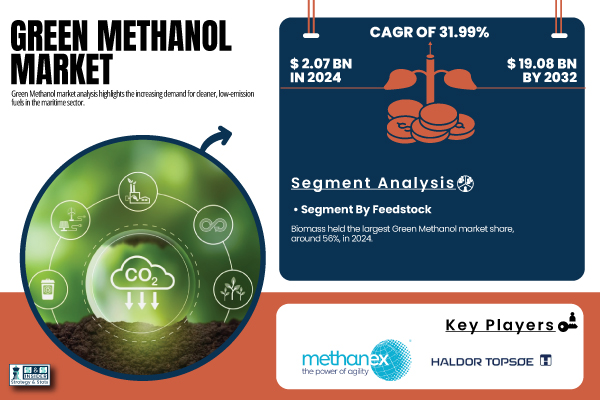

Austin, July 28, 2025 (GLOBE NEWSWIRE) -- The Green Methanol Market, valued at USD 2.07 billion in 2024, is projected to reach USD 19.08 billion by 2032, expanding at a strong compound annual growth rate (CAGR) of 31.99% from 2025 to 2032.

Growing pressure to decrease reliance on fossil fuels, as well as international policy backing for low-carbon energy, is driving demand for green methanol in sectors like maritime shipping, power generation, and chemicals.

Green methanol (renewable methanol) can be produced from sustainable feedstocks, including biomass, captured CO₂, and green hydrogen, with the process conducted using methods such as gasification or power to liquid (PtL) synthesis. Its application in internal combustion engines, fuel cells, and chemical syntheses is enhanced by carbon neutrality and compatibility with an existing infrastructure. Amidst more stringent global decarbonization mandates, notably including those of the International Maritime Organization (IMO) and the European Union’s Fit for 55 initiatives, green methanol is becoming a cornerstone fuel in a net-zero world.

Download PDF Sample of Green Methanol Market @ https://www.snsinsider.com/sample-request/7706

The U.S. Green Methanol market size was USD 650 million in 2024 and is expected to reach USD 5989 million by 2032 and grow at a CAGR of 32.01% over the forecast period of 2025-2032. It is due to its strong policy backing, well-developed infrastructure, and rapid investments in renewable energy and carbon capture technologies. The country has emerged as a leader in advancing green hydrogen production through large-scale electrolysis projects powered by solar and wind energy, which are key feedstocks for green methanol.

Key Players:

- Methanex Corporation

- OCI N.V.

- Carbon Recycling International

- Enerkem Inc.

- BioMCN

- BASF SE

- Nordic Green

- Haldor Topsoe

- Proman

- Vertimass

Green Methanol Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 2.07 Billion |

| Market Size by 2032 | USD 19.08 Billion |

| CAGR | CAGR of 31.99% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Feedstock (Biomass, Green Hydrogen, and CCS) • By Derivative (Formaldehyde, Biodiesel, Dimethyl Ether & Methyl Tert-Butyl Ether, Gasoline, Methyl Methacrylate, Methanol-To-Olefin, Solvents, Acetic Acid, and Others) • By Application (Chemical Feedstock, Fuel, and Others) |

Market Segmentation:

By Feedstock

Biomass dominated the green methanol market and accounted for about 56% of the market revenue in 2024, owing to the extensive availability, cost-effectiveness, and technological advancement in methanol production. Green methanol from biomass. The green methanol from biomass is obtained through various thermochemical routes (gasification of agricultural and forest residues, and of organic municipal waste), which represent an attractive alternative to the fossil methanol production.

By Derivative

The biodiesel segment held the largest market share, around 22%, in 2024. It is driven by the increasing global demand for renewable and low-emission fuels. Green methanol plays a vital role in biodiesel production as it is used in the transesterification process to convert fats and oils into methyl esters (biodiesel). With stricter environmental regulations and government mandates for blending biofuels into diesel, especially in regions like Europe, the U.S., and parts of Asia, the demand for biodiesel has significantly risen.

If You Need Any Customization on Green Methanol Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7706

By Application

The Green methanol market size was estimated in the chemical feedstock segment to have accounted for the largest share in 2024, as it is an essential intermediate to many industrial chemicals and their derivatives. Green methanol is also a basic chemical, which is further used to produce products ranging from formaldehyde, acetic acid, methyl tert-butyl ether (MTBE), and commonly used intermediates and solvents throughout the chemicals, adhesives, pharmaceutical, paint, and plastics industries.

Regional Analysis

North America was the largest green methanol market in 2024, with about 41.43% share, owing to a well-established technological base, coupled with a strong R&D base and increasing investments in clean energy solutions. The area, which is dominated by the United States, has seen significant progress in carbon capture, use, and storage (CCUS) and green hydrogen production– both key ingredients for green methanol production. Federal incentives, including the Inflation Reduction Act (IRA) tax credit, helped to drive project financing and improve the deployment of sustainable fuel technologies.

Recent Developments

- In June 2025, A.P. Moller Maersk received delivery of its first large container vessel running entirely on green methanol. The vessel, powered by dual-fuel engines, is part of Maersk’s order of over 25 methanol-fueled ships to be launched by 2030 as part of its decarbonization strategy.

- In March 2025, Liquid Wind AB began construction of its second commercial-scale eMethanol facility in Sweden, with a production capacity of 100,000 tons per year.

Exclusive Sections of the Report (The USPs) – Check Section 5

- Carbon Abatement Cost Matrix by Application & Region

Compares the cost per ton of CO₂ reduction using green methanol across different applications and regions to identify the most efficient use cases. - Green Methanol Cost Curve & Break-Even Analysis (2024–2032)

Projects cost trends and break-even points for various green methanol production methods to guide investment and pricing strategies. - Regulatory Heatmap & Carbon Policy Sensitivity Index

Highlights global policies and ranks regions by regulatory support, showing how policy shifts impact market demand for green methanol. - End-User Adoption Scenarios & Procurement Readiness Index

Evaluates which industries are most ready to adopt green methanol based on infrastructure, demand, and strategic alignment. - Green Methanol Demand Funnel: From R&D to Commercialization

Maps the development pipeline of green methanol projects, showing global progress from pilot to commercial scale.

Buy Full Research Report on Green Methanol Market 2025-2032 @ https://www.snsinsider.com/checkout/7706

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.