Austin, July 18, 2025 (GLOBE NEWSWIRE) -- Inverter Welding Equipment Market Size & Growth Analysis:

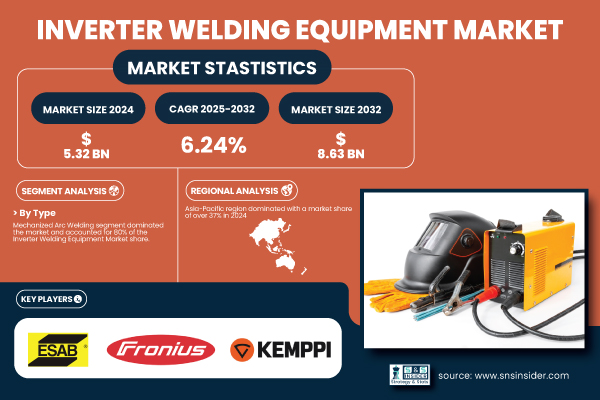

According to SNS Insider, the Inverter Welding Equipment Market is projected to grow from USD 5.32 billion in 2024 to USD 8.63 billion by 2032, at a CAGR of 6.24% during the forecast period (2025-2032). This growth is primarily driven by the increasing demand for automated, energy-efficient, and sustainable welding systems across major industries, including automotive, aerospace, construction, and renewable energy.

Inverter-based welding solutions offer enhanced precision, digital control, compact design, and reduced emissions, making them ideal for both mass production and specialized applications. Their integration with smart technologies, such as IoT and AI, further amplifies their relevance in modern manufacturing environments striving for decarbonization and operational efficiency.

Request Your Free Sample Copy of the Inverter Welding Equipment Market Report Today: https://www.snsinsider.com/sample-request/7453

The U.S. inverter welding equipment market is forecasted to grow from USD 0.97 billion in 2024 to USD 1.62 billion by 2032, with a CAGR of 6.62%. The growth can be associated with the demand for lightweight and portable welding solutions, increasing applications in the automotive and aerospace sectors, and smart automation system integration. Such inverter welders not only reduce energy consumption but also ensure precise welding, which helps them to fit perfectly into sustainable industrial practices.

Major Players Analysis Listed in this Report are:

- ESAB

- Fronius International GmbH

- Kemppi Oy

- Panasonic Industry Co. Ltd.

- Ador Welding Limited

- The Lincoln Electric Company

- Migatronic A/S

- GYS

- Miller Electric Mfg. LLC

- voestalpine Böhler Welding Group GmbH

Inverter Welding Equipment Market Report Scope

| Report Attributes | Details |

| Market Size in 2024 | US$ 5.32 billion |

| Market Size by 2032 | US$ 8.63 billion |

| CAGR | CAGR of 6.24% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Key Growth Drivers | Surging Demand for Portable, Energy-Efficient Inverter Welding Machines Drives Innovation and Sustainability Across Key Industries |

Mechanized Arc Welding, 1-Phase Supply, and Aerospace Applications Drive Segment Leadership in Inverter Welding Equipment Market

By Type

In 2024, the Mechanized Arc Welding segment held a dominant 80% share of the Inverter Welding Equipment Market. The dominance of this is due to it being widely employed in industries, particularly in industries with high performance and high consistency value. Compared to manual processes, arc welding systems can be automated, are less dependent on labor, and are also more efficient. This consistency in weld quality, combined with reduced human error and the ability to support high-throughput applications, means that laser welding is perfect for a mass production environment. The increasing need for automated welding solutions for heavy industries and infrastructure projects is also assisting in the growth of the segment, with a significant market share.

By Power Supply

The 1-phase power supply segment dominated the inverter welding equipment market in 2024 with a 58% market share. This has come to dominate because of ease of availability, lower installation costs, and it does not usually require extensive preparation, which allows for small-scale to mid-scale welding. Single-phase is common in workshops, car repair shops, and light industry, where lower voltage is adequate. This makes them perfect for non-industrial or mobile welding applications, since they provide mobility and compactness. In addition, this segment has gained strength from the growing use of inverter welding machines in residential and commercial sectors.

By End-Use

The aerospace segment accounted for over 32% of the inverter welding equipment market in 2024, emerging as the leading end-use sector. Inverter welding equipment gives unmatched factors like precision, quality, and defect-free welds, which are expected out of Aerospace manufacturing. Due to the need for lightweight aircraft, novel alloys, and a structurally safe environment, aerospace companies prefer inverter-based welding with its highly controlled heat input, stable arc blow, and energy efficiency. Market growth has also been driven by the global trend of ramping up aircraft production, MRO (maintenance, repair, and overhaul) activity, and defence spending.

For a Personalized Briefing with Our Industry Analysts, Connect Now: https://www.snsinsider.com/request-analyst/7453

Inverter Welding Equipment Market Segmentation

By Type

- Manual Arc Welding

- MIG

- TIG

- Plasma

- Mechanized Arc Welding

- MIG

- TIG

- Plasma

By Power Supply

- 1 Phase

- 3 Phase

By End Use

- Aerospace

- Automotive

- Building & Construction

- Energy

- Oil & Gas

- Marine

- Others

Asia-Pacific Dominates While North America Emerges as Fastest-Growing Region in Inverter Welding Equipment Market

Asia-Pacific leads the inverter welding equipment market, fueled by rapid industrial expansion and government-backed infrastructure projects. The demand across automotive, shipbuilding, construction, and renewable energy industries is booming in countries such as China, India, and Japan. Strengthening industrial growth through the presence of a considerable number of manufacturing hubs, increasing foreign capital investments in the regions, and a large pool of skilled workforce enhances the region. For better welding precision, operating efficiency, and energy saving, regional manufacturers are embracing inverter welding technologies.

North America is emerging as the fastest-growing region in the inverter welding equipment market. Automation in manufacturing plants, stringent environmental legislation urging energy efficiency in manufacturing plastics, and the increasing use of inverter welders in aerospace and automotive sectors are some of the factors contributing to this growth. As for U.S.-based companies, new technologies like IoT-enabled welders and AI-powered arc control are more widely adopted, but there is a similarly huge gap when it comes to utilizing the most advanced technologies. Industries in the region focused on sustainable operations and digital transformation are investing in innovative welding equipment to improve productivity and competitiveness.

Buy the Full Inverter Welding Equipment Market Report (Single-User License) Now: https://www.snsinsider.com/checkout/7453

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Manufacturing Output, by Region, (2020-2023)

5.2 Utilization Rates, by Region, (2020-2023)

5.3 Maintenance and Downtime Metrix

5.4 Technological Adoption Rates, by Region

5.5 Export/Import Data, by Region (2023)

6. Competitive Landscape

7. Inverter Welding Equipment Market by Type

8. Inverter Welding Equipment Market by Power Supply

9. Inverter Welding Equipment Market by End Use

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.