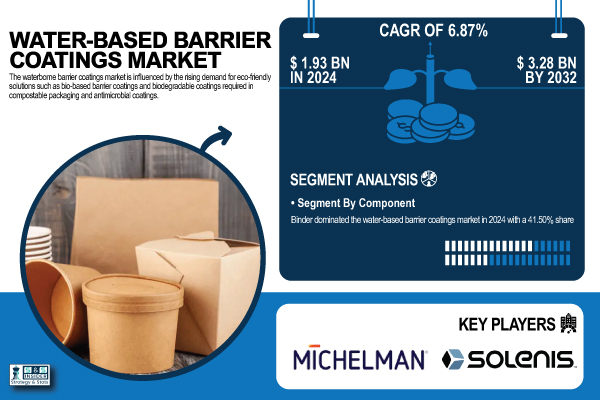

Austin, Aug. 25, 2025 (GLOBE NEWSWIRE) -- The Water-Based Barrier Coatings Market Size was valued at USD 1.93 billion in 2024 and is expected to reach USD 3.28 billion by 2032, growing at a CAGR of 6.87% over the forecast period of 2025-2032.

Growing Sustainability Initiatives and Regulatory Pressures Accelerate Adoption of Water-Based Barrier Coatings as Eco-Friendly Alternatives in Global Packaging Solutions

The adoption of water-based barrier coatings is accelerating worldwide, driven by sustainability targets, stricter regulations, and rising demand for recyclable packaging. According to the U.S. Environmental Protection Agency, food and packaging waste reached 82.2 million tons in 2023, intensifying the shift toward eco-friendly solutions. Companies like Stora Enso and Mondi are expanding portfolios to reduce reliance on plastics, while the European Food Safety Authority underscores safety benefits for food applications. Global bans on single-use plastics and circular economy goals are further fueling demand for these sustainable coatings.

Download PDF Sample of Water-Based Barrier Coatings Market @ https://www.snsinsider.com/sample-request/8252

The U.S. dominates North America’s water-based barrier coatings market, with a market size of USD 347.98 million in 2024, and is projected to reach a value of USD 608.88 million by 2032, accounting for approximately 76% of the market share.

The U.S. water-based barrier coatings market is witnessing strong growth, driven by rising demand for recyclable packaging in foodservice industries and compliance with FDA packaging safety standards. Companies such as WestRock and International Paper are expanding production to meet consumer demand for compostable packaging solutions. Additionally, state-level bans on PFAS chemicals are accelerating the transition toward safer, eco-friendly coatings, reinforcing the industry’s shift toward sustainable alternatives across diverse end-use sectors.

Key Players:

- Michelman, Inc.

- Solenis

- Paramelt B.V.

- Melodea Ltd

- Follmann GmbH & Co. KG

- CH-Polymers Oy

- Mica Corporation

- AQUASPERSIONS Limited

- Empowera Technorganics Pvt Ltd

- Siegwerk Druckfarben AG & Co. KGaA

Water-Based Barrier Coatings Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 1.93 billion |

| Market Size by 2032 | USD 3.28 billion |

| CAGR | CAGR of 6.87% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin Type (Acrylic, Polyethylene (Pe), Polyurethane (Pu), Biopolymers, Epoxy, Others) • By Component (Water, Filler, Binder, Additive) • By Barrier Type (Water Vapor, Oil/Greece, Others) • By End-Use Industry (Food, Beverage, Pharmaceutical, Chemical, Personal Care & Cosmetics, Electronics, Others) |

If You Need Any Customization on Water-Based Barrier Coatings Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8252

By Resin Type, the Acrylic dominated the Water-Based Barrier Coatings Market in 2024, with a 36.8% Market Share.

The dominance is due to acrylic resins being cost-effective, transparent, and offering excellent adhesion, making them highly suitable for food packaging applications. They are extensively adopted in paper and board coatings to ensure recyclability and grease resistance. Companies such as International Paper and Smurfit Kappa use acrylic-based coatings to replace plastics, supported by FDA approvals for direct food contact. Their lower environmental footprint compared to solvent-based options further strengthens their role in sustainable packaging innovations.

By End-Use Industry, the Food and Beverage Segment dominated the Water-Based Barrier Coatings Market in 2024, with a 46.70% Market Share.

The dominance is due to the food and beverage industry’s growing need for sustainable packaging that meets recyclability and safety standards. Quick-service chains like Starbucks and McDonald’s are shifting to compostable paper cups with water-based coatings, highlighting the sector’s role in accelerating adoption. The coatings provide essential moisture and grease resistance while ensuring compliance with USDA guidelines. Their adaptability across bakery, dairy, and beverage applications makes them the most preferred alternative to plastics and wax-based coatings.

By Region, Asia Pacific dominated the Water-Based Barrier Coatings Market in 2024, Holding A 39.20% Market Share.

The dominance is due to strong demand for sustainable packaging across China, India, and Japan, reinforced by government restrictions on single-use plastics and rising consumer eco-consciousness. India’s 2022 nationwide ban on plastic packaging triggered heavy investments in water-based coatings for fiber-based and e-commerce packaging. Leading regional manufacturers continue expanding coating capabilities to meet food, beverage, and online retail demand. These factors, combined with rapid industrial growth and regulatory pressure, firmly establish Asia Pacific as the leading hub for water-based barrier coatings.

Buy Full Research Report on Water-Based Barrier Coatings Market 2025-2032 @ https://www.snsinsider.com/checkout/8252

Unique Selling Propositions (USP’s) of the Water-Based Barrier Coatings Market

- Government Regulations Driving Eco-Friendly Packaging Adoption – Helps the client showcase compliance-led growth opportunities in packaging sectors.

- Decline In Polyethylene Coating Usage In Foodservice Packaging – Highlights substitution opportunities for coatings manufacturers.

- Rising Demand For Pfas-Free Coatings In North America – Guides clients on regulatory-driven innovation.

- Adoption Of Recyclable Fiber-Based Packaging In Qsr Chains – Demonstrates demand from fast-food and beverage leaders.

- Growth In Demand For Compostable Coffee Cups With Water-Based Coatings – Shows sustainability trends in on-the-go packaging.

- Increased r&d Investment In Bio-Based Resin Formulations – Identifies innovation opportunities for coating producers.

- Shifting Consumer Preference For Plastic-Free Cosmetic Packaging – Opens doors for coatings in personal care.

Recent Developments

- In November 2024, BASF opened a new production line for water-based dispersions in Heerenveen (Netherlands), increasing capacity for sustainable dispersion products while minimizing additional CO₂ emissions.

- In October 2024, Michelman debuted an expanded line of water-based barrier and PE-alternative coatings at Pack Expo and teamed with UPM Specialty Papers to introduce high-performance recyclable paper structures using Michelman aqueous coatings.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.