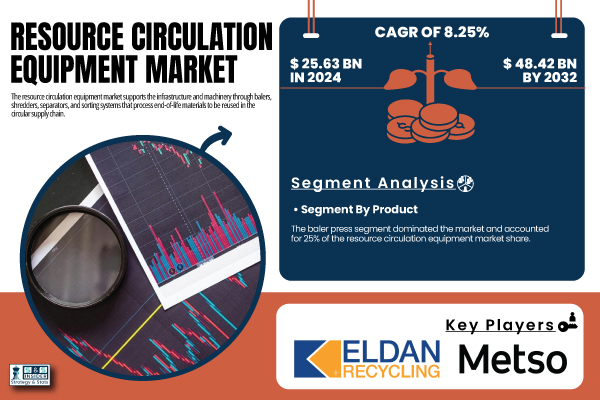

Austin, July 31, 2025 (GLOBE NEWSWIRE) -- The Resource Circulation Equipment Market Size was valued at USD 25.63 billion in 2024 and is expected to reach USD 48.42 billion by 2032, growing at a CAGR of 8.25% over the forecast period of 2025-2032.

Innovations and global regulations propel smart recycling equipment demand amid rising industrial waste and digital transformation initiatives

The resource circulation equipment market is experiencing robust growth as governments enforce stricter circular economy policies and industries target resource efficiency. The U.S. Environmental Protection Agency reported over 292.4 million tons of municipal waste in 2022, driving demand for balers and shredders. Japan’s Ministry of the Environment highlighted a 40% industrial recycling rate in 2023, boosting investment in advanced granulators. Companies like Harris Equipment launched IoT-enabled balers in 2024, while European firms and U.S. tech startups invest in smart sorting systems, fueling digitalized recycling infrastructure across industries.

Download PDF Sample of Resource Circulation Equipment Market @ https://www.snsinsider.com/sample-request/7852

The U.S. Resource Circulation Equipment market is valued at USD 4.18 billion in 2024 and is projected to reach a value of USD 8.20 billion by 2032 with a CAGR of around 8.79%.

The US Resource Circulation Equipment Market benefits from EPA-backed recycling targets, corporate zero-waste pledges, and increasing use of AI-enabled sorting systems. Leading U.S. companies like CP Group and SSI Shredding Systems are launching automated solutions, while the U.S. Department of Energy’s 2023 Circular Economy Roadmap further boosts market demand.

Key Players:

- Metso

- Danieli Centro Recycling

- ELDAN Recycling

- BHS Sonthofen

- LEFORT GROUP

- Marathon Equipment

- General Kinematics

- Kiverco

- American Baler

- The CP Group

Resource Circulation Equipment Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 25.63 Billion |

| Market Size by 2032 | USD 48.32 Billion |

| CAGR | CAGR of 8.25% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Baler, Press, Shredders, Granulators, Agglomerators, Shears, Separators, Extruders, Others) • By Application (Automotive, Construction, Electrical & Electronics, Paper, Plastic & Polymers, Metal, Oil & Gas, Others) |

If You Need Any Customization on Resource Circulation Equipment Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7852

By Product, the Baler Press Segment dominated the Resource Circulation Equipment Market in 2024, with a 25% Market Share.

The dominance is due to the widespread use of baler presses across automotive, packaging, and retail industries to reduce scrap volume and transport costs. In 2023, American Baler Co. introduced fully automated two-ram balers, improving productivity by 30%. Japanese firms like Maren Engineering invested in energy-efficient balers tailored for plastics and paper to meet global recycling targets. Demand surged further in distribution centers and warehouses aiming for space optimization. As industries align with stricter recycling regulations and circular economy goals, baler presses remain essential for operational efficiency and cost-effective waste handling.

By Application, the Electrical & Electronics Segment dominated the Resource Circulation Equipment Market in 2024, with a 34% Market Share.

The dominance is due to rising e-waste volumes and stricter compliance needs, pushing industries to adopt shredders and separators for valuable component recovery. According to the U.S. EPA, over 7 million tons of e-waste were generated in North America in 2023 alone. Companies like ERI in the U.S. and European recyclers expanded specialized lines for circuit boards and batteries. The proliferation of EVs, home appliances, and IT devices adds complexity, increasing demand for advanced recycling systems. Regulatory measures such as the EU’s WEEE Directive and U.S. state-level e-waste laws further reinforce segment strength.

By Region, Asia Pacific dominated the Resource Circulation Equipment Market in 2024, Holding A 39.00% Market Share.

The dominance is due to significant investments and government-backed recycling initiatives in China, Japan, and South Korea. Japan’s Ministry of Economy, Trade and Industry reported a 12% rise in equipment installations in 2023. China’s 14th Five-Year Plan supports circular economy measures across electronics and construction. Rapid industrialization, growing urban populations, and stricter environmental regulations also drive demand for modern recycling technologies. Local companies like China Recycling Development Co. are deploying AI-driven sorting systems and advanced granulators, further strengthening Asia Pacific’s leadership in resource circulation equipment and sustainable waste management solutions.

Recent Developments

- In July 2025, Metso acquired TL Solution’s recycling operations and induction heating technology, strengthening mill-lining recycling services and accelerating sustainable, closed-loop metal recovery solutions for mining and industrial scrap applications.

Buy Full Research Report on Resource Circulation Equipment Market 2025-2032 @ https://www.snsinsider.com/checkout/7852

USPs of the Resource Circulation Equipment Market

- Energy Consumption Benchmarking Trends - Manufacturers and recycling facilities are benchmarking equipment energy use to adopt low-consumption designs, reducing operational costs and supporting sustainability goals.

- Facility Capacity Distribution Insights - Market growth is shaped by the expansion of mid-to-large recycling plants, with capacity distribution highlighting demand for high-throughput balers, shredders, and granulators.

- Export Market Diversification Trends - Leading equipment makers are diversifying exports beyond traditional markets, targeting emerging regions in Asia and Latin America to mitigate trade risks.

- Environmental Compliance Cost Trends - Rising environmental regulations drive up compliance costs, prompting investment in advanced equipment that meets stricter emission and waste handling standards.

- Research and Development Spending - Key players are increasing R&D budgets to develop smarter, energy-efficient systems with AI and IoT integration, strengthening competitiveness and innovation leadership.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.