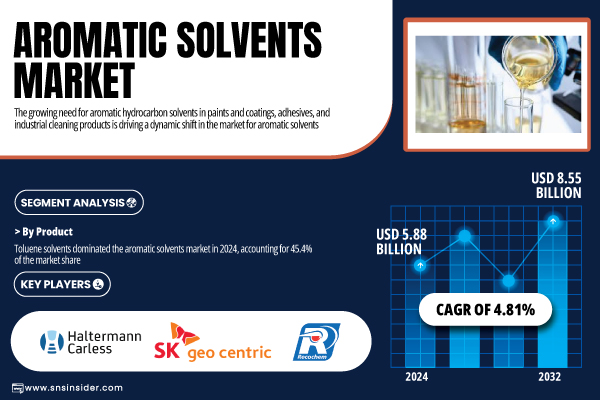

Austin, July 29, 2025 (GLOBE NEWSWIRE) -- The Aromatic Solvents Market Size was valued at USD 5.88 billion in 2024 and is expected to reach USD 8.55 billion by 2032, growing at a CAGR of 4.81% over the forecast period of 2025-2032.

Rising demand from coatings and adhesives fuels sustainable growth in aromatic solvents driven by innovation and evolving regulations

The aromatic solvents market is gaining strength as demand surges from end-use sectors like paints, coatings, and adhesives. According to the American Coatings Association, U.S. architectural paint demand rose by 4.5% in 2022, boosting solvent use. New EPA regulations have spurred innovation in low-VOC blends, while ExxonMobil expanded high-purity toluene output in Texas to meet growing needs. Additionally, electric vehicle production and construction recovery in Asia Pacific and Europe have accelerated adoption. Global chemical players are investing more in greener solutions to align with evolving environmental standards.

Download PDF Sample of Aromatic Solvents Market @ https://www.snsinsider.com/sample-request/7762

The U.S. Aromatic Solvents Market is valued at USD 1.00 billion in 2024 and is projected to reach a value of USD 1.45 billion by 2032.

The U.S. aromatic solvents market is advancing steadily, driven by stricter clean air regulations and a notable shift toward low-VOC paints and adhesives. Leading companies such as ExxonMobil and Eastman Chemical are expanding production and innovating eco-friendly solvent blends to address growing demand across automotive, construction, and industrial applications nationwide.

Key Players:

- Recochem Inc.

- Cepsa Química

- SK Geo Centric Co., Ltd.

- Haltermann Carless (HCS Group)

- Panama Petrochem Ltd.

- SolvChem, Inc.

- Hunstman Corporation

- DHC Solvent Chemie GmbH

- Nova Molecular Technologies, Inc.

- Pon Pure Chemicals Group

Aromatic Solvents Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 5.88 billion |

| Market Size by 2032 | USD 8.55 billion |

| CAGR | CAGR of 4.81% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Toluene Solvents, Xylene Solvents, Ethylbenzene Solvents, Others) •By Application (Paints & Coatings, Adhesives, Printing Inks, Cleaning & Degreasing, Others) |

If You Need Any Customization on Aromatic Solvents Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7762

USPs of Aromatic Solvents Market

- Greenhouse Gas Emission Trends

- Capital Expenditure Deployment Plans

- Logistics Cost per Kilogram Trends

- Supply Chain Risk Heatmap Overview

By Product, the Toluene Solvents Segment dominated the Aromatic Solvents Market in 2024, with a 45.4% Market Share.

The dominance is due to toluene’s excellent solvency, fast-drying properties, and cost-effectiveness, making it essential in paints, adhesives, and inks. Companies like PPG Industries and Sherwin-Williams depend on toluene-rich blends to meet quality and drying speed requirements. Rising demand from automotive refinishing and protective coatings further accelerates its use. In response to stricter VOC regulations, refiners have invested in high-purity grades, adding market value. For instance, Chevron Phillips Chemical expanded U.S. production capacity in 2023 to supply growing demand both domestically and in Asia, reflecting strong supply-side confidence and robust industrial need.

By Application, the Paints and Coatings Segment dominated the Aromatic Solvents Market in 2024, with a 37.9% Market Share.

The dominance is due to the vital role aromatic solvents play in ensuring flexibility, quick drying, and performance in paints and coatings. Growing demand for architectural and specialty coatings, noted by the American Coatings Association in 2023, has lifted solvent consumption. Rising construction activities, higher housing permits, and automotive production expansion all contribute to this growth. Leading producers like AkzoNobel and Sherwin-Williams increasingly use blended aromatic solvents in advanced protective and decorative coatings. These factors collectively reinforce the segment’s strength as manufacturers align products with durability and regulatory standards.

By Region, Asia Pacific dominated the Aromatic Solvents Market in 2024, Holding A 41.2% Market Share.

The dominance is due to rapid urbanization, large-scale infrastructure projects, and booming automotive production across China, India, and Southeast Asia. The National Development and Reform Commission reported a 9% real estate investment rise in China for 2022, significantly boosting demand for paints and coatings. Additionally, Japan and South Korea’s advanced electronics and packaging sectors require high-performance adhesives and inks using aromatic solvents. Growing domestic chemical manufacturing, rising middle-class consumption, and export-oriented industries in countries like Vietnam and Indonesia further strengthen the Asia Pacific’s leadership in the global aromatic solvents market.

Recent Developments

- In March 2025, Shell disclosed plans to pursue strategic partnerships in the U.S. and optimize its chemicals asset base, moves expected to strengthen its aromatic solvent portfolio while reducing emissions.

Buy Full Research Report on Aromatic Solvents Market 2025-2032 @ https://www.snsinsider.com/checkout/7762

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.