Austin, July 22, 2025 (GLOBE NEWSWIRE) -- Open Banking Market Size & Growth Insights:

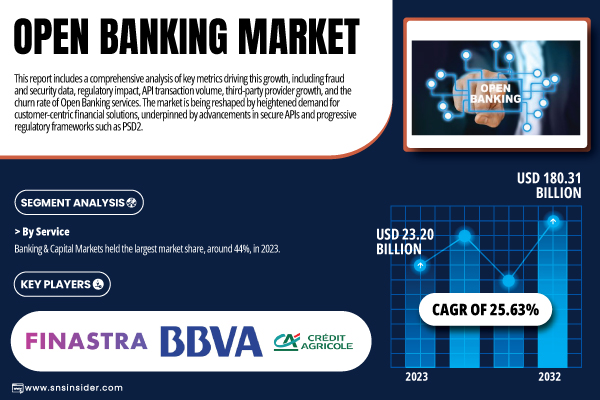

According to the SNS Insider Report, “The Open Banking Market Size was valued at USD 23.20 billion in 2023 and is projected to reach USD 180.31 billion by 2032, expanding at a compound annual growth rate (CAGR) of 25.63% during 2024–2032.”

The U.S. Open Banking Market is propelled by rising fintech collaborations, changing API standards, and increasing consumer demand for financial transparency. The market was valued at USD 4.61 billion in 2023 and is projected to reach USD 34.49 billion by 2032, growing at a CAGR of 25.06%. Regulatory evolution, embedded finance and AI-enabled personalization will drive future expansion.

Get a Sample Report of Open Banking Market @ https://www.snsinsider.com/sample-request/6896

Leading Market Players with their Product Listed in this Report are:

- Banco Bilbao Vizcaya Argentaria S.A.

- Crédit Agricole

- DemystData Ltd.

- Qwist

- Finastra

- FormFree Holdings Corporation

- Jack Henry & Associates Inc.

- Mambu

- MineralTree Inc.

- NCR Corporation

- Tink

- Societe Generale

- Nordigen Solutions

- Deposit Solutions

- Yapily Ltd.

- BBVA SA

- Revolut Ltd.

- Plaid

- Finicity (Mastercard)

- TrueLayer

- MX Technologies

- Token.io

- Flinks

- Bud Financial

- OpenWrks

Open Banking Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 23.20 Billion |

| Market Size by 2032 | USD 180.31 Billion |

| CAGR | CAGR of 25.63% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Banking & Capital Markets, Payments, Digital Currencies, Value Added Services) • By Deployment (Cloud, On-premise) • By Distribution Channel (Bank Channels, App Markets, Distributors, Aggregators) |

Purchase Single User PDF of Open Banking Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6896

Key Industry Segmentation

By Service: Banking & Capital Markets Dominate; Payments Fastest Growing

The Banking & Capital Markets segment dominated the open banking landscape in 2023 and accounted for 44% of revenue share, due to early adoption of secure APIs for account aggregation, lending services, and KYC (Know Your Customer) and AML (Anti‑Money Laundering) compliance. Legacy systems of traditional financial institutions enable real-time data sharing and new credit/investment products on open platforms that are about to be offered by these institutions.

The Payments segment is registering the fastest CAGR through 2032. Driven by the rise in mobile wallets, peer-to-peer payment solutions, and cross-border payment schemes. And regulators, by requiring PSD2-style open standards, have pushed and accelerated infrastructure upgrades and ecosystem partnerships. Over the next few years, better fraud monitoring, embedded payment experiences, and instant settlement systems will push high monetization from banks and the fintech innovators behind them.

By Deployment: On Premise Dominant, Cloud Fastest Growing

The on-premises deployment model dominated the open banking market in 2023 and accounted for 58% of revenue share. This can be attributed to a preference for data sovereignty, security, and infrastructure integration, mainly from large banks, especially in strictly regulated regions. On-prem installations were preferred by complex legacy, large financial institutions that wanted to have tighter control of their operations for the mission-critical applications. Traditional banking giants have largely preferred on-premise deployment due to the need to comply with local regulations and draw minimal involvement from third parties.

Cloud deployment is registering the fastest growth, which is primarily driven by agility, scalability, and cost. Fintechs and digitally native banks are at the forefront of this change, leveraging API-first, cloud-native platforms for faster time to market, geographic flexibility, and lower infrastructure overhead. By 2032, additional institutions will move toward hybrid and/or entirely cloud-based open banking architectures as compliance frameworks mature and confidence in cloud security grows.

By Distribution Channel: App Markets Dominate, Distributors Fastest Growing

App Markets segment dominated the market in 2023 and accounted for 39% of revenue share, and includes the distribution of open banking services via mobile banking apps, fintech aggregators, and app stores. However, these channels both allow for direct-to-consumer delivery, supreme convenience, and iteration cycles by days instead of months. This market dominance is strengthened by the increasing mobile phones and smartphones in developed and emerging markets.

The Distributors segment is expected to register the fastest CAGR, Distributors are taking off as banks and fintechs look for plug-and-play API marketplaces, unified access layers, and prebuilt connectors. Expect distributors to broaden offerings such as low-code integration, managed API services, and compliance-ready orchestration to expand further into the enterprise market.

Do you have any specific queries or need any customized research on Open Banking Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6896

By Region: Europe Leads in Revenue Share Due to Regulatory Head Start and Fintech Maturity

Europe dominated the market and held the largest revenue share in 2023 and accounting for 38% in the global Open Banking Market, due to the presence of proactive regulatory frameworks and the ability to aid in boosting the market, and advanced digital infrastructure in this region. The PSD2 directive required banks to offer secure API access to licensed third parties, which spurred innovation and competition in the financial industry. The use cases supporting open banking in the region serve payments, financial insights, and account aggregation, backed by wider fintech ecosystems, strong consumer data protection laws, and widespread smartphone usage. With a couple of years' head start and some clever regulation, Europe has become a global leader in open banking usage and maturity.

The Asia Pacific is expected to register the fastest CAGR during the forecast period, spanning Australia, India, Southeast Asia, and China. open banking is the fastest expansion sector. This rapid adoption is fueled by regulatory mandates on open APIs, the explosion in digital payments, and an expanding middle-class population. UPI-linked open data rails in India, the CDR in Australia, or nascent ASEAN platforms are creating phoenixes of fintech networks and regional-scale players.

Table of Contents - Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Open Banking Market, by Service

8. Open Banking Market, by Deployment

9. Open Banking Market, by Distribution Channel

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.