New York, USA, July 21, 2025 (GLOBE NEWSWIRE) -- Cutaneous T-cell Lymphoma Market Anticipates Impressive Growth Trajectory at a CAGR of 7.1% During the Study Period (2020–2034) | DelveInsight

The dynamics of the cutaneous T-cell lymphoma market are anticipated to change owing to the improvement in research and development activities, increasing prevalence, and the rising geriatric population. Additionally, the expected launch of therapies such as HyBryte, PTX-100, Lacutamab, BMS-986369, ONO-4685, and others will also boost the CTCL market growth.

DelveInsight’s Cutaneous T-cell Lymphoma Market Insights report includes a comprehensive understanding of current treatment practices, emerging cutaneous T-cell lymphoma drugs, market share of individual therapies, and current and forecasted cutaneous T-cell lymphoma market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the Cutaneous T-cell Lymphoma Market Report

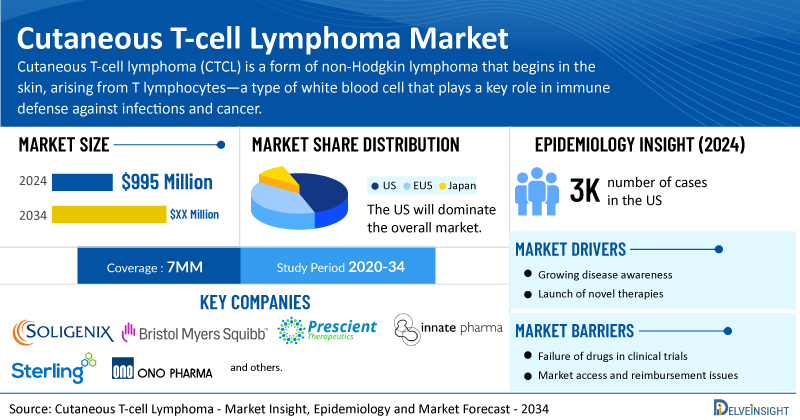

- According to DelveInsight’s analysis, the market size for cutaneous T-cell lymphoma was found to be USD 995 million in the 7MM in 2024.

- The United States accounted for the highest cutaneous T-cell lymphoma market size, approximately 70% of the total market size in 7MM in 2024, in comparison to the other major markets, i.e., EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Among the 7MM, the US accounted for the highest number of cases of CTCL in 2024, with nearly 3,000 cases. These cases are anticipated to increase by 2034.

- Prominent cutaneous T-cell lymphoma companies, including Soligenix and Sterling Pharma Solutions, Prescient Therapeutics, Innate Pharma, Bristol-Myers Squibb, ONO Pharmaceutical, and others, are actively working on innovative cutaneous T-cell lymphoma drugs.

- Some of the key cutaneous T-cell lymphoma therapies in the pipeline include HyBryte (Synthetic Hypericin/SGX301), PTX-100, Lacutamab (IPH4102), BMS-986369 (Golcadomide), ONO-4685, and others. These novel cutaneous T-cell lymphoma therapies are anticipated to enter the cutaneous T-cell lymphoma market in the forecast period and are expected to change the market.

- By 2034, among all the therapies in the late stage, the highest revenue is expected to be generated by POTELIGEO in the 7MM.

- In May 2025, 4SC received a negative opinion from the Committee for Medicinal Products for Human Use (CHMP) regarding the Marketing Authorization Application (MAA) for KINSELBY, intended for the treatment of advanced-stage CTCL, leading to the decision to discontinue its further development and commercialization.

- In March 2025, Prescient Therapeutics opened the first clinical site for its Phase IIa study of PTX-100 in patients with relapsed or refractory CTCL.

- In February 2025, Citius Pharmaceuticals and its oncology-focused subsidiary, Citius Oncology, announced that LYMPHIR has been assigned a unique, permanent HCPCS J-code (J9161) by the CMS. The establishment of a permanent J-code marks a critical milestone in supporting patient access to LYMPHIR, providing coding clarity for physicians and facilities who administer LYMPHIR, and facilitating reimbursement.

Discover which cutaneous T-cell lymphoma medications are expected to grab the market share @ Cutaneous T-cell Lymphoma Market Report

Cutaneous T-cell Lymphoma Overview

Cutaneous T-cell lymphoma (CTCL) is a form of non-Hodgkin lymphoma that begins in the skin, arising from T lymphocytes—a type of white blood cell that plays a key role in immune defense against infections and cancer. Unlike other lymphomas that typically originate in the lymph nodes or internal organs, CTCL starts in the skin, which itself functions as a major lymphoid organ. Although B-cell lymphomas are generally more common, T-cell lymphomas like CTCL are more frequently found in the skin.

Diagnosing CTCL involves a comprehensive clinical evaluation, including a review of symptoms, physical examination, detailed medical history, and specialized diagnostic tests. These tests help identify the exact type and stage of the disease and guide treatment planning. Skin biopsies are a standard diagnostic tool, particularly because early CTCL can mimic benign skin disorders such as psoriasis. In many cases, multiple biopsies are needed to establish a definitive diagnosis due to the subtle and variable nature of early-stage CTCL.

Cutaneous T-cell Lymphoma Epidemiology Segmentation

The cutaneous T-cell lymphoma epidemiology section provides insights into the historical and current cutaneous T-cell lymphoma patient pool and forecasted trends for the 7MM. It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The cutaneous T-cell lymphoma market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Incident Cases of CTCL

- Type-specific Cases of CTCL

- Gender-specific Cases of CTCL

- Stage-specific Cases of CTCL

- Treatment-eligible Pool in Early and Advanced Stages of CTCL

Download the report to understand which factors are driving cutaneous T-cell lymphoma epidemiology trends @ Cutaneous T-cell Lymphoma Treatment Algorithm

Cutaneous T-cell Lymphoma Treatment Market

The treatment strategy for mycosis fungoides and Sézary syndrome, both forms of cutaneous T-cell lymphoma, varies depending on the extent of skin involvement and whether the disease has spread. Mycosis fungoides typically responds well to therapies directed at the skin or the whole body, whereas Sézary syndrome usually necessitates systemic treatment approaches.

VALCHLOR (mechlorethamine) is the first and only FDA-approved topical formulation of mechlorethamine for patients with Stage IA or IB mycosis fungoides-type CTCL who have previously undergone skin-directed therapy. For patients with early-stage disease, topical corticosteroids are considered the first-line treatment. Additionally, topical Toll-like Receptor (TLR) agonists, which stimulate local production of interferons and cytokines to promote tumor cell death and enhance the immune response, have shown clinical benefit in managing limited-stage mycosis fungoides.

In cases of advanced-stage mycosis fungoides or Sézary syndrome, a comprehensive and multidisciplinary approach is required. Management often involves combinations of skin-directed therapies, immune-modulating agents, and sequential systemic chemotherapy. However, for early-stage disease, multi-agent chemotherapy is generally avoided. Instead, a risk- and stage-adapted strategy, aligned with the National Comprehensive Cancer Network (NCCN) Guidelines, is typically used. This includes the use of biologic-response modifiers (such as bexarotene and interferon-alpha), histone deacetylase (HDAC) inhibitors (like romidepsin), or targeted therapies such as monoclonal antibodies or antibody-drug conjugates (e.g., mogamulizumab, brentuximab vedotin). Treatment choices are tailored to each patient, taking into account factors such as age, overall health, disease stage and burden, progression rate, and prior treatments.

For advanced-stage CTCL (Stages IIB–IV), effective systemic therapies include HDAC inhibitors such as ISTODAX (romidepsin) and ZOLINZA (vorinostat). Notably, vorinostat was the first HDAC inhibitor to gain FDA approval in 2006 for treating progressive, persistent, or relapsing CTCL.

Learn more about the cutaneous T-cell lymphoma treatment options @ Cutaneous T-cell Lymphoma Treatment Guidelines

Cutaneous T-cell Lymphoma Emerging Drugs and Companies

Some of the drugs in the pipeline include HyBryte (Soligenix and Sterling Pharma Solutions), PTX-100 (Prescient Therapeutics), Lacutamab (Innate Pharma), Golcadomide (Bristol Myers Squibb), and others.

HyBryte is a topical formulation containing hypericin, one of the most light-sensitive compounds known. The product has been granted both Orphan Drug Designation and Fast Track Designation by the U.S. FDA, along with orphan status from the European Medicines Agency (EMA). Soligenix showcased new clinical data supporting HyBryte’s use in treating cutaneous T-cell lymphoma at two major events: the United States Cutaneous Lymphoma Consortium (USCLC) Workshop on March 6, 2025, and the American Academy of Dermatology (AAD) Annual Meeting held from March 7 to 11, 2025.

In an April 2024 press release, the company stated it expects to report top-line results from its 18-week confirmatory FLASH2 study, being conducted in both the U.S. and Europe, during the second half of 2026.

PTX-100 is a novel, first-in-class agent that inhibits a key enzyme involved in cancer progression by targeting the oncogenic Ras signaling pathway. The drug is currently undergoing a Phase IIa trial in patients with relapsed or refractory CTCL, with potential progression to a Phase IIb registration study. As outlined in Prescient Therapeutics’ May 2025 investor update, the company expects to receive Orphan Drug Designation in Europe by Q3 2025. Additionally, an interim review of Phase IIa trial data is planned for Q4 2025 or early 2026. Prescient also announced in May 2025 that the first patient had been successfully dosed in this ongoing Phase IIa study.

Lacutamab is a humanized, first-in-class antibody targeting KIR3DL2, designed to induce cytotoxicity. It is being tested in an open-label, multicohort Phase II study in CTCL and another Phase II study in peripheral T-cell lymphoma (PTCL). According to Innate Pharma’s most recent annual update from May 2025, the company aims to begin a Phase III trial of lacutamab, with plans to pursue accelerated approval by 2027.

Furthermore, long-term follow-up data from the TELLOMAK Phase II trial, focusing on patients with Sézary syndrome and mycosis fungoides, will be presented at the 2025 ASCO Annual Meeting on June 2 in Chicago, Illinois.

The anticipated launch of these emerging cutaneous T-cell lymphoma therapies are poised to transform the cutaneous T-cell lymphoma market landscape in the coming years. As these cutting-edge cutaneous T-cell lymphoma therapies continue to mature and gain regulatory approval, they are expected to reshape the cutaneous T-cell lymphoma market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about new treatment for cutaneous T-cell lymphoma, visit @ Cutaneous T-cell Lymphoma Management

Cutaneous T-cell Lymphoma Market Dynamics

The cutaneous T-cell lymphoma market dynamics are anticipated to change in the coming years. The prognosis for most patients with CTCL is promising, especially with early detection and timely treatment, which can enable decades of survival with ongoing care. However, the disease’s heterogeneity and involvement of multiple pathways create a strong foundation for the development of diverse targeted therapies. Emerging evidence supporting PTX-100’s superior efficacy and safety over LYMPHIR further underscores the potential of targeting GGT1 inhibition. Combined with the limited pipeline activity in CTCL, this presents a significant opportunity for drug developers to innovate and bring novel therapies to an underserved market.

Furthermore, many potential therapies are being investigated for the treatment of cutaneous T-cell lymphoma, and it is safe to predict that the treatment space will significantly impact the cutaneous T-cell lymphoma market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate is expected to drive the growth of the cutaneous T-cell lymphoma market in the 7MM.

However, several factors may impede the growth of the cutaneous T-cell lymphoma market. The diagnosis and treatment of cutaneous T-cell lymphoma remain challenging due to several factors: multiple biopsies are often required for a definitive diagnosis, potentially delaying appropriate treatment; the underlying mechanisms driving CTCL-associated pruritus are still poorly understood despite advances in research; targeted therapies frequently face issues of limited tolerance and efficacy, leading to discontinuation from toxicity or resistance; and the recent negative opinion and discontinuation of KINSELBY underscore regulatory risks, casting uncertainty over the future development of similar therapies.

Moreover, cutaneous T-cell lymphoma treatment poses a significant economic burden and disrupts patients’ overall well-being and QOL. Furthermore, the cutaneous T-cell lymphoma market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists. In addition, the undiagnosed, unreported cases and the unawareness about the disease may also impact the cutaneous T-cell lymphoma market growth.

| Cutaneous T-cell Lymphoma Report Metrics | Details |

| Study Period | 2020–2034 |

| Cutaneous T-cell Lymphoma Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Cutaneous T-cell Lymphoma Market CAGR | 7.1% |

| Cutaneous T-cell Lymphoma Market Size in 2024 | USD 995 Million |

| Key Cutaneous T-cell Lymphoma Companies | Soligenix and Sterling Pharma Solutions, Prescient Therapeutics, Innate Pharma, Bristol-Myers Squibb, ONO Pharmaceutical, Kyowa Hakko Kirin, Pfizer (Seagen), Takeda, Helsinn Therapeutics, Citius Pharmaceuticals, Valeant Pharmaceuticals, Bausch Health, and others |

| Key Cutaneous T-cell Lymphoma Therapies | HyBryte (Synthetic Hypericin/SGX301), PTX-100, Lacutamab (IPH4102), BMS-986369 (Golcadomide), ONO-4685, POTELIGEO, ADCETRIS, VALCHLOR/LEDAGA, LYMPHIR, TARGRETIN, ISTODAX, and others |

Scope of the Cutaneous T-cell Lymphoma Market Report

- Cutaneous T-cell Lymphoma Therapeutic Assessment: Cutaneous T-cell Lymphoma current marketed and emerging therapies

- Cutaneous T-cell Lymphoma Market Dynamics: Conjoint Analysis of Emerging Cutaneous T-cell Lymphoma Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Cutaneous T-cell Lymphoma Market Access and Reimbursement

Discover more about cutaneous T-cell lymphoma drugs in development @ Cutaneous T-cell Lymphoma Clinical Trials

Table of Contents

| 1 | Key Insights |

| 2 | CTCL Market Report Introduction |

| 3 | Executive Summary |

| 4 | Key Events |

| 5 | Epidemiology and Market Forecast Methodology |

| 6 | CTCL Market Overview at a Glance |

| 7 | Disease Background and Overview |

| 8 | CTCL Treatment |

| 8.1 | Treatment of Limited-stage Mycosis Fungoides/Sézary Syndrome |

| 8.2 | Treatment of Advanced-stage Mycosis Fungoides/Sezary Syndrome |

| 8.3 | CTCL Treatment Guidelines |

| 9 | Epidemiology and Patient Population |

| 9.1 | Key Findings |

| 9.2 | Assumptions and Rationale |

| 9.3 | Total Incident Cases of CTCL in the 7MM |

| 9.4 | The United States |

| 9.5 | EU4 and the UK |

| 9.6 | Japan |

| 10 | Patient Journey |

| 11 | CTCL Marketed Drugs |

| 11.1 | Key Competitors |

| 11.2 | POTELIGEO (mogamulizumab): Kyowa Hakko Kirin |

| 11.2.1 | Product Description |

| 11.2.2 | Regulatory Milestones |

| 11.2.3 | Other Developmental Activities |

| 11.2.4 | Clinical Development |

| 11.2.4.1 | Clinical Trial Information |

| 11.2.5 | Safety and Efficacy |

| 11.2.6 | Analyst Views |

| 11.3 | ADCETRIS (brentuximab vedotin): Pfizer (Seagen) and Takeda |

| 11.4 | VALCHLOR/LEDAGA (mechlorethamine): Helsinn Therapeutics |

| 11.5 | LYMPHIR/REMITORO/E7777/ONTAK (denileukin diftitox): Citius Pharmaceuticals |

| 12 | Discontinued Therapy |

| 12.1 | KINSELBY (resminostat): 4SC |

| 12.1.1 | Product Description |

| 12.1.2 | Other Developmental Activities |

| 12.1.3 | Clinical Development |

| 12.1.3.1 | Clinical Trials Information |

| 12.1.4 | Safety and Efficacy |

| 12.1.5 | Analyst Views |

| 13 | CTCL Emerging Therapies |

| 13.1 | Key Cross Competition |

| 13.2 | HyBryte (Synthetic Hypericin/SGX301): Soligenix and Sterling Pharma Solutions |

| 13.2.1 | Product Description |

| 13.2.2 | Other Developmental Activities |

| 13.2.3 | Clinical Development |

| 13.2.3.1 | Clinical Trials Information |

| 13.2.4 | Safety and Efficacy |

| 13.2.5 | Analyst Views |

| 13.3 | PTX-100: Prescient Therapeutics |

| 13.4 | Lacutamab (IPH4102): Innate Pharma |

| 14 | CTCL: Seven Major Market Analysis |

| 14.1 | Key Findings |

| 14.2 | Market Outlook |

| 14.3 | Conjoint Analysis |

| 14.4 | Key Market Forecast Assumptions |

| 14.4.1 | Cost Assumptions and Rebate |

| 14.4.2 | Pricing Trends |

| 14.4.3 | Analogue Assessment |

| 14.4.4 | Launch Year and Therapy Uptake |

| 14.5 | Total Market Size of CTCL in the 7MM |

| 14.6 | The United States Market Size |

| 14.7 | EU4 and the UK Market Size |

| 14.8 | Japan |

| 15 | Unmet Needs |

| 16 | SWOT Analysis |

| 17 | KOL Views |

| 18 | CTCL Market Access and Reimbursement |

| 18.1 | United States |

| 18.2 | EU4 and the UK |

| 18.3 | Japan |

| 18.4 | Market Access and Reimbursement of CTCL |

| 19 | Bibliography |

| 20 | Report Methodology |

Related Reports

Cutaneous T-cell Lymphoma Pipeline

Cutaneous T-cell Lymphoma Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key CTCL companies, including Mundipharma International, Shanghai Pharmaceuticals Holding, Moleculin Biotech, Inc., BeiGene, Mundipharma Research Limited, Jiangsu Simcere Biologics Co., Ltd, Teva Pharmaceuticals USA, Pfizer, Galderma R&D, Merck Sharp & Dohme LLC, Bio-Path Holdings, Inc., Kymera Therapeutics, Inc., Karyopharm Therapeutics Inc., among others.

Non-Hodgkin's Lymphoma Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key NHL companies, including AbbVie, Genmab, Novartis, Angiocrine Bioscience, Autolus, Zentera Therapeutics, Jiangsu Hengrui Medicine, among others.

Non-Hodgkin's Lymphoma Pipeline

Non-Hodgkin's Lymphoma Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key NHL companies, including Novartis, AstraZeneca, Genentech, BioInvent, Genmab, SystImmune, Nordic Nanovector, Pacylex Pharmaceuticals, Artiva Biotherapeutics, Inc., Chipscreen Biosciences, Ltd., Timmune Biotech Inc., Chia Tai Tianqing Pharmaceutical Group Co., Ltd., Gilead Sciences, Acerta Pharma BV, Adagene Inc, Conjupro Biotherapeutics, Inc., Rhizen Pharmaceuticals, Juventas Cell Therapy Ltd., Incyte Corporation, HUYA Bioscience International, SecuraBio, Genor Biopharma Co., Ltd., Kyowa Kirin Co., Ltd., Antengene Therapeutics Limited, Regeneron Pharmaceuticals, Jiangsu HengRui Medicine Co., Ltd., Xynomic Pharmaceuticals, Inc., BioTheryX, Inc., UWELL Biopharma, Kronos Bio, Bio-Thera Solutions, Spectrum Pharmaceuticals, Inc., Aptose Biosciences Inc., Miltenyi Biomedicine GmbH, Precision BioSciences, Inc., Teneobio, Inc., TCR2 Therapeutics, IGM Biosciences, Inc., among others.

Peripheral T-Cell Lymphoma Market

Peripheral T-Cell Lymphoma Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key PTCL companies, including Secura Bio, Shanghai YingLi Pharmaceutical, Dizal Pharmaceuticals, Viracta Therapeutics, Innate Pharma, CStone Pharmaceuticals, Affimed, Otsuka Pharmaceutical, Astex Pharmaceuticals, Autolus, Myeloid Therapeutics, Merck Sharp & Dohme, Bristol Myers Squibb, among others.

Diffuse Large B-cell Lymphoma Market

Diffuse Large B-cell Lymphoma Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key DLBCL companies, including Roche (Genentech), Biogen, Nektar Therapeutics, Merck, Allogene Therapeutics, Miltenyi Biomedicine, AstraZeneca, BioVaxys, ImmunoVaccine Technologies, Cellectar Biosciences, Galapagos, Novartis, Lyell, ImmPACT Bio, Pfizer, Kartos Therapeutics, 2seventy bio, Regeneron Pharmaceuticals, BeiGene, Ranok Therapeutics, Constellation Pharmaceuticals, Genmab, IDP Discovery Pharma S.L., Immunitas Therapeutics, Monte Rosa Therapeutics, SymBio Pharmaceuticals, AVM Biotechnology, Autolus Therapeutics, Kymera Therapeutics, Otsuka Pharmaceutical, Caribou Biosciences, Adicet Bio, Gilead Sciences, Xynomic Pharmaceuticals, Amgen, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Pharmaceutical Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter