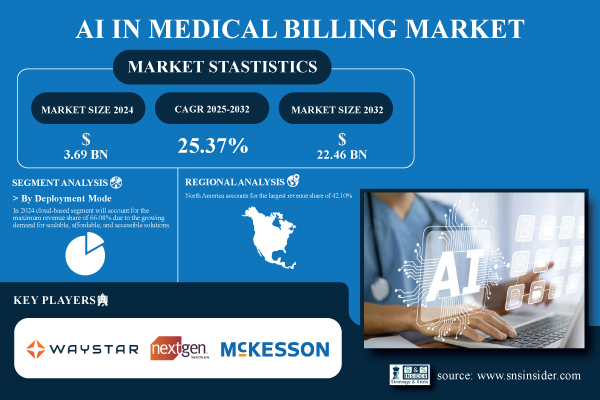

Austin, Aug. 21, 2025 (GLOBE NEWSWIRE) -- The AI in Medical Billing Market was USD 3.69 billion in 2024 and is expected to reach USD 22.46 billion by 2032, growing at a CAGR of 25.37% over the forecast period of 2025–2032.

AI in Medical Billing Revolutionizes Healthcare Finance with Automation and Accuracy

The AI in Medical Billing Market has emerged as one of the most transformative sectors in healthcare technology, reshaping how providers, insurers, and patients interact with financial processes. The market is characterized by intense competition as healthcare organizations prioritize efficiency, accuracy, and regulatory adherence. AI technologies are streamlining workflows by automating claim submissions, coding, eligibility verification, and payment posting, functions that were previously time-intensive and prone to human error.

Download PDF Sample of AI in Medical Billing Market @ https://www.snsinsider.com/sample-request/7320

The U.S AI in the Medical Billing Market size reached USD 1.29 billion in 2024 and is expected to reach USD 7.41 billion in 2032 at a CAGR of 24.46% from 2025 to 2032.

The U.S. remains a major hub, fueled by robust healthcare infrastructure, strict billing regulations, and high AI adoption rates. Hospitals and clinics continue to drive demand, while telehealth growth, regulatory compliance, and the emphasis on revenue cycle optimization provide fertile ground for further expansion.

Key Players:

- Waystar

- NextGen Healthcare, Inc.

- McKesson Corporation

- Epic Systems Corporation

- Athenahealth, Inc.

- eClinicalWorks LLC

- GE Healthcare

- Optum, Inc.

- RapidClaims.Ai

- Nym Health

AI in Medical Billing Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 3.69 Billion |

| Market Size by 2032 | USD 22.46 Billion |

| CAGR | CAGR of 25.37% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Mode (Cloud-Based, On-Premise) • By Application (Automated Billing and Documentation, Revenue Cycle Management, Claims Processing, Denial Management, Fraud Detection, Others) • By End-User (Hospitals and Clinics, Healthcare Payers, Ambulatory Surgical Centers, Others) |

If You Need Any Customization on AI in Medical Billing Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7320

Segmentation Analysis:

By deployment

In 2024, cloud-based solutions held 66.08% of the market share, driven by their affordability, scalability, and ability to integrate seamlessly with telehealth and EHR systems. Leading platforms like Athenahealth and Kareo have developed cloud-based AI tools that improve coding accuracy, prevent claim denials, and enable remote accessibility. The demand for real-time data collaboration and regulatory compliance further cements the cloud’s dominance.

The on-premises segment is expected to record the fastest CAGR of 26.08%. This growth is primarily fueled by large healthcare institutions that require greater control over infrastructure and patient data security. On-premises deployments cater to organizations bound by strict compliance requirements. Companies like AdvancedMD and eClinicalWorks are enhancing their on-premises AI tools to support claims processing and billing analytics, positioning this segment as a critical choice for data-sensitive healthcare providers.

By application

Revenue cycle management (RCM) accounted for 49.37% of the market in 2024. Healthcare facilities increasingly rely on AI to automate patient registration, eligibility verification, coding, and denial management, enabling faster payments and fewer administrative burdens. Companies such as Change Healthcare and R1 RCM are spearheading this trend by embedding AI into their RCM platforms.

The fraud detection segment, however, is forecast to grow at the highest CAGR of 30.85%. With regulatory scrutiny intensifying and fraudulent claims on the rise, AI’s ability to identify anomalies and detect billing fraud is becoming indispensable. Providers and insurers are ramping up investments in fraud detection solutions offered by players like Optum and SAS.

By end-user

In 2024, hospitals and clinics dominated the AI in medical billing market, accounting for a 60.22% share, driven by high patient volumes and significant administrative workloads. AI enables these institutions to automate complex billing processes, improving accuracy and efficiency. Leading providers like Epic Systems and Cerner have integrated AI-driven billing tools into clinical and financial workflows, reinforcing hospitals’ position as the largest market contributors.

Meanwhile, healthcare payers are projected to grow at the fastest CAGR of 26.84%, fueled by investments in AI for claims adjudication, fraud detection, and billing error reduction. Major insurers, such as Humana and UnitedHealth Group, are leveraging AI to reduce costs, enhance efficiency, and support the transition to value-based care and predictive analytics.

North America Leads; Asia Pacific Emerges as Fastest-Growing Region in AI Medical Billing Market

North America leads the AI in Medical Billing Market with a 42.10% revenue share, bolstered by advanced healthcare infrastructure, high AI adoption, and stringent regulations. The U.S. dominates regional growth due to substantial healthcare spending, early integration of AI, and strong digital health initiatives. Providers across the U.S. increasingly adopt AI to manage claims, avoid denials, and ensure compliance.

In Europe, the market is being shaped by healthcare digitization and supportive government policies. Germany stands out as the leading country, driven by IT infrastructure investments and aggressive adoption of AI in billing workflows. Stringent data privacy regulations further necessitate secure, AI-driven billing platforms.

The Asia Pacific region is the fastest-growing market, expanding at a CAGR of 27.30%. Countries like China are leading adoption with government-driven digital healthcare initiatives, rapidly growing hospital networks, and investments in AI-enabled cloud billing platforms.

Recent Developments

- April 2024 – McKesson’s Ontada partnered with Microsoft to leverage Azure AI and OpenAI capabilities, analyzing more than 150 million oncology documents to enhance data extraction and insights.

- May 2025 – Optum launched Optum Integrity One, an AI-enabled revenue cycle platform aimed at reducing inefficiencies and improving documentation accuracy. Early pilot studies revealed a 20% increase in coding productivity.

Buy Full Research Report on AI in Medical Billing Market 2025-2032 @ https://www.snsinsider.com/checkout/7320

Exclusive Sections of the Report (The USPs)

- Cost Savings & Efficiency Metrics – helps you measure operational cost reductions, process automation benefits, and improved resource utilization from AI-driven billing.

- Accuracy & Error Rate Improvements – helps you track reductions in claim denials, coding errors, and administrative mistakes through AI-powered automation.

- Customer Satisfaction & ROI – helps you evaluate patient/provider experience enhancements, faster claim processing, and enterprise-level return on investment timelines.

- Payment Recovery Rate – helps you understand improvements in reimbursement timelines, higher claim acceptance ratios, and overall revenue cycle performance.

- Adoption & Deployment Insights – helps you analyze adoption across hospitals, clinics, and payers, highlighting maturity levels in AI billing solutions.

- Technological Integration Benchmarks – helps you assess integration with EHR/EMR systems, cloud-based billing platforms, and interoperability standards.

- Market Penetration Dynamics – helps you identify growth opportunities in underpenetrated regions, emerging healthcare ecosystems, and AI-driven compliance use cases.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.