Austin, Aug. 01, 2025 (GLOBE NEWSWIRE) -- Fecal Calprotectin Testing Market Size & Trends:

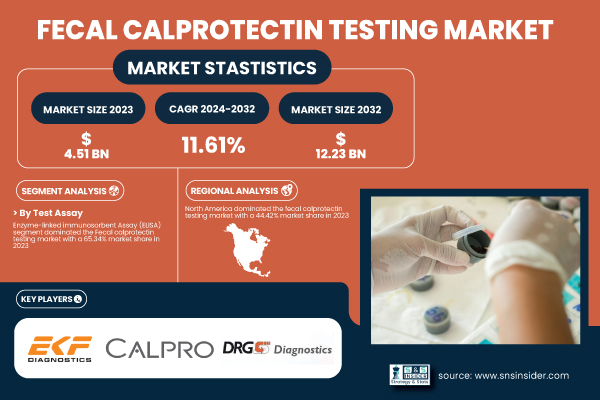

According to SNS Insider, the global Fecal Calprotectin Testing Market was valued at USD 4.51 billion in 2023 and is expected to reach USD 12.23 billion by 2032, growing at a CAGR of 11.61% over the forecast period of 2024-2032. The U.S. market, a significant contributor to this expansion, is projected to rise from USD 1.31 billion in 2023 to USD 3.57 billion by 2032, growing at a CAGR of 11.7%.

Get Free Sample Report of the Fecal Calprotectin Testing Market: https://www.snsinsider.com/sample-request/6223

Fecal calprotectin is a vital biomarker used to distinguish between inflammatory bowel diseases (IBD) such as Crohn’s disease and ulcerative colitis, and non-inflammatory conditions like irritable bowel syndrome (IBS). The growing prevalence of gastrointestinal disorders, increasing awareness about early disease diagnosis, and the rising demand for non-invasive testing methods are the primary factors driving the market's rapid growth.

The U.S. remains the largest and fastest-growing market globally due to its strong healthcare infrastructure, extensive insurance coverage, and high rates of GI disorder diagnosis. Hospitals, specialty clinics, and independent diagnostic labs account for the majority of testing demand, with direct-to-consumer testing solutions on the rise.

Key Fecal Calprotectin Testing Companies Profiled in the Report

- BÜHLMANN Laboratories AG (BÜHLMANN fCAL ELISA, BÜHLMANN Quantum Blue Calprotectin)

- Calpro AS (Calpro Calprotectin ELISA Test, CalproSmart Home Test)

- EKF Diagnostics (Calprotectin High Range ELISA, Calprotectin Low Range ELISA)

- Alpco Diagnostics (Fecal Calprotectin ELISA, STELLUX Chemi Calprotectin ELISA)

- Biohit Oyj (Calprotectin ELISA Test, Quick Test Calprotectin)

- DRG International, Inc. (DRG Calprotectin ELISA, Calprotectin Chemiluminescence Immunoassay)

- Eurospital S.p.A. (Calprest ELISA, Calfast Rapid Test)

- Immundiagnostik AG (Calprotectin ELISA K 6927, IDK Calprotectin Turbidimetric Assay)

- NovaTec Immundiagnostica GmbH (NovaLisa Calprotectin ELISA, Calprotectin Rapid Test)

- R-Biopharm AG (RIDASCREEN Calprotectin, RIDAQUICK Calprotectin)

- ScheBo Biotech AG (ScheBo • Calprotectin Quick, ScheBo • Calprotectin ELISA)

- Savyon Diagnostics (Calprotectin ELISA Kit, Calprotectin Rapid Test)

- Trinity Biotech (Calprotectin ELISA, Calprotectin Chemiluminescent Immunoassay)

- Werfen (formerly Inova Diagnostics) (QUANTA Lite Calprotectin ELISA, QUANTA Flash Calprotectin)

- Biotecna Diagnostic (Calprotectin ELISA, Calprotectin Rapid Test)

- Creative Diagnostics (Calprotectin ELISA Kit, Calprotectin Rapid Test Kit)

- GenWay Biotech, Inc. (Calprotectin ELISA Kit, Calprotectin Lateral Flow Assay)

- Hycult Biotech (Calprotectin ELISA, Calprotectin Lateral Flow Assay)

- IBL International (a Tecan Group company) (Calprotectin ELISA, Calprotectin Chemiluminescent Assay)

- Medipan GmbH (Calprotectin ELISA, Calprotectin Rapid Test)

Segment Insights

By Test Assay:

The ELISA (Enzyme-linked Immunosorbent Assay) segment is estimated to disrupt the market in 2023, accounting for a share of 65.34%. The high utilization of the method is based on its proven accuracy and the possibility of using automated ELISA analyzers, and the economical nature of the analysis in a large number of samples. Furthermore, based on reproducibility and quantitative capabilities, ELISA-based tests continue to be the gold standard in clinical labs.

Point-of-care (POC) tests are growing the fastest. It is preferred in outpatient and home care setups owing to the fast turnaround time, facilitating rapid on-the-spot decision-making, especially in children and inaccessible populations.

By Application:

The IBD segment occupied more than 67.11% share in 2023 and is considered to be the leading segment in the market. There is now a growing prevalence of IBD globally and increasing demand for long-term, non-invasive disease surveillance, both of which have established fecal calprotectin as a main diagnostic tool in IBD management.

The colorectal cancer screening market is also growing rapidly because fecal calprotectin could help differentiate between malignant (cancerous) lesions and benign inflammation, which can lead to earlier detection without the need for invasive colonoscopy in routine screenings.

By End-Use:

Hospitals & Clinics was the largest application market with a 55.25% share in 2023. Environments such as centralized hospital labs provide more sample processing and testing, a larger number of patients, and deeper integration with EHRs.

The fastest growing segment of diagnostic laboratories is due to more outsourcing by the hospitals, cheaper operational costs and solutions, and better automation in private labs.

For a Personalized Briefing with Our Industry Analysts, Connect Now: https://www.snsinsider.com/request-analyst/6223

Regional Outlook

The largest share of the market was held by North America (44.42% in 2023), owing to a high burden of the disease, fast adoption of diagnostic technology, and good reimbursement policies, especially in the U.S. The nation's high clinical awareness regarding IBD and colorectal cancer has driven broad adoption of testing.

Asia-Pacific is the fastest-growing region. Rising investments in healthcare, better lab facilities, and increasing awareness regarding GI health in countries such as China and India are fueling the demand. Moreover, government-initiated screening programs as well as the presence of corporate diagnostic chains continue to drive the market growth.

Fecal Calprotectin Testing Market Recent Developments

- June 2024: BÜHLMANN Laboratories released the enhanced version of their IBDoc Home Test App that provides patient-friendly use and real-time result management for patients with IBD.

- May 2024: Thermo Fisher Scientific launched a high-sensitivity fecal calprotectin ELISA test specifically for monitoring disease activity and early detection of inflammation in patients with no symptoms.

Fecal Calprotectin Testing Market Segmentation

By Test Assay

- Enzyme-Linked Immunosorbent Assay

- Enzyme Fluroimmunoassay

- Quantitative Immunochromatography

By Application

- Inflammatory Bowel Disease

- Colorectal Cancer

- Others

By End-Use

- Hospitals and Clinics

- Diagnostic Laboratories

- Academic and Research Institutes

Fecal Calprotectin Testing Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.51 billion |

| Market Size by 2032 | US$ 12.23 billion |

| CAGR | CAGR of 11.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Key Growth Drivers | The growing incidence of Inflammatory Bowel Disease (IBD) such as Crohn's disease and ulcerative colitis remains a key contributor to the Fecal Calprotectin Testing Market. |

Unique Selling Propositions (USPs) of the Report:

- Cost-Effectiveness and Health Economics Impact Analysis: ROI analysis comparing fecal calprotectin testing vs. colonoscopy and CRP testing in diagnosis and monitoring.

- Integration with Telemedicine and Remote Monitoring Platforms: Assessing use of smartphone-compatible POC kits and their role in home-based care models.

- Reimbursement and Policy Trends: Comparative review of reimbursement structures across major countries and payer incentives for early diagnostics.

- Clinical Workflow Optimization: Evaluating the impact of test automation and batch-processing assays on laboratory productivity and TAT (Turnaround Time).

- Regulatory Landscape and Pipeline Diagnostics: Overview of FDA, CE-mark approvals, and upcoming product pipelines enhancing test performance.

- End-user Adoption Matrix: Behavior mapping of adoption trends across hospitals, labs, and home care providers segmented by region and size.

- Technology Convergence: How fecal calprotectin is being bundled with multiplex biomarkers, AI-assisted decision systems, or integrated health platforms.

Buy the Full Fecal Calprotectin Testing Market Report (Single-User License) Now: https://www.snsinsider.com/checkout/6223

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.