Austin, July 30, 2025 (GLOBE NEWSWIRE) -- Veterinary Microchips Market Size & Trends:

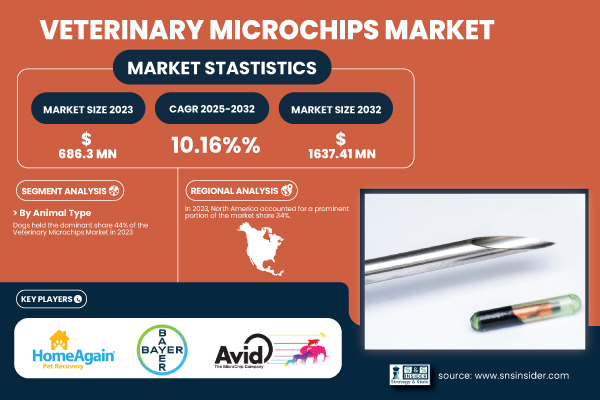

According to SNS Insider, the global Veterinary Microchips Market was valued at USD 686.3 million in 2023 and is projected to reach USD 1637.41 million by 2032, growing at a CAGR of 10.16% during the forecast period (2024–2032). This growth is fueled by heightened awareness of pet safety, rising incidences of lost pet cases, and the expansion of regulatory mandates for pet identification and registration. Moreover, technology convergence between microchips and digital pet management systems is also attracting veterinary clinics, breeders, and pet owners toward adopting microchipping solutions.

Get Free Sample Report of the Veterinary Microchips Market: https://www.snsinsider.com/sample-request/6141

The U.S. veterinary microchips market was valued at USD 191.07 million in 2023 and is expected to reach USD 385.77 million by 2032, registering a CAGR of 9.18%. The U.S. market benefits from proactive legislation, advanced veterinary infrastructure, and increasing adoption of microchipping among rescue shelters and animal hospitals. The integration of microchips into broader pet care ecosystems, such as telemedicine and smart trackers, is further supporting market penetration in the country.

Key Veterinary Microchips Companies Profiled in the Report

- Allflex Livestock Intelligence (Microchip, Thermochip)

- Datamars Pet ID (T-SL Slim Polymer Microchip, T-IS Bio Glass Microchip)

- AdvaCare Pharma (Microchip Implant Kit, Veterinary Injection Instruments)

- EIDAP Inc. (12mm ISO Microchip, 8mm ISO Microchip)

- Pet Pulse (RFID Microchip Implants, RFID Microchip Readers)

- PetLink (Microchip Registration Services, Pet Recovery Services)

- Trovan (Unique-ID 100, Unique-ID 200)

- HomeAgain (Standard Microchip, Universal WorldScan Reader)

- AVID Identification Systems (FriendChip, MiniTracker 3)

- Microchip ID Systems (Microchip ID Mini, ProScan 700)

- Bayer (ResQ Microchip, ResQ Scanner)

- Virbac (BackHome BioTec Microchip, BackHome Reader)

- PetID Global (PetID Microchip, PetID Scanner)

- PeddyMark (Standard Microchip, Halo Scanner)

- IdentiPet (IdentiPet Microchip, IdentiPet Scanner)

- Animalcare (Identichip, Identichip Scanner)

- Pet Travel (ISO Microchip, Universal Scanner)

- SmartTag Microchips (SmartTag Microchip, SmartTag Scanner)

- PetSafe (Microchip Cat Flap, Microchip Pet Feeder)

- Sure Petcare (SureFlap Microchip Pet Door, SureFeed Microchip Pet Feeder)

Segment Analysis

By Animal Type

Dogs were the most common animal category in 2023 and contributed to over 44% of the overall veterinary microchips market share. This is because there are high levels of registration of dogs under microchipping legislation in a number of territories, including North America, Europe, and Australia. The fact that they are ubiquitous as service and companion animals also contributes to their prevalence.

Conversely, the fastest growing sector is cats, due to changes in the law in places such as the UK and Australia, where microchipping has now become a legal requirement. Increased public awareness and support from government bodies and veterinary organizations are likely to fuel this segment.

By Scanner Type

134.2 KHz scanners accounted for the largest market share in 2023. These scanners are considered the scanners of choice worldwide for their ability to read ISO-standard microchips and availability in most veterinary practices. Their excellent performance and global recognition make them mainstream technologies.

At the same time, multi-frequency (134.2KHz + 125KHz) scanners are the fastest growing as they scan for both ISO (ISO 11784/11785) and non-ISO chits, and are the most flexible for animal shelters and rescue organizations who encounter a variety of microchipped pets.

By Distribution Channel

Hospitals & clinics dominated the market share in 2023. Having earned pet owner confidence and offering the convenience of bundled vaccination and microchipping, they have become the go-to location.

E-commerce is growing faster than anyone can imagine. Microchip kits and pet scanners are rapidly becoming more and more available online as many breeders and individual pet owners seek simpler and cheaper options.

For a Personalized Briefing with Our Industry Analysts, Connect Now: https://www.snsinsider.com/request-analyst/6141

Regional Analysis

In terms of share, North America held a 34% share of the veterinary microchips market in 2023 on the back of a high pet ownership ratio, stringent rules for ID tagging, and high expenditure on companion animals. The area is also served by managed veterinary care systems and government-owned campaigns promoting pet microchipping.

Asia-Pacific is the fastest-growing region owing to increasing pet adoption, particularly in urban areas in China, India, and Southeast Asia. The growth in this market is largely driven by factors such as a strong focus on safeguarding livestock from contracting infectious disease and, prevention of animal loss.

Recent Developments

- May 2023 – Datamars has acquired Kippy S.r.l., the company behind a range of GPS and activity monitors for dogs, in a bid to bolster its combined identification and tracking offering.

- March 2023 – The UK made it compulsory to have pet cats microchipped to aid lost pet reunification, leading to a substantial surge in sales.

Veterinary Microchips Market Segmentation

By Animal Type

- Dogs

- Horses

- Cats

- Others

By Distribution Channel

- Veterinary Hospitals/clinics

- Others

By Scanner type

- 134.2 KHz

- 125 KHz

- 128 KHz

Veterinary Microchips Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 686.3 million |

| Market Size by 2032 | US$ 1637.41 million |

| CAGR (2024–2032) | 10.16% |

| U.S. Market 2023 | USD 191.07 million |

| U.S. Forecast by 2032 | USD 385.77 million |

| Base Year | 2023 |

| Forecast Period | 2024–2032 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

Suggested Unique USP Sections for Client Report

- Pet Identification Policy Tracker

Comparative overview of country-wise regulations and upcoming mandates for pet microchipping across North America, Europe, and Asia-Pacific.

- Tech-Integrated Chip Ecosystem Mapping

Analysis of innovations in smart microchips integrated with GPS, Bluetooth, and cloud-based data systems.

- Microchip Lifecycle Cost Optimization Model

Breakdown of initial cost vs long-term utility savings in lost pet recovery, vet database integration, and ownership proof.

- Veterinary Practice Adoption Funnel

Diagnostic flowchart of how veterinary professionals are incorporating microchipping into standard pet care routines, including training and ROI perspectives.

- Rescue & Shelter Enablement Scorecard

Index evaluating the role of microchips in increasing adoption and reducing shelter congestion through faster pet-owner reunification.

- Pet Owner Sentiment Index on Microchipping

Insights from primary surveys highlighting pet owner attitudes, hesitations, and satisfaction levels related to microchipping technologies.

Buy the Full Veterinary Microchips Market Report (Single-User License) Now: https://www.snsinsider.com/checkout/6141

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.