Austin, July 29, 2025 (GLOBE NEWSWIRE) -- Burial Insurance Market Size & Growth Analysis:

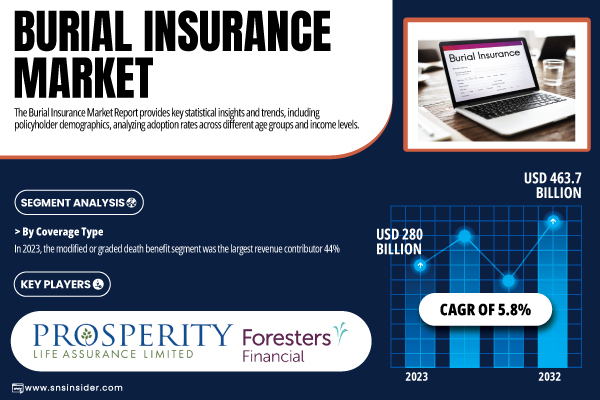

According to SNS Insider, the Global Burial Insurance Market was valued at USD 280 billion in 2023 and is projected to reach USD 463.7 billion by 2032, expanding at a CAGR of 5.8% from 2024 to 2032. The rising awareness around end-of-life financial planning, increasing aging population, and the affordability of burial insurance compared to traditional life insurance policies are contributing to its significant growth globally.

Get Free Sample Report of the Burial Insurance Market: https://www.snsinsider.com/sample-request/5909

In the U.S., the burial insurance market accounted for USD 75.60 billion in 2023 and is projected to reach USD 116.30 billion by 2032. The market is witnessing robust demand due to the increasing adoption of simplified underwriting processes and guaranteed issue policies catering to seniors seeking accessible and no-medical-exam coverage solutions.

Burial Insurance Market Overview

Burial insurance, also known as final expense insurance, is gaining rapid traction as individuals and families look for secure, cost-effective ways to manage funeral and end-of-life costs. The market is witnessing a strong uptick in policy adoption among elderly individuals, particularly due to its relatively low premiums, guaranteed acceptance models, and fixed benefits. Insurance providers are also leveraging digital channels to simplify policy application processes, appealing especially to the tech-savvy senior population.

The increasing healthcare and funeral costs globally, combined with the aging baby boomer population, are significantly fueling market growth. Insurance companies are responding to the growing demand by offering customizable plans with flexible payment terms and graded benefits for high-risk individuals. Moreover, regulatory developments supporting consumer-friendly disclosure norms are enhancing transparency in the insurance landscape, making burial insurance more accessible and trustworthy.

Major Players Analysis Listed in this Report are:

- Mutual of Omaha

- American Amicable

- Prosperity Life Group

- Royal Neighbors of America

- Aetna (Accendo)

- Transamerica

- Guarantee Trust Life Insurance

- Gerber Life Insurance Company

- AIG (American International Group)

- Foresters Financial

- Fidelity Life Association

- Colonial Penn

- State Farm

- New York Life Insurance Company

- Lemonade

- Globe Life

- Allianz Life

- The Baltimore Life Companies

- Zurich Insurance

- Ethos

Segment Analysis

By Coverage Type

In 2023, modified or graded death benefit led coverage types, with its market share reaching around 44%. These policies are quite popular with people who have health issues or who are elderly and who can’t get traditional life insurance policies. The attraction is that you are assured of acceptance and structured receiving benefits for a specific duration or term.

The simplified issue policies category is growing rapidly, as consumers look for easy and fast application processes. With few health inquiries and no physicals, this segment is becoming popular in middle-aged market for extremely affordable and simplified burial coverage with no examination underwriting.

By End User

The 70 years and above segment led the market in 2023, contributing a 33% share of the total revenue. This supremacy is as a result of the growing demand for elder folks wanting to take their families off of the ontological pressures of funeral and final costs. The guaranteed acceptance, level premium policy is also very popular among this group in the market.

The 50–60 group is the one growing the fastest. In this group, more are taking end-of-life planning into their own hands and now see burial insurance as a practical instrument to prepare themselves financially. Insurance companies are designing plans specifically for this population with richer benefits and lower premiums because of their lower-risk profile compared with older age groups.

For a Personalized Briefing with Our Industry Analysts, Connect Now: https://www.snsinsider.com/request-analyst/5909

Regional Analysis

The burial insurance market was dominated by North America in 2023 with a 36% market share, globally. The United States leads the way due to the expensive burial services, developed distribution network, and rising consumer knowledge. Insurers in the region are increasing availability of products online and customized products tailored to seniors and retires.

Asia Pacific is expected to grow the fastest during the forecast period. The development is primarily attributed to the rising knowledge about financial planning, the growing middle-class population, and the rise in disposable income. Japan, China, and India are among the countries where the sale of micro-insurance and low-premium burial plans is on the rise, with insurers pairing up with banks and fintech platforms to spread risk through rural and underserved areas.

Recent Developments

- Jan 2024 – Colonial Penn Life Insurance Company launched a way for online buyers of burial insurance to apply over the internet. This is to cater to senior citizens who choose to make the transaction online.

- March 2024 – Mutual of Omaha Insurance Company enhanced its whole life product portfolio with the new Xelerator Whole Life series of products, which offer higher face amounts and flexible payment options designed to meet the needs for burial insurance.

- February 2024 – Aetna Senior Supplemental Insurance introduced a bundled burial insurance product, which joined Medicare supplement plans, to appeal to price-sensitive seniors in search of a single product for health and final expense needs.

Burial Insurance Market Segmentation

By Coverage

- Level Death Benefit

- Guaranteed Acceptance

- Modified or Graded Death Benefit

By End Use

- Over 50

- Over 60

- Over 70

- Over 80

Burial Insurance Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 280 billion |

| Market Size by 2032 | US$ 463.7 billion |

| CAGR (2024–2032) | 5.80% |

| U.S. Market 2023 | USD 75.60 billion |

| U.S. Forecast by 2032 | USD 116.30 billion |

| Base Year | 2023 |

| Forecast Period | 2024–2032 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

Buy the Full Burial Insurance Market Report (Single-User License) Now: https://www.snsinsider.com/checkout/5909

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Market Overview

4. Statistical Insights & Trends Reporting

5. Burial Insurance Market Segmental Analysis & Forecast, By Coverage

6. Burial Insurance Market Segmental Analysis & Forecast, By End Use

7. Burial Insurance Market Segmental Analysis & Forecast, By Region

8. Competitive Landscape

9. Analyst Recommendations

10. Assumptions

11. Disclaimer

12. Appendix

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.