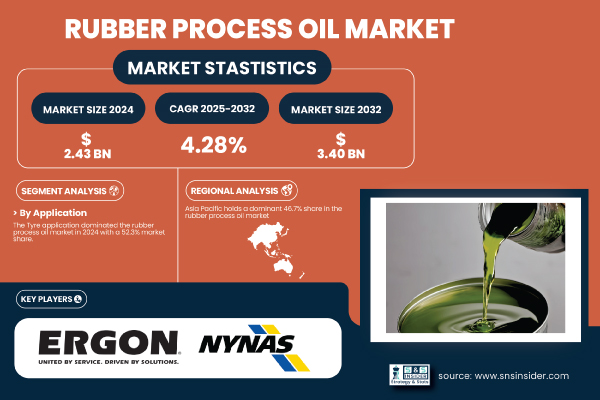

Austin, July 28, 2025 (GLOBE NEWSWIRE) -- The Rubber Process Oil Market Size was valued at USD 2.43 billion in 2024 and is expected to reach USD 3.40 billion by 2032, growing at a CAGR of 4.28% over the forecast period of 2025-2032.

Expanding automotive production and sustainable innovations propel global rubber process oil demand

Global rubber process oil demand is rising, supported by higher tyre production and broader industrial use. USTMA reported US tire shipments climbing to 334.8 million units in 2023, while IRSG noted a 3.1% global rubber consumption increase. Producers like ExxonMobil and TotalEnergies boosted capacities, focusing on sustainable, low-PAH formulations aligned with REACH and EPA standards. Rapid urbanization drives demand across footwear, adhesives, and wire coverings, while innovation in bio-based oils and R&D investment by Shell further accelerates market diversification and steady growth.

Download PDF Sample of Rubber Process Oil Market @ https://www.snsinsider.com/sample-request/7920

The U.S. Rubber Process Oil market is valued at USD 321.14 million in 2024 and is projected to reach a value of USD 440.48 million by 2032, with a market share of approximately 71%.

The US Rubber Process Oil Market grew steadily, driven by rising vehicle production and replacement tyre demand. For example, USTMA’s 2023 report showed increased demand for replacement passenger tires and growing interest in sustainable formulations by local producers like Ergon and HollyFrontier.

Key Players:

- Nynas AB

- Ergon, Inc.

- H&R Group (Hansen & Rosenthal)

- Apar Industries Ltd.

- Panama Petrochem Ltd.

- Raj Petro Specialities Pvt. Ltd. (A Brenntag Group Company)

- Behran Oil Company

- Sinopec Lubricant Company

- ORGI Chemie FZC

- Savita Oil Technologies Ltd.

Rubber Process Oil Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 2.43 billion |

| Market Size by 2032 | USD 3.40 billion |

| CAGR | CAGR of 4.28% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Aromatic, Paraffinic, Naphthenic, Others) • By Application (Tyre, Footwear, Wire & Cable Covering, Flooring Materials, Paints & Coatings, Adhesive & Sealants, and Others) |

If You Need Any Customization on Rubber Process Oil Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7920

By Product, Aromatic Segment dominated the Rubber Process Oil Market in 2024, with a 50.3% Market Share.

The dominance is due to aromatic oils’ excellent compatibility with natural rubber, making them essential for tyres and conveyor belts. ExxonMobil’s 2023 brief shows tyre makers favor these oils for processing benefits, despite low-PAH trends. Paraffinic and naphthenic oils are growing in synthetic rubber applications, while TotalEnergies and Shell invest in hybrid oils to serve diverse demands. Flexible regulations in Asia Pacific and Latin America also sustain strong aromatic oil use alongside low-PAH product launches by leading producers.

By Application, Tyre Segment dominated the Rubber Process Oil Market in 2024, with a 52.3% Market Share.

The dominance is due to rising vehicle production, higher replacement tyre demand, and rapid radial tyre adoption worldwide. According to the U.S. Tire Manufacturers Association, US replacement passenger tire shipments hit 222 million units in 2023. Post-COVID auto production recovery boosted process oil use, while EV-focused tyre designs from Bridgestone and Goodyear continue to rely on performance oils. Though footwear, adhesives, and cables grew too, they remain secondary to tyre manufacturing’s scale and consistency.

By Region, Asia Pacific dominated the Rubber Process Oil Market in 2024, Holding A 46.7% Market Share.

The dominance is due to vast automotive hubs in China, India, and Thailand, plus rapid urbanization and infrastructure investment. China’s auto production surpassed 30 million units in 2023 (CAAM), fueling demand. Regional leaders like Sinopec and Indian Oil boosted aromatic oil output to meet tyre sector needs. Additionally, expanding footwear manufacturing and lower production costs support consumption. More flexible regulations compared to Europe further enable continued use of traditional aromatic oils despite global sustainability trends.

Recent Developments

- In February 2024, TotalEnergies commissioned a dedicated low-PAH aromatic oil line at its Antwerp site, directly expanding RPO output.

- In March 2023, ExxonMobil increased capacity of its Baytown paraffinic/RPO unit by 20%, explicitly to meet growing tyre-oils demand.

- In January 2023: Shell began pilot production of its first renewable rubber process oils at its Texas facility, targeting biobased RPO applications.

Buy Full Research Report on Rubber Process Oil Market 2025-2032 @ https://www.snsinsider.com/checkout/7920

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.