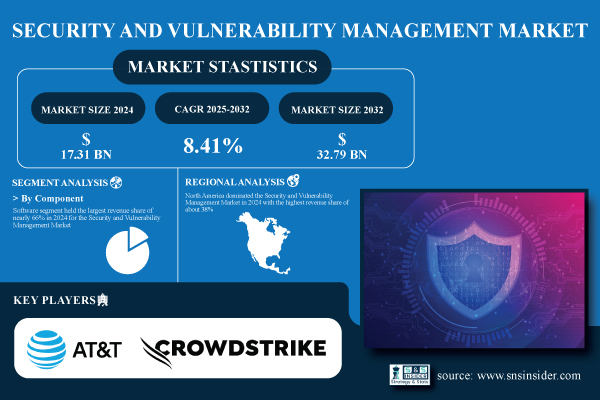

Austin, Aug. 18, 2025 (GLOBE NEWSWIRE) -- The Security and Vulnerability Management Market was valued at USD 17.31 billion in 2024 and is expected to reach USD 32.79 billion by 2032, growing at a CAGR of 8.41% from 2025 to 2032.

Rising Cyber Threats and Compliance Pressures Fuel Rapid Growth in Security and Vulnerability Management Market

The security and vulnerability management market is rapidly expanding as organizations face escalating cyber threats and increased regulatory scrutiny. This market is driven by the growing need for advanced security solutions capable of identifying and mitigating vulnerabilities before they can be exploited. Businesses, especially in highly regulated sectors, are recognizing the need to deploy robust frameworks that ensure compliance while protecting sensitive data.

Download PDF Sample of Security And Vulnerability Management Market @ https://www.snsinsider.com/sample-request/7208

The U.S. Security and Vulnerability Management Market was valued at USD 4.66 billion in 2024 and is projected to reach USD 8.65 billion by 2032, registering a CAGR of 8.06% during the forecast period of 2025–2032. The market’s growth is being propelled by the increasing frequency of cyberattacks, a heightened need for sophisticated tools to detect and mitigate vulnerabilities in critical infrastructure, and the widespread adoption of advanced security technologies.

Key Players:

- AT&T Intellectual Property

- CrowdStrike

- Cisco Systems, Inc.

- Fortra, LLC

- IBM Corporation

- Microsoft

- Qualys, Inc.

- Rapid7

- RSI Security

- Tenable, Inc

Security And Vulnerability Management Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 17.31 Billion |

| Market Size by 2032 | USD 32.79 Billion |

| CAGR | CAGR of 8.41% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Type (Endpoint Security, Cloud Security, Network Security, Application Security, Infrastructure Protection, Data Security, Others) • By Target (Content Management Vulnerabilities, IoT Vulnerabilities, API Vulnerabilities, Others) • By Deployment (Cloud, On-premises) • By Enterprise Size (Large Enterprises, SMEs) • By Vertical (BFSI, Healthcare, Defense/Government, IT and Telecom, Energy, Retail, Manufacturing, Others) |

If You Need Any Customization on Security And Vulnerability Management Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7208

Segment Analysis

By Component

The Software segment led the market with a dominant revenue share of approximately 66% in 2024, attributed to its capabilities in real-time vulnerability scanning, threat detection, and automation. Enterprises prefer software solutions for their ease of deployment, scalability, and ability to integrate seamlessly with existing security stacks. On the other hand, the Services segment is forecasted to grow at the fastest CAGR of 9.66%, fueled by increasing reliance on managed security services and the shortage of skilled cybersecurity professionals.

By Enterprise Size

Large Enterprises captured the largest share, around 69% in 2024, owing to their vast IT infrastructures and stringent compliance requirements. These organizations have the financial and technical resources to deploy and manage sophisticated SVM systems. Conversely, SMEs are expected to grow at a CAGR of 9.67% due to the rising frequency of cyberattacks targeting smaller organizations and the growing availability of affordable, cloud-based solutions.

By Deployment

The Cloud segment dominated with a share of 58% in 2024, benefiting from widespread adoption of cloud infrastructure. Cloud-native SVM tools are favored for their agility, real-time visibility, and centralized threat management capabilities. Meanwhile, On-premises deployment is set to grow at 9.34% CAGR, driven by sectors like healthcare and defense that prioritize data sovereignty and regulatory compliance.

By Vertical

The Defense and Government sector led the market with a 24% share, given their high-security requirements and persistent exposure to sophisticated cyber threats. The BFSI sector is projected to grow at the fastest CAGR of 9.74%, driven by increased digital banking activities, heightened regulatory oversight, and the need to secure critical financial data.

By Type

Infrastructure Protection accounted for the largest share at 25% in 2024, underscoring the critical need to protect vital public and private infrastructure systems. The Cloud Security segment is poised for the highest growth (CAGR 9.45%), driven by increasing cloud adoption and the necessity to secure multi-cloud environments.

By Target

Content Management System (CMS) vulnerabilities dominated with 36% of market share due to the widespread use of platforms like WordPress and Joomla, which are common attack vectors. API vulnerabilities will see the fastest CAGR of 10.14%, as enterprises embrace API-driven architectures, which present new vectors for potential exploitation.

North America Dominates Security and Vulnerability Management Market as Asia Pacific Emerges Fastest Growing Region

In 2024, North America led the Security and Vulnerability Management market, capturing 38% of global revenue, driven by robust cybersecurity infrastructure, frequent cyberattacks, and stringent regulations like HIPAA and CCPA. The U.S. remains the top contributor due to significant investments in digital security and enforcement of ICTS rules. Meanwhile, Asia Pacific is projected to grow at the fastest CAGR of 10.51% from 2025–2032, fueled by rapid digital transformation, IT expansion, and growing cybersecurity initiatives in China, India, and Japan. Europe holds a notable share, with the UK at the forefront due to strict GDPR enforcement and rising digital threats. Middle East & Africa and Latin America are also experiencing steady growth, supported by increasing digitization, cybersecurity awareness, and government initiatives to bolster data protection infrastructure. Global market dynamics reflect a widespread prioritization of proactive vulnerability management across diverse economic landscapes.

Recent Developments

- March 2025: CrowdStrike introduced an AI-powered Network Vulnerability Assessment feature within its Falcon Exposure Management platform. The innovation allows enterprises to prioritize network risks in real time without requiring additional hardware.

- April 2025: Rapid7 enhanced its Managed Detection and Response (MDR) service by launching a new Detection & Response Dashboard and AI Alert Triage Transparency features, providing better threat visibility and transparency into AI-driven decisions.

Buy Full Research Report on Security And Vulnerability Management Market 2025-2032 @ https://www.snsinsider.com/checkout/7208

Exclusive Sections of the Report (The USPs)

- Threat Detection & Response Time – helps you assess how quickly organizations are identifying and responding to cyber threats, with leading firms reducing detection time from weeks to hours through advanced SVM platforms.

- Tool Usage & Integration Statistics – helps you understand enterprise reliance on multi-tool security ecosystems, highlighting that over 65% of firms use integrated vulnerability management tools with SIEM, SOAR, and endpoint security systems.

- Automation and AI Usage – helps you evaluate the growing role of AI and automation, where over 70% of top-performing organizations use AI-based triage and risk prioritization, significantly enhancing remediation efficiency.

- Incident Volume Reduction Rate – helps you measure the tangible impact of SVM adoption, with organizations reporting up to 45% reduction in security incidents post-implementation of automated vulnerability management frameworks.

- Emerging Technology Vulnerability Stats – helps you track risks in newer environments, revealing APIs and cloud-native platforms as top targets, with API vulnerabilities growing at over 10% CAGR due to increased microservices adoption.

- Security Compliance Adherence Rate – helps you gauge how organizations are aligning with regulations like GDPR, HIPAA, and the Cyber Security and Resilience Bill, with compliance-driven adoption contributing to nearly 60% of new deployments.

- Ransomware And Advanced Threat Trends – helps you understand the evolving threat landscape, noting a 73% global surge in ransomware attacks in 2023, with healthcare and BFSI sectors most affected, driving sector-specific SVM investment.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.