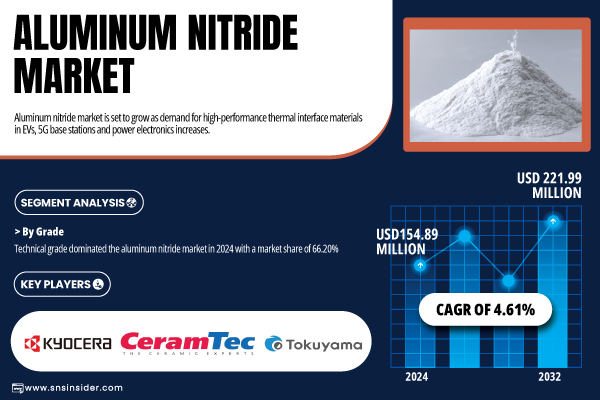

Austin, July 31, 2025 (GLOBE NEWSWIRE) -- The Aluminum Nitride Market Size was valued at USD 154.89 million in 2024 and is expected to reach USD 221.99 million by 2032, growing at a CAGR of 4.61% over the forecast period of 2025-2032.

Growing demand for high thermal conductivity materials drives aluminum nitride adoption across electronics, EVs, LEDs, and defense applications

The aluminum nitride market is gaining momentum as industries seek materials with superior thermal conductivity and insulation for semiconductors, power electronics, and EV systems. Backed by global aluminum production exceeding 69 million metric tons in 2023 (USGS), raw material supply remains strong. KYOCERA’s recent expansion of aluminum nitride substrate production highlights rising investment, while U.S. electronics makers increasingly use these ceramics in 5G base stations and EV inverters. Growing adoption in LED manufacturing and defense applications, along with R&D to improve purity, further accelerates market evolution.

Download PDF Sample of Aluminum Nitride Market @ https://www.snsinsider.com/sample-request/1419

The U.S. dominates the North American aluminum nitride market with a market size of USD 26.87 million in 2024 and is projected to reach a value of USD 39.85 million by 2032.

The US Aluminum Nitride Market benefits from rising integration in electric vehicle power modules and 5G telecom equipment, backed by innovation from companies like CoorsTek and support from associations like the American Ceramic Society.

Key Players:

- Tokuyama Corporation

- KYOCERA Corporation

- Morgan Advanced Materials plc

- CeramTec Group

- MARUWA Co., Ltd.

- FURUKAWA CO., LTD.

- TOSHIBA MATERIALS CO., LTD.

- CoorsTek Inc.

- Surmet Corporation

- Thrutek Applied Materials Co., Ltd.

- TOYO ALUMINIUM K.K.

- Nippon Light Metal Co., Ltd.

- Merck KGaA

- H.C. Starck GmbH

- American Elements

- Accumet Materials Co.

- Precision Ceramics USA

- Adtech Ceramics Company

- Ferro Ceramic-Grinding

- Höganäs AB

Aluminum Nitride Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 154.89 million |

| Market Size by 2032 | USD 221.99 million |

| CAGR | CAGR of 4.61% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Technical Grade, Analytical Grade) • By Method (Carbothermal Reduction Method, Direct Nitridation Method, Nitridation Method) • By Form (Powder, Granules, Sheet) • By Application (Micro Electronics, Naval Radio, Power Electronics, Aeronautical System, Automotive, Emission Control, Others) |

If You Need Any Customization on Aluminum Nitride Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/1419

By Grade, the Technical Grade dominated the Aluminum Nitride Market in 2024, with a 66.20% Market Share.

The dominance is due to the strong demand for high thermal conductivity substrates critical in electronic circuits, EV power modules, and LED cooling systems. Technical grade Aluminum Nitride offers a practical balance of cost and sufficient purity, making it ideal for large-scale industrial applications like microelectronics and automotive heat sinks. Updates from KYOCERA and CoorsTek illustrate its widespread use in modern power transistors. As electric mobility, power electronics, and renewable energy storage continue to grow, technical grade Aluminum Nitride remains the preferred choice, while analytical grade serves specialized, higher-purity applications.

By Application, the Microelectronics Segment dominated the Aluminum Nitride Market in 2024, with a 48.30% Market Share.

The dominance is due to Aluminum Nitride’s exceptional thermal management properties, crucial for semiconductors, ICs, and power transistors in the micro electronics sector. Demand is driven by the miniaturization of devices, rising 5G network deployment, and higher power density systems. Companies such as Toshiba and Infineon have emphasized its role in preventing thermal fatigue and enhancing reliability. The ongoing need for efficient heat dissipation to maintain device performance supports its leadership over other applications like automotive or emission control, making micro electronics the largest and most dynamic segment.

By Region, Asia Pacific dominated the Aluminum Nitride Market in 2024, Holding a 52.80% Market Share.

The dominance is due to high-volume manufacturing clusters in China, Japan, South Korea, and Taiwan, alongside rapid growth in electric vehicles and consumer electronics. Major electronics producers and power electronics manufacturers are investing in Aluminum Nitride components, supported by examples like TDK’s production upgrades in Japan (2023). Local availability of raw materials, expanding semiconductor industries, and government-led industrialization efforts strengthen demand. This mix of production capacity, technological advancement, and cost efficiency ensures Asia Pacific’s lead in the Aluminum Nitride market, fueled further by rising exports and R&D initiatives.

USPs of the Aluminum Nitride Market

- Export And Import Flow Analysis - Tracks shifting global trade flows of Aluminum Nitride powders, highlighting key exporting hubs and emerging import-dependent regions shaping demand.

- Patent Landscape And Innovation Trends - Analyzes recent patents to reveal innovation hotspots, showing how R&D is enhancing thermal conductivity, purity, and application scope.

- Pricing Trends For Aluminum Nitride Powders - Examines historical and current price movements, linking raw aluminum cost fluctuations and grade-specific demand to market pricing strategies.

- Investment In New Processing Technologies - Details industry moves into advanced sintering, ultra-pure powder production, and energy-efficient kilns boosting capacity and product performance.

- Regulatory Impact Analysis – Explores how evolving environmental, export control, and safety regulations influence production costs, supply chains, and regional competitiveness.

- Raw Material Sourcing Strategy Trends – Highlights companies’ shift toward domestic aluminum sourcing, long-term contracts, and recycling to stabilize supply and mitigate volatility.

- Technological Shift Toward Additive Manufacturing - Covers the growing use of Aluminum Nitride in 3D printing applications, supporting complex thermal management designs and rapid prototyping.

Recent Developments

- In May 2024, KYOCERA announced new Aluminum Nitride substrate production lines in Japan to meet EV and power electronics demand.

Buy Full Research Report on Aluminum Nitride Market 2025-2032 @ https://www.snsinsider.com/checkout/1419

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.