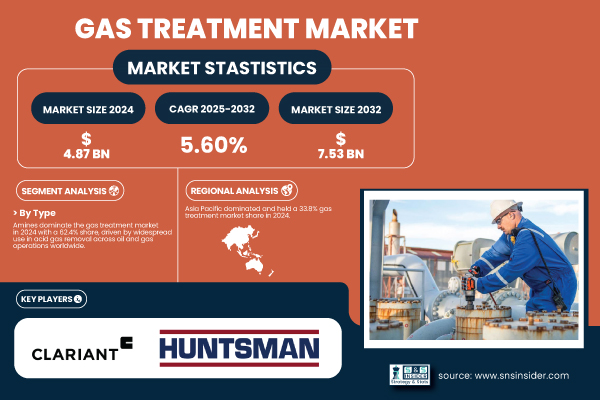

Austin, July 25, 2025 (GLOBE NEWSWIRE) -- The Gas Treatment Market Size was valued at USD 4.87 billion in 2024 and is expected to reach USD 7.53 billion by 2032, growing at a CAGR of 5.60% over the forecast period of 2025-2032.

Advancements in gas treatment technologies accelerate adoption amid tightening environmental regulations and clean energy demand

The gas treatment sector is expanding rapidly due to stricter air quality regulations and innovations in amine-based solvents. Key players like ExxonMobil are investing in advanced CO₂ capture systems to significantly reduce emissions. Global CO₂ capture capacity has also increased substantially, reflecting growing commitments to cleaner energy. Collaborations between energy companies and technology providers are driving the development of efficient, cost-effective treatment units capable of handling diverse industrial gases, supporting the shift toward sustainable industrial processes and environmental compliance.

Download PDF Sample of Gas Treatment Market @ https://www.snsinsider.com/sample-request/7917

The U.S. Gas Treatment market is valued at USD 1.07 billion in 2024 and is projected to reach a value of USD 1.68 billion by 2032, with a market share of approximately 71% in the forecast period of 2025 to 2032.

The US Gas Treatment Market is growing rapidly, fueled by stringent EPA emission regulations, large-scale refinery upgrades, and widespread adoption of carbon capture systems in LNG terminals. Notably, in 2023, Chevron retrofitted advanced amine treatment units at its Pasadena refinery to enhance sulfur removal efficiency and comply with evolving standards.

Key Players:

- BASF SE

- Huntsman Corporation

- Dow Inc.

- Clariant AG

- Ecolab Inc. (Nalco division)

- Baker Hughes Company

- INEOS Group

- Arkema S.A.

- Solvay S.A.

- Chevron Phillips Chemical Company

Gas Treatment Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 4.87 Billion |

| Market Size by 2032 | USD 7.53 Billion |

| CAGR | CAGR of 5.60% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Amines [Primary Amines, Secondary Amines, Tertiary Amines], Non-amines [Triazine, Glycols, Others]) •By Application (Acid Gas Removal, Dehydration) •By End-user (Oil & Gas, Power Plants, Refineries, Paper and Pulp, Food and Beverages, Others) |

If You Need Any Customization on Gas Treatment Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7917

By Type, Amines dominated the Gas Treatment Market in 2024, with a 62.4% Market Share.

The dominance is due to amines’ high reactivity with acid gases and consistent reliability across large-scale applications. BASF’s amine solutions are used in over 500 plants worldwide, while Shell’s 2023 upgrade reduced solvent degradation by 20%. Widely chosen for removing hydrogen sulfide and carbon dioxide in oil refining and LNG, amines also offer faster regeneration cycles and lower energy use than non-amines, making them the preferred, cost-effective choice for industries seeking efficient sulfur and CO₂ removal.

By End-User, Oil & Gas dominated the Gas Treatment Market in 2024, with a 51.6% Market Share.

The dominance is due to increased crude oil production, higher natural gas processing, and stricter emission standards driving acid gas removal demand. According to the U.S. Energy Information Administration, daily natural gas output rose significantly in 2023. Chevron, for example, added gas sweetening units at Gulf Coast LNG facilities. Refineries worldwide upgraded treatment capacity to produce ultra-low sulfur fuels and cut CO₂ emissions, while rising LNG investments further strengthened Oil & Gas as the primary driver of market growth.

By Region, Asia Pacific dominated the Gas Treatment Market in 2024, Holding a 33.8% Market Share.

The dominance is due to rapid industrialization, rising energy demand, and strict environmental regulations in countries like China and India. China’s Ministry of Ecology and Environment reported a 12% rise in desulfurization units in 2023, while Indian refineries upgraded amine systems to meet Bharat Stage VI norms. Heavy investments by Asian manufacturers in advanced treatment units to support natural gas and petrochemical growth, alongside government-led environmental initiatives, have firmly positioned Asia Pacific as the leading region in this sector.

Recent Developments

- In April 2025, Honeywell and Argent LNG signed an agreement to assess Honeywell’s innovative pretreatment solutions for a new LNG export terminal in Port Fourchon, Louisiana, to enhance gas-treatment reliability and efficiency.

- In January 2025, ExxonMobil announced plans to start up its expanded CCS facility at LaBarge, Wyoming, aiming to reduce site emissions by 1.2 million tons of CO₂ annually.

Buy Full Research Report on Gas Treatment Market 2025-2032 @ https://www.snsinsider.com/checkout/7917

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.