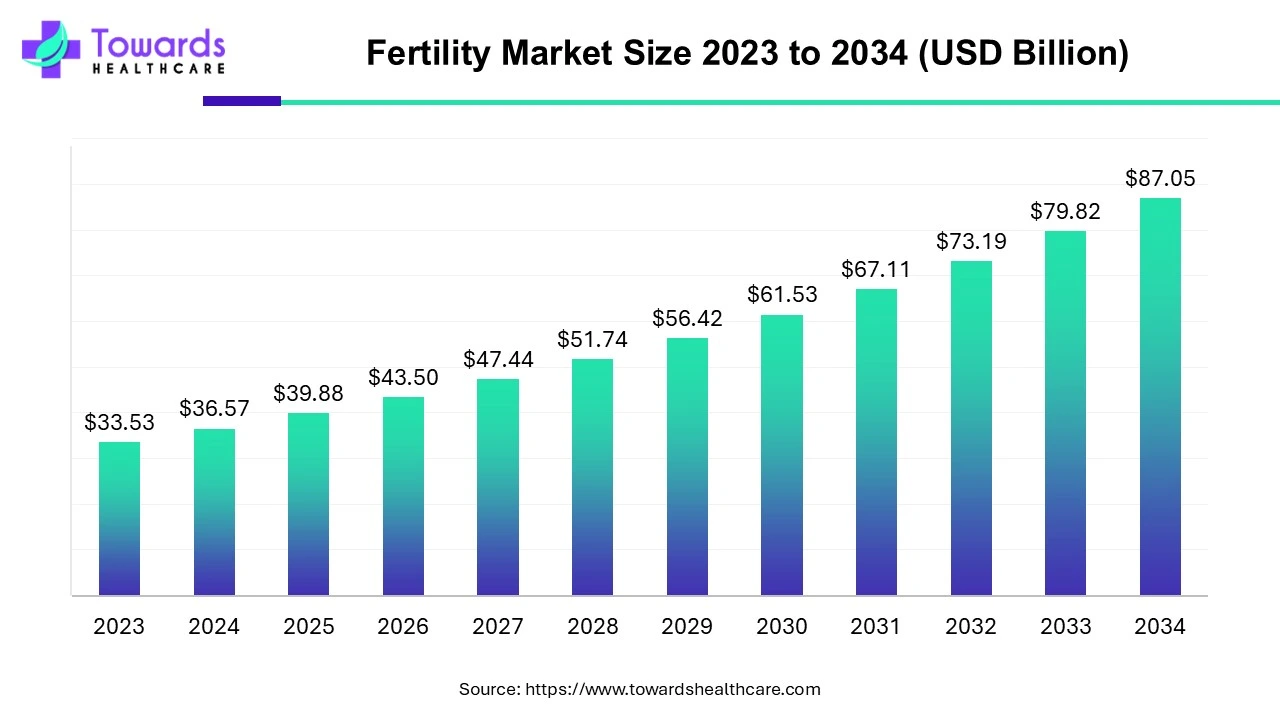

Ottawa, Aug. 04, 2025 (GLOBE NEWSWIRE) -- The global fertility market size was valued at USD 36.57 billion in 2024 and is predicted to hit around USD 87.05 billion by 2034, a study published by Towards Healthcare a sister firm of Precedence Research.

The growth of the market is driven by the growing awareness and demand for advance technology due to increasing infertility rates, which fuels the growth of the market.

Explore key highlights and trends – grab your free sample of the Fertility Market report @ https://www.towardshealthcare.com/download-sample/5464

Key Takeaways

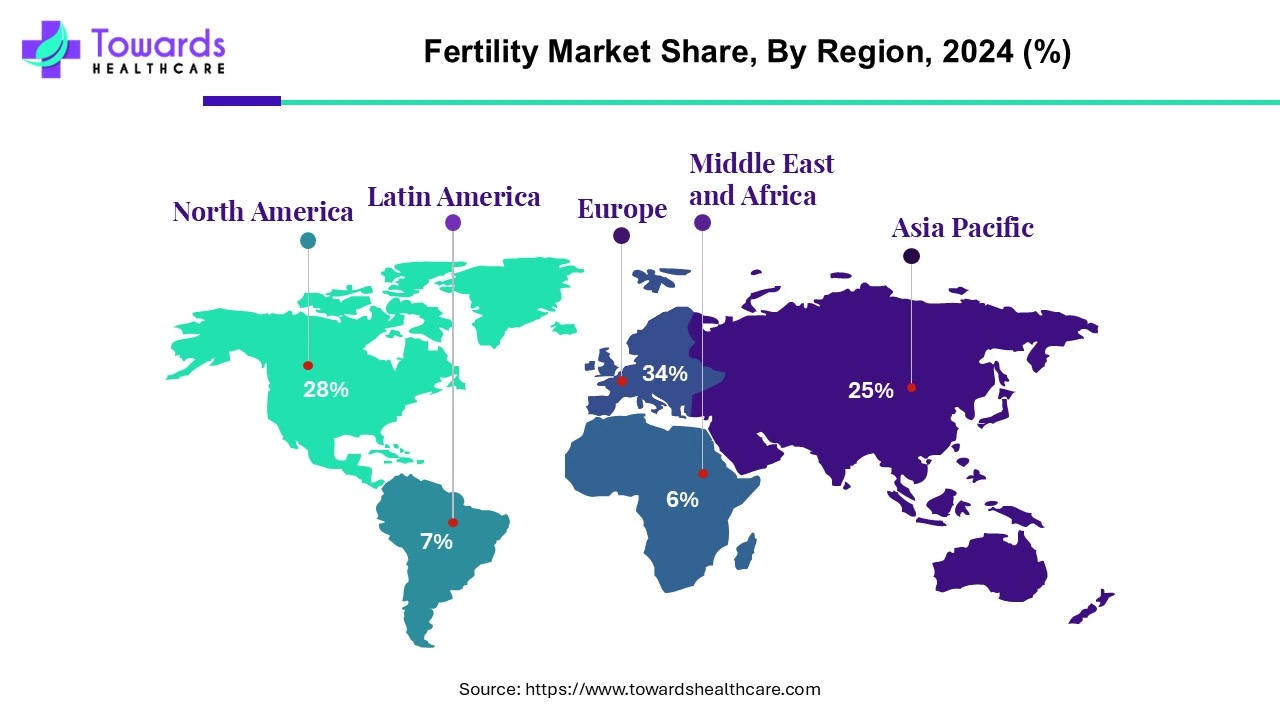

- Europe dominated globally and held the largest share of 34% in the fertility market in 2024.

- Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By offering, the assisted reproductive technology segment registered its dominance over the global fertility market in 2024.

- By offering, the fertility drugs segment is expected to grow at a significant rate in the market during the forecast period.

- By end-user, the fertility clinics segment held a dominant presence in the market in 2024.

- By end-user, the hospital segment is projected to grow at a significant rate during the coming years.

Fertility Market Overview & Potential

Fertility refers to an organism's natural ability to achieve a clinical pregnancy through a complex biological process known as reproduction, assisted by the reproductive system, to produce offspring and ensure the survival of the species. The growing rate of infertility worldwide significantly contributes to market growth. Major causes of infertility include lifestyle changes such as poor diet and obesity, stress, and alcohol consumption, as well as medical conditions like polycystic ovary syndrome (PCOS), endometrial tuberculosis, and sexually transmitted infections (STIs). Furthermore, in older women, declining egg quality due to late pregnancy also plays a role in increasing infertility rates.

Key Metrics and Overview

| Metric | Details | |

| Market Size in 2025 | USD 39.88 Billion | |

| Projected Market Size in 2034 | USD 87.05 Billion | |

| CAGR (2025 - 2034) | 9.06 | % |

| Leading Region | Europe | |

| Market Segmentation | By Offering, By End-user and By Region | |

| Top Key Players | PFCLA, Mayo Foundation for Medical Education and Research (MFMER), Cleveland Clinic, Apricity Fertility UK Limited, King’s Fertility Limited Dallas IVF, Midwest Fertility Specialists, Europe IVF, Care Fertility, Aspire Fertility, Virtus Health and Monash IVF Group | |

What is the Growth Potential Responsible for The Growth of The Fertility Market?

The growth of the market is driven by the growing and increasing fertility rates due to various factors like stress, smoking, obesity, and environmental pollutants, which cause infertility in both genders. Delayed parenthood and underlying medical conditions are the major drivers of the market. The advanced technology, like IVF, AI, and machine learning integration, improved cryopreservation these factors drive the growth of the market. The rising awareness and acceptance due to rising awareness about infertility and available treatment demand for the market. The government initiatives for the development of infrastructure and social acceptance are the major drivers that boost the growth of the market and also support expansion.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Emerging Trends in the Fertility Market?

Increasing Infertility Prevalence:

- The high rate of infertility among couples worldwide drives the demand for fertility services.

Advances in ART:

- Innovations such as IVF, ICSI, and genetic testing are making treatments more successful and widely available.

Customized Fertility Treatments:

- Genomic medicine allows for personalized treatment plans based on individual genetic profiles, boosting success rates.

Improved Cryopreservation:

- Progress in the preservation of eggs, sperm, and embryos leads to higher survival and thawing success.

Microfluidics and Lab-on-a-Chip:

- These technologies facilitate precise and efficient handling of gametes and embryos.

What are the Key Challenges that Hinder the Growth of the Fertility Market?

The market faces obstacles like high costs, limited access, ethical issues, and the emotional burden of treatment. Additionally, demographic changes, technological advancements, and regulatory hurdles further shape the industry. Fertility treatments, especially IVF, can be very expensive, creating financial barriers for many individuals and couples, particularly those with lower incomes. The need for clinics to adapt to new technologies, regulations, and billing procedures adds to administrative challenges, which can limit market growth and expansion.

Regional Analysis

How Did Europe Dominate the Fertility Market in 2024?

The 34% growth of the market in Europe is driven due to the demand for fertility treatments across Europe, which has grown due to changing lifestyles, delayed childbearing, and increasing infertility rates, which demand for the market. Regulations vary by country, with some nations allowing more reproductive options and others maintaining stricter rules. Many fertility clinics offer advanced treatments and basic fertility assessments, often providing customized care for individuals and couples. Due to differences in costs and regulations, some individuals may travel to other European countries for treatment. These factors boost the growth of the market in the region.

The U.S. faces declining fertility rates, reaching a record low of 1.62 births per woman in 2023. Economic pressures, delayed childbearing, and work-life imbalance contribute. Assisted reproductive technologies are rising, but access varies. Aging population and workforce concerns are prompting policy discussions around childcare, family leave, and reproductive healthcare access.

Canada's fertility rate dropped to 1.33 births per woman in 2023. High living costs, housing affordability, and delayed parenthood influence this trend. Immigration offsets population decline, but concerns about long-term sustainability remain. Policymakers are exploring child benefits, affordable childcare, and support for work-family balance to address demographic and economic impacts.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

What Made Asia Pacific Significantly Grow in The Fertility Market In 2024?

The growth of the market in the region is driven by the rise in fertility treatment demand is linked to postponed childbearing, lifestyle changes, and higher infertility rates. Advances in assisted reproductive technologies (ART), such as ICSI, PGT, and IVF, have improved access and success rates. In the Asia Pacific region, government subsidies help make these treatments more affordable. Increased awareness of reproductive health and reduced stigma have encouraged more people to seek help. Additionally, many countries are updating their ART laws to make treatments more accessible and inclusive. These factors boost the growth and expansion of the market in the region.

China's fertility crisis deepened after the end of the one-child policy. The 2023 rate fell below 1.0, with shrinking births and a rapidly aging population. Economic insecurity, high education costs, and gender inequality deter childbearing. Despite incentives like cash bonuses and extended leave, young adults remain reluctant to start families, threatening future growth.

India's fertility rate is nearing replacement level, averaging 2.0 births per woman in 2023. Urbanization, rising education levels, and women’s workforce participation contribute. While the overall population remains high, regional disparities persist. Southern states show below-replacement rates, raising concerns about aging. Policy focus is shifting toward maternal health, education, and empowerment.

Segmental Insights

By Offering

The assisted reproductive technology segment registered its dominance over the global fertility market in 2024. Assisted Reproductive Technology (ART) forms the core of the market, offering procedures such as IVF, ICSI, IUI, and donor-assisted treatments. This segment is driven by rising infertility rates, delayed parenthood, and increased acceptance of ART among single individuals and same-sex couples. Technological advancements like time-lapse embryo imaging and genetic screening have improved success rates and patient confidence. With growing awareness, expanding fertility clinics, and supportive legal frameworks in several countries, ART continues to witness strong demand. This remains the most sought-after solution for managing complex infertility issues worldwide. These factors drive the growth and expansion of the market.

The fertility drugs segment is expected to grow at a significant rate in the fertility market during the forecast period. Fertility drugs are a foundational component of infertility treatment, used to stimulate ovulation, regulate hormonal balance, and improve the chances of conception. These medications are often the first line of treatment and are also essential in assisted reproductive procedures like IVF and IUI. The segment is fueled by increasing awareness, rising infertility prevalence, and a growing preference for non-invasive, cost-effective solutions. Common drugs include clomiphene citrate, letrozole, gonadotropins, and hormone injections. Pharmaceutical advancements and expanding prescription access are enhancing global availability. These factors support the growth and expansion of the market.

By End-User

The fertility clinics segment held a dominant presence in the market in 2024. Fertility clinics represent the largest end-use segment in the fertility market, offering comprehensive reproductive services ranging from diagnostics to advanced assisted reproductive technologies. These clinics are equipped with specialized infrastructure, skilled embryologists, and cutting-edge technologies that improve treatment outcomes.

Increasing infertility rates, rising awareness, and delayed parenthood are driving more patients to seek expert care at such centers. Fertility clinics also attract international patients through medical tourism, offering cost-effective, high-success-rate treatment packages. Their ability to provide personalized care, psychological support, and continuous monitoring makes them the preferred destination for individuals and couples undergoing fertility treatments globally.

The hospital segment is projected to grow at a significant rate during the coming years. Hospitals play a crucial role in the fertility market by providing specialized reproductive care alongside broader medical services. Many multi-specialty and maternity hospitals have dedicated fertility departments offering treatments such as ovulation induction, IVF, ICSI, and surgical interventions.

Their integrated approach ensures access to emergency care, advanced diagnostics, and post-treatment support under one roof. Hospitals are often preferred for high-risk or complex infertility cases due to the availability of multidisciplinary teams. Growing investments in reproductive health infrastructure and the inclusion of fertility services in hospital networks are enhancing their presence in this segment, particularly in urban and developed regions.

Elevate your healthcare strategy with Towards Healthcare. Enhance efficiency and drive better outcomes schedule a call today: https://www.towardshealthcare.com/schedule-meeting

Recent Developments in the Fertility Market

- In July 2025, Carrot, a family care platform for employers and health plans, launched Sprints, a program addressing fertility issues related to metabolic problems like obesity, blood sugar imbalances, and sperm damage, which can affect conception and IVF success.

- In July 2025, Siliguri District Hospital (SDH) will open the region's first government-run infertility clinic within its maternity ward. This initiative aims to enhance public health services in North Bengal amid rising demand for infertility treatments.

Top Companies and Their Contributions to the Fertility Market

| Company | Contributions & Offerings |

| PFCLA | A pioneer in IVF since 1991, PFCLA is known for personalized fertility care, success with international patients, and advanced egg donation and surrogacy programs. |

| MFMER | Mayo Clinic integrates fertility treatments with research and education. It offers IVF, ICSI, egg freezing, and reproductive surgery backed by cutting-edge innovation. |

| Cleveland Clinic | Offers comprehensive fertility services including IVF, fertility preservation, and third-party reproduction, supported by world-class research and patient care. |

| Apricity Fertility UK Limited | A digital-first clinic, Apricity combines telemedicine with AI to personalize IVF journeys, offering home diagnostics, virtual consultations, and treatment coordination. |

| King’s Fertility Limited | Based in London, it provides high-success IVF, IUI, and egg donation services, emphasizing ethical care and clinical research excellence. |

| Dallas IVF | A leading Texas-based center, known for high success rates, offers IVF, fertility preservation, and genetic screening with state-of-the-art labs. |

| Midwest Fertility Specialists | Offers IVF, IUI, donor services, and reproductive surgeries with individualized treatment plans and advanced lab capabilities. |

| Europe IVF | Located in Prague, it specializes in affordable, high-quality IVF treatments for international patients, with modern facilities and multilingual staff. |

| Care Fertility | One of the UK’s largest fertility groups, Care Fertility offers IVF, egg/sperm donation, and genetic testing with a strong emphasis on research. |

| Aspire Fertility | A U.S. network offering patient-focused IVF, IUI, and fertility preservation with a streamlined, supportive care model and high technology use. |

Browse More Insights in Women’s Health & Related Markets – Global Outlook

- Global Women’s Digital Health Market

The women’s digital health market is valued at USD 3.17 billion in 2024, expected to grow to USD 3.82 billion in 2025, and projected to reach around USD 20.92 billion by 2034, expanding at a CAGR of 20.54% from 2025 to 2034. - Europe Women’s Digital Health Market

The Europe women’s digital health market is estimated at USD 1.03 billion in 2024, set to reach USD 1.24 billion in 2025, and further grow to USD 6.69 billion by 2034, at a CAGR of 20.24% during the forecast period. - Asia-Pacific Women’s Digital Health Market

The Asia-Pacific women’s digital health market stands at USD 724.17 million in 2024, rising to USD 889.14 million in 2025, and is anticipated to reach USD 5.69 billion by 2034, expanding at a CAGR of 22.74% from 2025 onward. - Global Natural Fertility Supplements Market

The natural fertility supplements market is valued at USD 2.32 billion in 2024, increasing to USD 2.54 billion in 2025, and is forecast to hit USD 6.01 billion by 2034, growing at a CAGR of 9.44% between 2025 and 2034. - Global Infertility Treatment Market

The infertility treatment market is calculated at USD 1.70 billion in 2024, and expected to reach USD 3.65 billion by 2034, expanding at a CAGR of 7.9%, driven by rising demand for fertility solutions. - Global Progesterone Market

The progesterone market is projected at USD 1.52 billion in 2024, rising to USD 1.72 billion in 2025, and is estimated to reach USD 5.05 billion by 2034, growing at a CAGR of 12.74% from 2025 to 2034. - Global Women’s Health App Market

The women’s health app market stands at USD 4.89 billion in 2024, is projected to rise to USD 5.76 billion in 2025, and reach approximately USD 25.18 billion by 2034, expanding at a CAGR of 17.81% during the forecast period. - Global Breast Cancer Liquid Biopsy Market

The breast cancer liquid biopsy market is valued at USD 200 million in 2024, growing to USD 229.6 million in 2025, and expected to reach around USD 795.42 million by 2034, expanding at a CAGR of 14.8% between 2025 and 2034. - Global Breast Cancer Screening Tests Market

The breast cancer screening tests market is valued at USD 4.44 billion in 2024, rising to USD 4.75 billion in 2025, and is projected to reach USD 8.77 billion by 2034, growing at a CAGR of 7.04%. - Global Breast Implants Market

The breast implants market stands at USD 2.72 billion in 2024, increasing to USD 2.93 billion in 2025, and is anticipated to reach USD 5.62 billion by 2034, expanding at a CAGR of 7.54% over the forecast period.

Key Players in the Fertility Market

- PFCLA

- Mayo Foundation for Medical Education and Research (MFMER)

- Cleveland Clinic

- Apricity Fertility UK Limited

- King’s Fertility Limited

- Dallas IVF

- Midwest Fertility Specialists

- Europe IVF

- Care Fertility

- Aspire Fertility

- Virtus Health

- Monash IVF Group

Segments Covered in The Report

By Offering

- Assisted Reproductive Technology

- IVF

- Artificial Insemination

- Surrogacy

- Others

- Fertility Drugs

- Gonadotropin

- Anti-estrogen

- Others

By End-user

- Fertility Clinics

- Hospitals

- Clinical Research Institutes

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Gain full access to expert insights and in-depth analysis – get the complete Fertility Market report today @ https://www.towardshealthcare.com/price/5464

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram