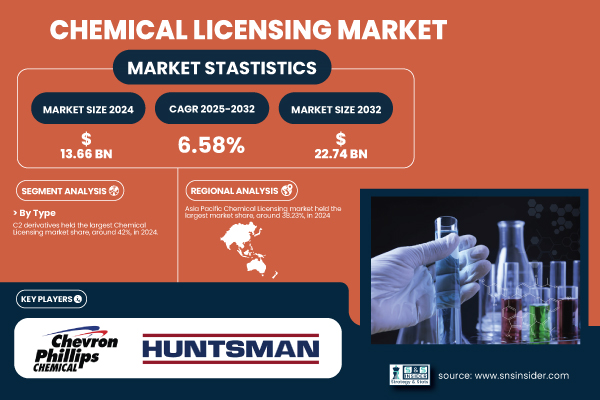

Austin, Aug. 01, 2025 (GLOBE NEWSWIRE) -- The Chemical Licensing Market Size was valued at USD 13.66 billion in 2024 and is expected to reach USD 22.74 billion by 2032, growing at a CAGR of 6.58% over the forecast period of 2025-2032.

Advancements in Sustainable Technologies and Regulatory Pressure Propel Growth in Chemical Licensing

The chemical licensing sector is advancing rapidly due to more complex petrochemical processes and global sustainability efforts. U.S. chemical production increased by 2.4% in 2023, highlighting demand for licensed technologies. Key players like ExxonMobil and BASF expanded licensing agreements for polyolefin and low-carbon ammonia production. Stricter environmental regulations and EPA initiatives worldwide encourage the adoption of energy-efficient licensed processes. Additionally, digital tools and growing cross-border deals in emerging markets are accelerating transformation and capacity expansion within the industry.

Download PDF Sample of Chemical Licensing Market @ https://www.snsinsider.com/sample-request/7864

The U.S Chemical Licensing market size was USD 2.7 billion in 2024 and is expected to reach USD 4.79 billion by 2032 and grow at a CAGR of 7.43% over the forecast period of 2025-2032.

The U.S. chemical licensing market is thriving due to corporate moves to cut carbon intensity and boost efficiency. For example, Dow Inc. and Lummus Technology expanded their licensing collaboration in 2023 to commercialize lower-emission olefins processes, as per company announcements. Digital twin technologies and AI-enhanced process control also drive adoption by cutting downtime and improving yield.

Key Players:

- BASF

- Dow

- DuPont

- Chevron Phillips Chemical

- ExxonMobil

- Shell

- Huntsman

- Eastman

- Johnson Matthey

- LyondellBasell

Chemical Licensing Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 13.66 Billion |

| Market Size by 2032 | USD 22.74 Billion |

| CAGR | CAGR of 6.58% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (C1 derivatives, C2 derivatives, C3 derivatives, and C4 derivatives) • By End User (Oil & Gas, and Chemical) |

If You Need Any Customization on Chemical Licensing Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7864

By Type, the C2 derivatives dominated the Chemical Licensing Market in 2024, with a 42% Market Share.

The dominance is due to rising global ethylene demand, vital for polyethylene and related polymers. ExxonMobil and Shell’s advanced cracking licenses support higher yields and lower energy use. According to the U.S. EIA, record-high ethane consumption in 2023 further strengthened licensing needs. Middle Eastern projects like SABIC’s new ethylene units also added capacity. Demand for lightweight plastics in automotive and packaging markets keeps driving the need for efficient, licensed C2 derivative technologies worldwide.

By End-User, the Chemical Segment dominated the Chemical Licensing Market in 2024, with a 64%Market Share.

The dominance is due to chemical producers using licensed technologies to tap into high-margin segments and meet stricter global regulations. In 2023, BASF and Linde licensed hydrogen production processes to Asian and European firms, reflecting sustainable shifts. The American Chemistry Council noted U.S. specialty chemical investment growth of 3.2% in 2023. Steady demand for polymers, surfactants, and specialty intermediates motivates chemical manufacturers to rely on licensed technologies to improve quality, efficiency, and environmental compliance.

By Region, Asia Pacific dominated the Chemical Licensing Market in 2024, Holding a 38.23% Market Share.

The dominance is due to rapid expansion of refinery and petrochemical capacity in China, India, and Southeast Asia, driven by industrial growth and energy demand. PetroChina’s 2023 report cited new licensing deals to boost output, while Indian Oil Corporation launched chemical units using licensed technology. These projects reflect the region’s strategy to meet rising domestic needs and align with stricter environmental norms, fueling continuous demand for efficient licensed processes to ensure competitiveness and consistent production.

Recent Developments

- In April 2025, Sinopec’s Ningbo Zhenhai subsidiary selected ECI Group’s high-pressure polyethylene (HPPE) technology license and process design package for its new high-pressure system installation.

Buy Full Research Report on Chemical Licensing Market 2025-2032 @ https://www.snsinsider.com/checkout/7864

USPs of the Chemical Licensing Market

- Global Licensing Investment Trends - Tracks rising corporate capital allocation toward advanced licensed processes to boost yield, efficiency, and sustainability across petrochemical and specialty segments.

- Trade Flow and Export Analysis - Analyzes cross-border movements of licensed chemical products, highlighting regional demand shifts and competitive positioning in global supply chains.

- Patent and Intellectual Property Trends - Examines new process technology patents, innovation hotspots, and how intellectual property strategies shape competitive advantage among licensors.

- R&D Pipeline Statistics by Region - Details ongoing research investments and new licensed process developments, segmented by geography to reveal regional innovation strengths.

- Regional Regulatory Impact Data – Explores how evolving environmental, safety, and carbon regulations in key regions directly drive demand for advanced licensed technologies.

- Catalyst and Additive Licensing Trends – Covers growth in specialized catalyst and additive technologies licensed to improve process efficiency, product quality, and environmental compliance.

- Export and Import Flow Dynamics - Maps global import and export volumes of products produced via licensed processes, underlining trade dependencies and market growth drivers.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.