Austin, July 22, 2025 (GLOBE NEWSWIRE) -- Computerized Physician Order Entry Market Size & Growth Analysis:

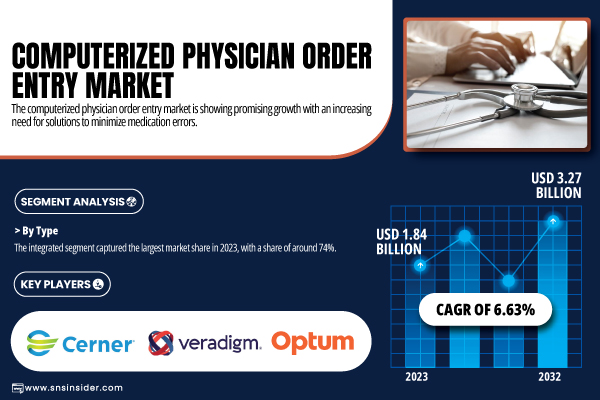

According to SNS Insider, the Computerized Physician Order Entry Market was valued at USD 1.84 billion in 2023 and is projected to reach USD 3.27 billion by 2032, growing at a compound annual growth rate (CAGR) of 6.63% during the forecast period 2024-2032.

In the United States, the CPOE market stood at USD 871.99 million in 2023 and is expected to reach USD 1.54 billion by 2032, advancing at a CAGR of 6.49%. Growth is being propelled by the accelerating implementation of electronic health records (EHR), stricter regulatory mandates for digital healthcare infrastructure, and the increasing need for clinical workflow automation to enhance patient safety and reduce prescription errors.

Request Your Free Sample Copy of the Computerized Physician Order Entry Market Report Today: https://www.snsinsider.com/sample-request/2319

Market Overview

The growth of the computerized physician order entry (CPOE) market is being driven by several transformative factors. One of the primary drivers is the widespread integration of CPOE systems into electronic health records (EHRs), enabling hospitals and ambulatory care centers to streamline the ordering of medications, lab tests, and diagnostic imaging, thereby improving clinical efficiency. In addition, CPOE systems play a critical role in enhancing patient safety by reducing medication errors and transcription mistakes, leading to improved clinical outcomes and compliance with regulatory quality standards. Government mandates and supportive regulatory frameworks—such as the HITECH Act in the U.S.—continue to accelerate healthcare IT adoption by incentivizing providers to invest in digital solutions. Furthermore, the incorporation of artificial intelligence into CPOE platforms and advancements in system interoperability are opening new avenues for innovation and adoption across both developed and emerging healthcare markets.

Major Players Analysis Listed in this Report are:

- IBM (IBM Watson Health, IBM Clinical Development)

- Cerner Corporation (Cerner Millennium, PowerChart)

- SAS Institute Inc. (SAS Health Analytics, SAS Advanced Analytics)

- Veradigm LLC (Veradigm EHR, Veradigm CPOE)

- Optum, Inc. (Optum Health Platform, Optum Cloud-Based EHR)

- Verisk Analytics, Inc. (Verisk Health Analytics, Verisk Data Solutions)

- Athenahealth, Inc. (AthenaOne, AthenaClinicals)

- Carestream Health (Carestream Radiology Information System, Carestream PACS)

- Philips Healthcare (Philips IntelliSpace, Philips Epic)

- Allscripts Healthcare, LLC (Allscripts Sunrise, Allscripts TouchWorks)

- Siemens Healthineers GmbH (Siemens Soarian, Siemens Syngo)

- Koninklijke Philips N.V. (Philips HealthSuite, Philips IntelliSpace)

- Medical Information Technology, Inc. (MEDITECH) (MEDITECH Expanse, MEDITECH Web EHR)

- eClinicalWorks (eClinicalWorks EHR, eClinicalWorks Care Coordination)

- Epic Systems Corporation (EpicCare, Epic Beacon)

- General Electric (GE) (GE Centricity, GE Healthcare Imaging)

- McKesson Corporation (McKesson Paragon, McKesson EnterpriseRx)

- CareCloud Inc. (CareCloud Central, CareCloud EHR)

- First Databank, Inc. (First Databank Drug Information System, First Databank CPOE)

Segment Insights

Integrated Segment is Anticipated to Hold the Largest Share of the Computerized Physician Order Entry Market, By Type

In 2023, the integrated segment held the largest market share with 74%, driven by encompassing a computerized physician order entry with EHRs, lab systems, and CDS tools. This integration creates workflow efficiency, reduces mistakes, and allows for the sharing of real-time data. Integrated systems are favored by providers for their operational efficiency and ability to deliver better patient outcomes through coordinated care.

Based on Component, the Services Sector Segment Accounted for the Largest Share of the Computerized Physician Order Entry Market

The services sector segment dominated the computerized physician order entry market with a 53% market share in 2023, as demand increased for deployment, training, and maintenance support.” Healthcare systems depend on vendors for easy implementation, user uptake, and system utilization. This ongoing requirement for support ensures the continual expansion of the services market in all healthcare facilities.

By Delivery Mode, the Online Solutions Segment is the Dominating Segment of the Computerized Physician Order Entry Market

In 2023, the online solutions segment held the largest share of the computerized physician order entry market, owing to its scale, mobility, and lower infrastructure expense. Cloud-based systems make real-time updates and rapid deployment, and easy integration with other platforms possible. Hospitals and clinics continue to utilize these tools to optimize productivity, promote telehealth, and maintain HIPAA-compliant, centralized data access.

For a Personalized Briefing with Our Industry Analysts, Connect Now: https://www.snsinsider.com/request-analyst/2319

Regional Insights

Computerized Physician Order Entry Market is Expected to Register Fastest Growth in Asia-Pacific, North America Dominates

The computerized physician order entry market in North America accounted for the largest share in 2023, owing to its mature health system, broad EHR penetration, and the high engagement of digital health in regulation. Australia has a range of policy options on the table. Policy interventions compel hospitals to adopt CPOE. Moreover, the high level of expenditure on healthcare and innovation in technology is also the factors that drive the region to be at the forefront in this market.

The Asia-Pacific region is estimated to grow at the highest CAGR during the forecast period, owing to the growing adoption of health IT, government backing for health IT, and investment in hospital infrastructure. Rising awareness of patient safety, increasing medical tourism, and the uptake of cloud-based solutions are the major factors driving the growth of the CPOE market in emerging nations, including India, China, and a few countries in Southeast Asia.

Computerized Physician Order Entry Market Segmentation

By Type

- Integrated

- Standalone

By Component

- Software

- Hardware

- Services

By Delivery Mode

- On-Premises

- Web-Based

- Cloud-Based

By End User

- Hospital

- Ambulatory Centers

- Physician’s Office

- Emergency Healthcare Services

Computerized Physician Order Entry Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.84 billion |

| Market Size by 2032 | US$ 3.27 billion |

| CAGR | CAGR of 6.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

Buy the Full Computerized Physician Order Entry Market Report (Single-User License) Now: https://www.snsinsider.com/checkout/2319

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates, 2023

5.2 User Demographics, By User Type and Roles, 2023

5.3 Integration Capabilities

5.4 Regulatory Compliance, by Region

5.5 Cost Analysis, by Software

6. Competitive Landscape

7. Computerized Physician Order Entry Market by Type

8. Computerized Physician Order Entry Market by Component

9. Computerized Physician Order Entry Market by Delivery Mode

10. Computerized Physician Order Entry Market by End User

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Related Reports

Clinical Decision Support Systems Market Report

Electronic Health Records (EHR) Market Report

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.