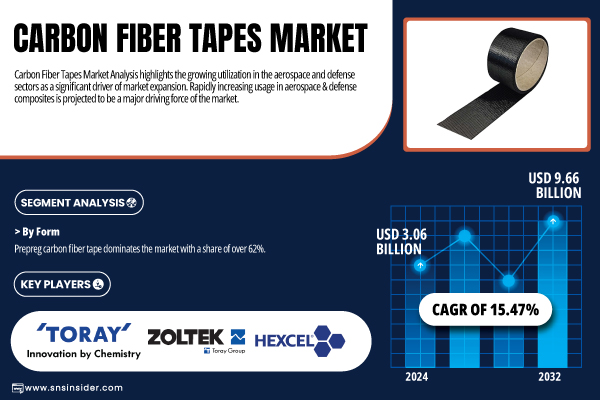

Austin, Aug. 05, 2025 (GLOBE NEWSWIRE) -- The Carbon Fiber Tapes Market Size was valued at USD 3.06 billion in 2024 and is expected to reach USD 9.66 billion by 2032, growing at a CAGR of 15.47% over the forecast period of 2025-2032.

Advancements in Aerospace and Automotive Drive Carbon Fiber Tape Adoption for Sustainable and Lightweight Solutions

The carbon fiber tapes industry is rapidly advancing due to increasing use in aerospace and automotive sectors focused on lightweight, high-strength materials. Government initiatives promoting energy efficiency and sustainability, such as the U.S. Environmental Protection Agency’s roadmap and the Inflation Reduction Act, are accelerating adoption. Major players like Boeing and Ford are investing in carbon fiber tape technologies to reduce vehicle and aircraft weight significantly. Growth is also fueled by expanding renewable energy projects and a shift toward recyclable thermoplastic tapes, highlighting innovation and environmental responsibility.

Download PDF Sample of Carbon Fiber Tapes Market @ https://www.snsinsider.com/sample-request/7933

Key Players:

- Hexcel Corporation

- Toray Industries Inc.

- Teijin Limited

- Mitsubishi Chemical Group

- SGL Carbon

- Zoltek Corporation

- Gurit Holding AG

- Park Aerospace Corp.

- Royal DSM

- Solvay S.A.

- Celanese Corporation

- Rhein Composite GmbH

- TCR Composites

- SHD Composite Materials Ltd.

- North Thin Ply Technology (NTPT)

- ATC Manufacturing

- Cytec Engineered Materials

- Cristex Composite Materials

- PRF Composite Materials

- TenCate Advanced Composites

Carbon Fiber Tapes Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 3.06 Billion |

| Market Size by 2032 | USD 9.66 Billion |

| CAGR | CAGR of 15.47% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form: Prepreg Tape, Dry Tape, Others (Woven Tape, Multi-axial Tape) • By Resin Type: Epoxy, Thermoplastic, Polyamide, Bismaleimide, Others (Vinyl Ester, Phenolic, Polyimide) • By Grade: PAN-based Carbon Fiber, Pitch-based Carbon Fiber, High-Strength Grade, High-Modulus Grade, Others (Intermediate Modulus Grade, Ultra-High Modulus, Recycled Carbon Fiber) • By Manufacturing Process: Hot Melt, Solvent Dip, Wet Layup, Pultrusion, Others (Dry Winding, Braiding) • By End-Use Industry: Aerospace & Defense, Automotive, Sports & Leisure, Marine, Others (Pipe & Tank, Construction & Infrastructure, Wind Energy, Others) |

If You Need Any Customization on Carbon Fiber Tapes Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7933

The U.S Carbon Fiber Tapes market size was USD 909 million in 2024 and is expected to reach USD 2871 million by 2032 and grow at a CAGR of 15.47% over the forecast period of 2025-2032.

The US carbon fiber tapes market is growing, driven by strong aerospace investments, EV expansion, and innovation by firms like Boeing and Hexcel. Advancements such as automated tape laying systems and new thermoplastic tape production lines support applications in defense, automotive, and next-generation lightweight components.

By Resin Type, the Epoxy Resins dominated the Carbon Fiber Tapes Market in 2024, with a 40% Market Share.

The dominance is due to epoxy’s superior bonding, temperature resistance, and fatigue performance, making it ideal for critical aerospace and automotive parts. Boeing’s 777X wings heavily use epoxy tapes, highlighting its reliability for structural strength. While thermoplastic tapes gain interest for recyclability, epoxy remains favored for primary load-bearing structures and wind turbine blades. Recent investments by Hexcel in expanding epoxy tape capacity further reflect sustained demand for high-performance applications requiring durability and precise engineering standards.

By End-Use Industry, the Aerospace & Defense Segment dominated the Carbon Fiber Tapes Market in 2024, with a 55%Market Share.

The dominance is due to widespread use of carbon fiber tapes in aircraft wings, fuselage sections, and rotor blades to reduce weight and boost fuel efficiency. FAA data shows composite use in new-generation aircraft surged over 50% from 2010–2023. U.S. defense modernization programs, UAV projects, and next-gen fighters further fuel demand. Companies like Northrop Grumman and Lockheed Martin integrate these tapes into critical components, underlining the sector’s strategic reliance on lightweight, high-strength materials.

By Region, North America dominated the Carbon Fiber Tapes Market in 2024, Holding a 39.50% Market Share.

The dominance is due to North America’s strong aerospace OEM base, automotive lightweighting innovations, and supportive policies for advanced composites. Boeing and Lockheed Martin drive large-scale applications, while EV manufacturers adopt carbon fiber tapes to cut vehicle weight. According to the U.S. Department of Commerce, composite exports rose 15% in 2023. Coupled with partnerships between material producers and OEMs, and the rise of renewable projects like wind blades, this strengthens North America’s leadership.

Recent Developments

- In March 2025, Teijin Carbon unveiled Tenax Next HTS45 E23 24K carbon fiber tape at JEC World 2025, featuring a 35% lower CO₂ footprint and compatibility with automated tape laying, advancing sustainability in high-performance composites

- In November 2024, Toray Industries announced expanded capacity and enhanced capabilities in its continuous fiber–reinforced thermoplastic carbon fiber tape portfolio, increasing throughput for aerospace and automotive lightweight components at its Morgan Hill, California, facility

Buy Full Research Report on Carbon Fiber Tapes Market 2025-2032 @ https://www.snsinsider.com/checkout/7933

USPs of the Carbon Fiber Tapes Market

- Investment in Production Facilities - Rising investments in automated and high-capacity tape manufacturing plants are strengthening supply reliability and meeting growing aerospace and automotive demand.

- Regulatory Compliance Impact Assessment - Strict global aerospace and automotive safety standards are driving innovation in resin systems and boosting demand for certified carbon fiber tapes.

- Recyclability and Circular Economy Initiatives - Growing focus on recyclable thermoplastic tapes aligns with circular economy goals, appealing to industries prioritizing sustainable lightweight solutions.

- Benchmarking Against Substitute Materials - Carbon fiber tapes outperform metals and traditional composites by offering superior strength-to-weight ratios and corrosion resistance, supporting wider adoption.

- Export Tariff Impact Analysis – Shifts in global trade tariffs affect pricing competitiveness and regional supply strategies, prompting manufacturers to diversify sourcing and production bases.

- Impact of Sustainability Certifications – Environmental certifications enhance market appeal, especially in Europe and North America, by validating reduced carbon footprints and sustainable production methods.

- Transportation and Logistics Efficiency - Optimized distribution networks and regional hubs reduce lead times and costs, ensuring timely delivery to key aerospace and automotive manufacturing centers.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.