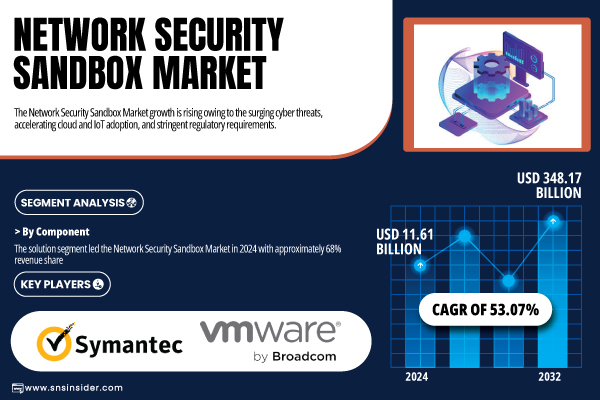

Austin, July 28, 2025 (GLOBE NEWSWIRE) -- The Network Security Sandbox Market was USD 11.61 billion in 2024 and is expected to reach USD 348.17 billion by 2032, growing at a CAGR of 53.07% over the forecast period of 2025–2032.

Rising Cyber Threats and Cloud Adoption Fuel Rapid Expansion of the Network Security Sandbox Market

The Network Security Sandbox Market is booming in such a way that enterprises are forced to enhance their security infrastructures according to the advanced level of threat. One of the main drivers is the growing number of cyberattacks on sensitive data in all business domains, mainly in organizations that are moving to the cloud and IoT environments. Traditional defensive postures are now insufficient alone, however, and enterprises are increasingly seeking out sandboxing technologies capable of securely executing and analyzing unknown files and malicious code on isolated devices without jeopardizing operating environments.

Download PDF Sample of Network Security Sandbox Market @ https://www.snsinsider.com/sample-request/7190

In the U.S., the market stood at USD 3.19 billion in 2024 and is projected to reach USD 95.16 billion by 2032, reflecting a CAGR of 52.89% during the forecast period. The growth is driven by an increased number of sophisticated cyber incidents, strict regulatory frameworks, and aggressive cloud adoption strategies. U.S. federal agencies alone reported a 10% increase in cyber incidents between 2022 and 2023, with a total of 32,211 incidents logged by the Cybersecurity and Infrastructure Security Agency (CISA).

Key Players:

- Cisco DevNet

- VMware (Broadcom)

- Fortinet, Inc.

- McAfee, LLC

- Palo Alto Networks

- Trend Micro Incorporated

- Forcepoint

- Juniper Networks, Inc.

- Check Point Software Technologies Ltd.

- Sophos Ltd.

- Lastline Inc.

- Symantec Corporation

- SonicWall

- FireEye, Inc.

- Blue Coat

- Network Security Investigations Inc.

- VMRay

- Sophos OEM

Network Security Sandbox Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 11.61 Billion |

| Market Size by 2032 | USD 348.17 Billion |

| CAGR | CAGR of 53.07% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component(Solution, Services) • By Enterprise Size(SMEs, Large Enterprises) • By End Use(BFSI, IT & Telecom, Retail, Education, Public Sector, Defense, Others) |

Segment Analysis

By Component

The solution segment dominated the Network Security Sandbox Market in 2024, with around 68% of the revenue share. Enterprises are making this shift because of concerns over the risks posed by zero-day vulnerabilities and real-time persistent threat (RPT) scenarios, causing them increasingly to favor detection platforms. Scalable, adaptive, AI-powered sandboxing platforms that allow for seamless integration with the rest of the cyber ecosystem to provide holistic protection are now being leveraged by large industry verticals such as banking, telecoms, and healthcare. The services segment will grow at the highest CAGR of 54.74% from 2025 to 2032. As more organizations outsource these functions and require expert consulting, deployment, and monitoring, cybersecurity as a service is becoming more common. Given the complexity of sandbox solutions, professional services are vital, especially for small and mid-sized businesses without an in-house security team.

By Enterprise Size

Large enterprises accounted for 62% of the market share in 2024, reflecting their extensive investment capacity and heightened exposure to cyber risks. With expansive networks and large-scale operations, these organizations rely on sandboxing to prevent disruptions and comply with stringent regulatory requirements. SMEs are expected to grow at the fastest CAGR of 54.55% between 2025 and 2032. Heightened awareness of cyber risks, affordable cloud-based sandbox solutions, and increased government support have prompted a shift in small and mid-sized business cybersecurity postures.

By End-Users

The BFSI sector led with 30% revenue share in 2024. The industry's high vulnerability to data breaches and regulatory demands makes sandboxing technologies indispensable. Conversely, the defense segment is forecasted to experience the fastest CAGR of 55.89%, driven by rising cyberwarfare incidents and nation-state threats. Government agencies require real-time, behavior-based threat identification to maintain national security and protect classified systems.

If You Need Any Customization on Network Security Sandbox Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7190

North America Leads While Asia Pacific Emerges as Fastest-Growing Region in the Network Security Sandbox Market

In 2024 and the market in North America held the largest revenue share of 39% in 2024, attributed to the strong cybersecurity infrastructure, high compliance requirement, and high R & D spending in the field in the country, specifically the U. S. The Asia Pacific region is expected to grow at the highest CAGR of 55.56% between 2025 and 2032, driven by increasing digitalization and digital transformation, growing cyberattacks, and government support towards cybersecurity, especially in China. The Situational Background Steady Growth in Europe Now GDPR Compliance and Rising Ransomware Threats Driving the Efforts (Germany in the Lead) At the same time, digital expansion, awareness of the need for cybersecurity, and the growing attention of governments on the subject of protecting digital infrastructures, are driving increased adoption in Latin America and the Middle East & Africa.

Recent Developments

- October 2024: Juniper Networks launches an integrated cloud and AI-based solution that fusion security and networking, providing visibility and control across domains. Doing so backs a change to its consolidated network security environments enabled via AI.

- May 2024: Check Point expanded a new API discovery feature to Check Point CloudGuard WAF, protecting cloud-native applications. Later on, in GigaOm’s Radar report, it was recognized for application and API security use cases.

Exclusive Sections of the Report (The USPs) – Check Section 5

- Threat detection efficacy index – helps you benchmark how effectively sandbox solutions identify zero-day threats and advanced persistent threats (APTs), guiding procurement decisions and product enhancements.

- Incident response time metrics – helps you evaluate how quickly organizations using sandboxing tools can detect, analyze, and respond to breaches, revealing the operational readiness of key solutions.

- Cost efficiency ratios – help you assess the return on investment (ROI) of sandbox deployments across industries by comparing the cost of deployment versus mitigation value, aiding budget justification.

- Sandbox environment diversity score – helps you understand the variety and adaptability of sandbox environments (Windows, macOS, Linux, Android, iOS), showing solution robustness against multi-platform threats.

- Mobile sandbox adoption rate – helps you identify growth trends in mobile-specific sandbox solutions, highlighting rising demand across BYOD ecosystems and remote workforce sectors.

Buy Full Research Report on Network Security Sandbox Market 2025-2032 @ https://www.snsinsider.com/checkout/7190

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.