Austin, July 30, 2025 (GLOBE NEWSWIRE) -- Large Format Display Market Size & Growth Insights:

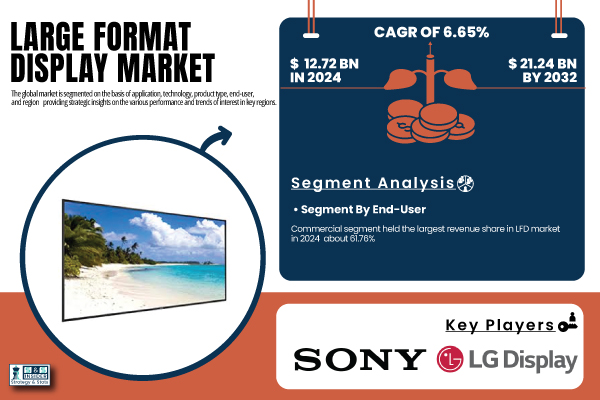

According to the SNS Insider,“The Large Format Display Market Size was valued at USD 12.72 billion in 2024 and is expected to reach USD 21.24 billion by 2032 and grow at a CAGR of 6.65% over the forecast period 2025-2032.”

Rising Adoption of LED & OLED Displays Fueling Growth in the Large Format Display Market

Increasing adoption in retail, corporate, and transportation verticals is expected to drive the growth of global Large Format Display market during the forecast period, while continuous technological evolution in LED and OLED display technologies is also developing in this market. This new generation of displays provides ultra-high-definition visuals, increased energy efficiency, and flexible form factors that are perfect for digital signage, public display walls, control rooms, and smart infrastructure. More than 65% of retailers across the globe and 70% of retailers in the U.S. are now embracing digital signage as a means of enhancing customer interactions and improving brand visibility. Production costs for LED tiles have fallen 25% over five years in a time span that has spurred somewhat faster adoption in mid-tier enterprises as well. Following the 2025–2032 period, a 6.64% CAGR is expected in the U.S. as large displays integrated into urban infrastructure, retail hubs, and corporate communication contribute to creating the enhanced experience to increase interaction, retention, and clarity in message.

Get a Sample Report of Large Format Display Market Forecast @ https://www.snsinsider.com/sample-request/7690

Leading Market Players with their Product Listed in this Report are:

- Samsung Electronics Co. Ltd.

- LG Display Co. Ltd.

- Sony Corporation

- Sharp Corporation

- NEC Display Solutions Ltd.

- Barco NV

- Leyard Optoelectronic Co. Ltd.

- ViewSonic Corporation

- Panasonic Corporation

- Delta Electronics Inc

Large Format Display Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 12.72 Billion |

| Market Size by 2032 | USD 21.24 Billion |

| CAGR | CAGR of 6.65% From 2025 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Application (Retail, Transportation, Corporate, Education, Entertainment) • By Technology (LCD, LED, OLED, DLP, Projection) • By Product Type (Digital Signage, Video Walls, Transparent Displays, Interactive Displays) • By End-User (Commercial, Industrial, Institutional) |

Purchase Single User PDF of Large Format Display Market Report (20% Discount) @ https://www.snsinsider.com/checkout/7690

Key Industry Segmentation

By Application

In 2024, the retail segment accounted for the highest market share as Large Format Displays (LFDs) are widely deployed in retail stores for dynamic ads, branding, positioning, and promotion to attract consumer engagement. Top retail brands such as Samsung have advanced, compact, bright and industrial-grade Signage systems available along with a central content management system which can improve the in-store experience and push up sales.

By application, the transportation segment is forecast to witness the most rapid CAGR over the period of 2023 to 2032 owed to rising adoption in airports, metro stations and smart transit systems. LG Display Durable, Anti-glare, Non-stagnant Long life, Non-announced 24/7 Operable LFDs for Real-time Schedule, Way Find and Public Reminders in Transit and Other High-traffic Locations

By Technology

In 2024, the market was led by LCD technology due to its affordability, energy efficiency, and broad use in corporate and institutional spaces. NEC Display Solutions remains a key player with high-resolution LCDs up to 98 inches.

LED displays are rapidly gaining traction, driven by bezel-less designs, superior brightness, and outdoor durability. Leyard leads in LED video walls, offering ultra-fine pixel pitch solutions ideal for immersive public spaces, command centers, and high-end commercial settings requiring long-life, high-impact visuals.

By Product Type

Digital signage led the market in 2024 due to its widespread use in retail, hospitality, and corporate sectors for dynamic content delivery and customer engagement. Sony offers 4K professional displays with remote content control, enhancing brand messaging.

video walls are expected to grow at the highest CAGR from 2025–2032, driven by adoption in control rooms and public installations. Barco leads with scalable, high-brightness solutions for 24/7 mission-critical environments.

By End-User

The commercial segment dominated the Large Format Display (LFD) market in 2024, with widespread adoption in malls, airports, hotels, and corporate buildings for advertising, navigation, and internal communication. Sharp Corporation offers professional-grade displays with smart connectivity and scheduling features tailored for commercial use.

The industrial segment is set to grow at the highest CAGR, driven by demand in manufacturing, energy, and transport sectors. ViewSonic leads with durable, high-reliability LFDs designed for real-time data visualization in demanding industrial environments.

Regional Outlook: Asia Pacific Leads, U.S. and Germany Follow in Global LFD Market Expansion

The global Large Format Display (LFD) market shows robust regional dynamics, with Asia Pacific leading in revenue share (32.1% in 2024) and projected to grow fastest at a CAGR of 8.05% through 2032, driven by urbanization, smart city initiatives, and digital modernization in countries like China, Japan, and India. China dominates the region with large-scale infrastructure and public sector investments.

North America follows, led by the U.S. due to its strong digital infrastructure and early tech adoption across retail and transportation sectors. Europe is steadily growing, with Germany at the forefront, propelled by smart city deployments and a strong industrial-retail base. Meanwhile, the UAE leads the Middle East & Africa market with smart infrastructure investment, while Brazil dominates Latin America with rising urban and public sector digital signage deployments.

Do you have any specific queries or need any customized research on Large Format Display Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/7690

Recent Developments:

-In May 2025, Innolux and Delta Electronics are building a 40MWh energy storage system at Innolux’s Plant 7 in Southern Taiwan Science Park, marking a key milestone in regional smart energy infrastructure development.

-In Sept 2024, Panasonic Returns to U.S. TV Market with OLED & Mini-LED Lineup Featuring Fire TVAfter a decade, Panasonic re-enters the U.S. with a new range of OLED and Mini-LED TVs (55–85 inches), built with Fire TV and designed in Japan—now available via Amazon and Costco.

Large Format Display Market USP

- Adoption & Usage Statistics: Rapid adoption across retail, corporate, and public sectors drives market growth and visibility.

- Technology-Specific Metrics: Cutting-edge display technologies deliver superior resolution, brightness, and energy efficiency.

- Performance & Impact Metrics: High-performance displays ensure immersive visual experiences and enhanced viewer engagement.

- Software & Connectivity Trends: Advanced software integration and connectivity enable seamless content management and real-time updates.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.