Austin, Aug. 05, 2025 (GLOBE NEWSWIRE) -- D-dimer Testing Market Size & Growth Analysis:

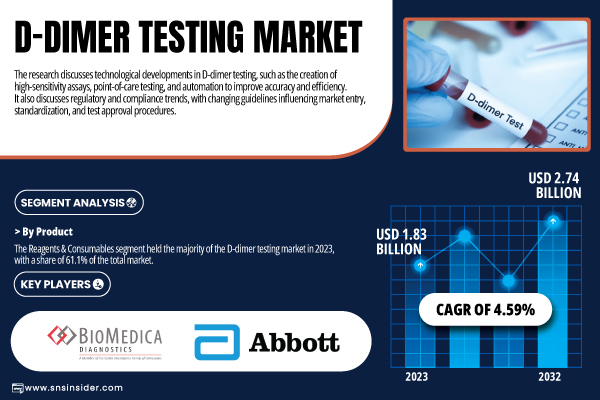

According to SNS Insider, The D-dimer Testing Market was valued at USD 1.83 billion in 2023 and is projected to reach USD 2.74 billion by 2032, growing at a CAGR of 4.59% during the forecast period 2024–2032.

The U.S. D-dimer Testing Market alone contributed USD 0.43 billion in 2023 and is projected to reach USD 0.59 billion by 2032, showcasing consistent demand in a region with a high prevalence of thrombotic and cardiovascular diseases.

Get Free Sample Report of the D-dimer Testing Market: https://www.snsinsider.com/sample-request/6259

D-dimer testing is increasingly being adopted for its critical role in diagnosing deep vein thrombosis (DVT), pulmonary embolism (PE), and disseminated intravascular coagulation (DIC). The rise in chronic conditions, aging global populations, and post-COVID-19 complications are expected to further fuel demand.

Key Growth Drivers:

Rising Prevalence of Thrombotic Events: Sedentary lifestyles, obesity, and smoking contribute to growing cases of DVT and PE.

Aging Population: Older adults are more susceptible to clotting disorders, increasing demand for rapid diagnostic solutions.

Point-of-Care Testing (POCT) Advances: Technological innovations are expanding test accessibility across outpatient and emergency care settings.

Healthcare Infrastructure Expansion in Emerging Markets: Developing regions are investing in diagnostic technologies to improve patient outcomes.

Major Players Analysis Listed in this Report are:

- Siemens Healthcare

- Biomedica Diagnostics

- Abbott

- Thermo Fisher Scientific Inc.

- WERFEN

- HORIBA, Ltd.

- SEKISUI Diagnostics

- F. Hoffmann-La Roche Ltd

- BIOMÉRIEUX

- QuidelOrtho Corporation

- Diazyme Laboratories

Segment Analysis

By Product:

The market is led by the reagents & consumables segment in 2023, which held a share of 61.1% owing to its high-volume use for repetitive testing as well as rising demand for standardized product kits available at hospitals and laboratories. Test operation essential: Dynamic filling and dumping, consumables must be recycled frequently.

By Test Type:

Clinical laboratory tests held the majority share of 59.5% in 2023 on account of higher throughput and the fact that they can process bulk testing effectively, especially in hospitals & diagnostic centers. However, point-of-care tests (POCT) are experiencing the fastest growth owing to their rising application in the emergency department and outpatient care. A major driver is their potential to deliver fast, actionable results at the bedside or in ambulances.

By Method:

In 2023, the ELISA was responsible for a 39.6% market share driven by its proven efficiency and scalability to clinical lab settings with high accuracy levels. The latex-enhanced immunoturbidimetric assay is a rapidly expanding method with a shorter turnaround time and full integration into automated analyzers, which allows rapid high-throughput testing.

By Application:

The highest DVT market share was for the deep vein thrombosis (DVT) segment in 2023, with a global spread and significant clinical emphasis on its early detection. Pulmonary embolism (PE) is turning out to be the fastest growing segment, and this growth is particularly attributed to an increase in awareness as well as advancements in detection technologies across emergency medicine.

By End-Use:

Hospitals controlled the largest share of the market in 2023, at 32.8%. This occurs because of the large number of emergency, ICU, and in-house laboratories capable of carrying out rapid diagnostic work-ups.

For a Personalized Briefing with Our Industry Analysts, Connect Now: https://www.snsinsider.com/request-analyst/6259

D-dimer Testing Market Segmentation

By Product

- Analyzers

- Reagents & Consumables

By Test Type

- Clinical Laboratory Tests

- Point-of-Care Tests

By Method

- Enzyme-linked Immunosorbent Assay (ELISA)

- Latex-enhanced Immunoturbidimetric Assays

- Fluorescence Immunoassays

- Others

By Application

- Deep Vein Thrombosis (DVT)

- Pulmonary Embolism (PE)

- Disseminated Intravascular Coagulation (DIC)

- Others

By End-Use

- Hospitals

- Academic & Research Institutes

- Diagnostic Centers

- Others

Regional Analysis

The market in North America is expected to grow at the highest CAGR during the forecast period, driven by high healthcare expenditure, strong laboratory testing base, and a well-developed physician network. The U.S., especially, has high diagnostic rates and cardiovascular disease incidence, thus ruling the region.

Asia Pacific is the largest growing region for the anticipated period. The diagnostic field is experiencing an exponential growth in several countries, such as China and India, driven by escalating investments toward healthcare infrastructure development and growing accessibility to POCT products. Several drivers contribute to RT acceptance: heightened public awareness, wider insurance coverage, and government moves against noncommunicable disease.

Recent Advances in D-dimer Testing Market

- Feb 2023 – Carolina Liquid Chemistries Corp. and Diazyme Laboratories added D-dimer to its test menu on the DZ-Lite c270 analyzer, part of a batch of 25 new assays to give diagnosticians more flexibility.

- April 2024 – Siemens Healthineers introduced an enhanced D-dimer assay to the Atellica Solution platform, which provided enhanced sensitivity and turnaround times for emergency settings.

Suggested Unique USP Sections for Client Proposal

- Prevalence-Based Demand Modeling – Country-wise mapping of thrombotic disease burden vs. current D-dimer testing rates.

- Point-of-Care Ecosystem Analysis – Mapping adoption trends and infrastructure requirements for POCT expansion across regions.

- Regulatory & Reimbursement Landscape – Coverage policies, regional regulatory hurdles, and HTA frameworks impacting test adoption.

- AI Integration & Diagnostic Decision Support – Innovations around AI-enhanced interpretation of D-dimer results for clinical triage.

- Hospital-Laboratory Partnership Models – Case studies on how labs and hospitals are optimizing diagnostic turnaround and cost via partnerships.

- Workflow & Automation Impact Analysis – Efficiency benchmarking of automated platforms vs. manual processing for D-dimer testing.

- D-dimer in Multi-Analyte Panels – Future scope and pipeline analysis of D-dimer integration into cardiovascular or coagulation biomarker panels.

Buy the Full D-dimer Testing Market Report (Single-User License) Now: https://www.snsinsider.com/checkout/6259

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.