Austin, July 15, 2025 (GLOBE NEWSWIRE) -- Blockchain in Energy Market Size & Growth Insights:

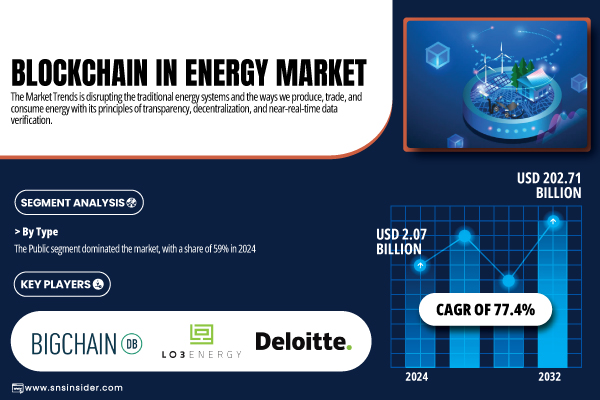

According to the SNS Insider,“The Blockchain Energy Market was valued at USD 2.07 billion in 2024 and is expected to reach USD 202.71 billion by 2032, growing at a staggering CAGR of 77.4% over the forecast period of 2025–2032.”

Empowering the Future: Blockchain Revolutionizes Energy Systems with Transparency and Decentralization

The Blockchain Energy Market is expanding quickly by integrating transparency, decentralization, and concurrent data validation into energy frameworks. Blockchain can therefore serve as an effective mode for P2P trading of energy, advanced grids management, trusted and secure transactions environments, lower operational costs, and improved reliability of the systems. Indeed, this second generation of infrastructure benefits both the consumer and the utility by allowing free and instantaneous trading of energy, overhead-less sources of power, and real-time settlements of energy on a high-speed network.

Get a Sample Report of Blockchain in Energy Market Forecast @ https://www.snsinsider.com/sample-request/6894

Leading Market Players with their Product Listed in this Report are:

- BigchainDB GmbH

- LO3 Energy Inc.

- Deloitte Touche Tohmatsu Limited

- Microsoft Corporation

- IBM Corporation

- WePower UAB

- Accenture plc

- Oracle Corporation

- SAP SE

- Infosys Limited

Blockchain in Energy Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 2.07 Billion |

| Market Size by 2032 | USD 202.71 Billion |

| CAGR | CAGR of 77.4% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Type (Private, Public) • By Application (Sustainability Attribution, Electric Vehicle, Energy Financing, Grid Transactions, Peer-To-Peer Transaction, Others) • By End-Use (Power, Oil & Gas) |

Purchase Single User PDF of Blockchain in Energy Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6894

Key Industry Segmentation

By type

The Public blockchain sector held over 59% of the market share in 2024, as it allows access to the framework and enables maintaining transparency and inclusivity among market exploiters in the energy sector. High-profile projects such as Power Ledger in Australia and Brooklyn Microgrid by LO3 Energy demonstrate the public blockchain’s capabilities in facilitating peer-to-peer energy trading. The public blockchains are an ideal match for the trend toward energy democratization, in the sense that systems are more open and verifiable.

The Private blockchain segment is expected to register the fastest CAGR of 80.7% throughout 2025–2032. This growth is due in large part to rapid data privacy and autonomy, compliance, and transactional processing. Pioneer companies like IBM and SAP are leading the way and developing private blockchain solutions for secured energy data exchange and automated trading in utility grids.

By end-use

The Power segment contributed the largest share to the market in 2024. This has been spurred on primarily by the growing use of smart grids and a greater focus on renewable integration. Solutions such as WePower and Electrify have made a lucrative market from cleaning up PPAs and tokenizing energy in power exchanges that have brought the power sector in their stride but in line with modernization objectives.

The Oil & Gas segment is projected to accelerate at the highest rate of 82.07% CAGR during the forecast period of 2023 to 2032. The need for visibility, traceability, and efficiency in supply chains is driving this development. Other big players, such as Accenture and IBM, also participate in-game and create blockchain-based solutions for oil orders and logistics.

By application

The peer-to-peer (P2P) segment was the highest contributor towards market and held an overall market share of 33% in 2024. This is dominance is a result of decentralized energy models that enable consumers to also become producers, thus reducing drastically the dependence on central utilities. Companies such as Power Ledger and LO3 Energy are leading the way in neighborhood energy-sharing initiatives.

The Grid Transactions segment is expected to be the most quickly growing one with a CAGR of 82.1%, as there is an increasing requirement for real-time, automation of settlements in advanced grid systems. Organizations, for example, Microsoft and Siemens, are incorporating blockchain into smart grid systems to enhance system functions and grid resilience.

Do you have any specific queries or need any customized research on Blockchain in Energy Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6894

Global Blockchain Energy Adoption Surges, Led by U.S., China, and Germany

North America accounted for 37% of the Blockchain in Energy Market in 2024, thanks to the progressive infrastructure, clean energy mandates, and tech investments by companies such as IBM and Microsoft. The U.S. leads the charge with pilot programs for P2P trading and carbon tracking. Asia-Pacific is the fastest-growing region CAGR of 80.8%, due to huge energy demand in China, digital transformation, and the government support for blockchain in energy trading. Europe remains an interesting player with Germany leading the way with its ambitious renewable and decentralization focus. Meanwhile, the Middle East and Africa, and Latin America are increasingly also deploying blockchain to enhance energy transparency, incorporate renewables, and update infrastructure to reduce grid waste and bolster energy security.

Recent Developments

• January 2024: LO3 Energy announced a pilot of a decentralized microgrid with a blockchain-based trading platform. This initiative intends to improve energy trading efficiency and provide trustless, community-enabled sustainability through blockchain innovation.

• May 2023: A coalition of financial and technology institutions, including Deloitte, partnered to launch the Canton Network, a blockchain for secure and interoperable transactions. Although the network centers around finance-first, its functionality extends to enabling applications in energy trading.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Blockchain in Energy Market Segmentation, by Type

8. Blockchain in Energy Market Segmentation, by Application

9. Blockchain in Energy Market Segmentation, by End-Use

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.