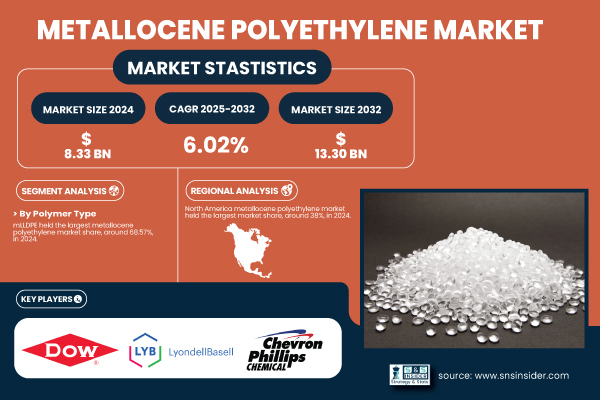

Austin, Aug. 04, 2025 (GLOBE NEWSWIRE) -- The Metallocene Polyethylene Market Size was valued at USD 8.33 billion in 2024 and is expected to reach USD 13.30 billion by 2032, growing at a CAGR of 6.02% over the forecast period of 2025-2032.

Growth propelled by recyclable packaging demand, production expansion, and advanced catalyst technologies in the evolving metallocene polyethylene landscape

Metallocene polyethylene, valued for its clarity, toughness, and processability, plays a vital role in packaging, agricultural films, and healthcare uses. Recent capacity expansions by ExxonMobil and new grade launches from Chevron Phillips Chemical illustrate rising investment and innovation. Sustainability efforts, such as Dow’s plan to boost recycled content and initiatives like the U.S. Plastics Pact, drive industry transformation. Supported by robust domestic production of over 24 million metric tons in 2023 and booming e-commerce packaging, demand continues to gain momentum across North America and the Asia Pacific into 2024 and beyond.

Download PDF Sample of Metallocene Polyethylene Market @ https://www.snsinsider.com/sample-request/7828

The U.S. metallocene polyethylene market size was USD 2.38 billion in 2024 and is expected to reach USD 3.85 billion by 2032 and grow at a CAGR of 6.21% over the forecast period of 2025-2032.

The US market is driven by growth in high-performance flexible packaging and sustainable agriculture films. Supported by investments from Dow, ExxonMobil, and Chevron Phillips Chemical, demand is further boosted by sustainability targets and evolving consumer preferences.

Key Players:

- ExxonMobil

- Dow Chemical Company

- LyondellBasell

- SABIC

- Chevron Phillips Chemical

- INEOS Olefins & Polymers

- Braskem

- LG Chem

- Borealis

- TotalEnergies Polymers

Metallocene Polyethylene Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 8.33 Billion |

| Market Size by 2032 | USD 13.30 Billion |

| CAGR | CAGR of 6.02% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Polymer Type (mLLDPE and mHDPE) • By Application (Films, Sheets, Extrusion Coating, Injection Molding, Blow Molding, Wire & Cable Insulation, and Others) |

If You Need Any Customization on Metallocene Polyethylene Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7828

By Polymer Type, the mLLDPE dominated the Metallocene Polyethylene Market in 2024, with a 68.57% Market Share.

The dominance is due to superior toughness, sealability, and puncture resistance offered by mLLDPE, making it the material of choice for stretch and shrink films. Its ability to support downgauging helps reduce plastic use without sacrificing performance, aligning with brand sustainability goals. Innovations like ExxonMobil’s Exceed XP grades launched in 2022 enhance strength and efficiency, boosting adoption. Additionally, mLLDPE’s rising use in agricultural mulch films and flexible food packaging reflects market expansion. Its processability on advanced blown film lines lowers energy consumption, while broad versatility across food, industrial, and agricultural applications solidifies its leadership in metallocene polyethylene.

By Application, the Films Segment dominated the Metallocene Polyethylene Market in 2024, with a 56% Market Share.

The dominance is due to rising demand for lightweight, flexible packaging, agricultural films, and lamination films using metallocene polyethylene. Flexible food packaging alone accounts for substantial consumption as consumers seek convenient and resealable options. Dow’s 2023 innovations enabled downgauging by up to 20%, reducing plastic without sacrificing performance. In agriculture, multi-layer metallocene films enhance UV resistance and crop protection. Rapid e-commerce growth has driven higher demand for stretch wraps and courier bags. Collectively, these factors encourage converters and brand owners to invest in recyclable, high-performance film applications, reinforcing films as the largest and most dynamic segment.

By Region, North America dominated the Metallocene Polyethylene Market in 2024, Holding A 38% Market Share.

The dominance is due to extensive domestic production capacity, technological leadership, and a strong regulatory focus on sustainability. ExxonMobil, Dow, and Chevron Phillips Chemical expanded or upgraded facilities in Texas and Louisiana to boost high-performance metallocene polyethylene output. Industry-wide initiatives like the U.S. Plastics Pact have encouraged the shift toward recyclable packaging solutions. Retail brand commitments to lightweight and sustainable packaging further increase demand. The region benefits from advanced R&D, stable supply chains, and innovation in catalyst technology, ensuring North America remains a central hub for production and application development in the metallocene polyethylene industry.

Recent Developments

- In March 2024, Dow launched new AGILITY CE metallocene grades using 70% post-consumer recycled content.

Buy Full Research Report on Metallocene Polyethylene Market 2025-2032 @ https://www.snsinsider.com/checkout/7828

USPs of the Metallocene Polyethylene Market

- Technological Innovation Investment Trends - Rising R&D in advanced metallocene catalysts and multi-layer film technologies is driving performance gains and expanding application scope.

- Pricing Dynamics and Cost Analysis - Fluctuating feedstock prices and process efficiency improvements directly influence regional price competitiveness and profit margins.

- End-Use Industry Consumption Patterns - Flexible packaging, agricultural films, and healthcare applications lead demand due to durability, lightweight properties, and sustainability benefits.

- Packaging Downgauging Adoption Analysis - Brand owners increasingly adopt thinner, high-strength films to reduce plastic use while maintaining protective and functional qualities.

- Regional Regulatory Impact Mapping – Plastic tax policies, recycled content mandates, and circular economy regulations shape product design and regional demand patterns.

- Corporate Capital Expenditure Benchmarking – Major producers invest in plant expansions, catalyst upgrades, and sustainability projects to secure market share and meet demand.

- Export and Import Flow Dynamics - Trade flows reflect capacity shifts, regional consumption trends, and competitiveness driven by logistics and cost factors.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.