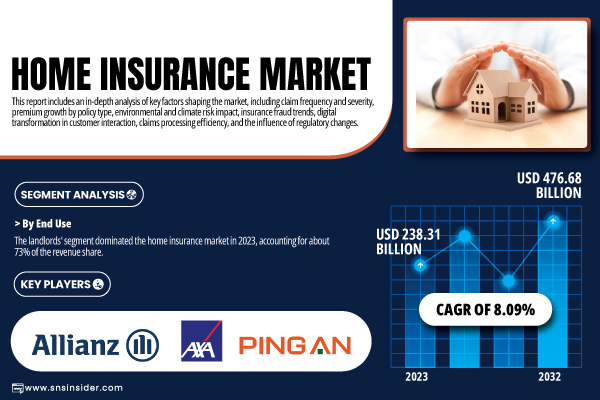

Austin, July 14, 2025 (GLOBE NEWSWIRE) -- The global home insurance market was valued at USD 238.31 billion in 2023 and is projected to reach USD 476.68 billion by 2032, expanding at a compound annual growth rate (CAGR) of 8.09% from 2024 to 2032.

This growth is driven by increasing awareness of property protection, rising instances of natural disasters due to climate change, and growing demand for comprehensive coverage. Additionally, urbanization, real estate development, and government regulations mandating home insurance in certain regions are fueling demand. The integration of digital platforms and AI for policy customization and claims processing is also enhancing consumer access and operational efficiency.

Download PDF Sample of Home Insurance Market @ https://www.snsinsider.com/sample-request/6863

The U.S. home insurance market was valued at USD 64.11 billion in 2023 and is forecasted to reach USD 125.89 billion by 2032, growing at a CAGR of 7.79% from 2024 to 2032.

Growth is driven by rising climate-related damages, increasing homeownership, higher property values, and advancements in digital underwriting and claims management enhancing customer experience.

Key Players:

- Allianz SE

- AXA S.A.

- Ping An Insurance

- China Life Insurance Co. Ltd

- Assicurazioni Generali S.p.A.

- Zurich Insurance Group AG

- Munich Re Group

- Prudential plc

- Nippon Life Insurance Company

- MetLife Inc

- Manulife Financial Corp

- CNP Assurances

- Aegon N.V.

- Aviva plc

- Sumitomo Life Insurance Company

- Swiss Life Holding

- MS&AD Insurance

- Dai-ichi Life Holdings Inc

- Allstate Insurance Company

- American International Group, Inc.

- Chubb

- Liberty Mutual Insurance Company

- Farmers Insurance

- Travelers Insurance

- PICC RE

Home Insurance Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 238.31 Billion |

| Market Size by 2032 | USD 476.68 Billion |

| CAGR | CAGR of 8.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • Rising real estate investments and urban expansion are creating sustained demand for home insurance to safeguard high-value assets. |

If You Need Any Customization on Home Insurance Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6863

By Coverage, Comprehensive Coverage Segment Dominated the Home Insurance Market in 2023 Amid Rising Demand for All-Round Protection

In 2023, the comprehensive coverage segment led the home insurance market with around 43% revenue share. This dominance is driven by its ability to cover a broad spectrum of risks, including fire, theft, vandalism, and natural disasters. As climate unpredictability increases and homeowners become more risk-conscious, comprehensive policies are becoming the preferred choice for ensuring financial safety and property security.

By Distribution Channel, Brokers Segment Led the Home Insurance Market, Tied Agents & Branches Segment to Grow Fastest

In 2023, brokers dominated the home insurance market, capturing about 46% of the total revenue share. Their leadership is attributed to offering customized insurance solutions, access to a wide range of providers, and competitive pricing. As homeowners seek tailored and flexible coverage options, brokers remain essential intermediaries, leveraging their expertise to simplify complex offerings and align products with individual customer needs in a dynamic market landscape.

The tied agents and branches segment is projected to grow at a CAGR of 8.88% from 2024 to 2032, the fastest in the distribution category. This surge is fueled by consumers’ preference for personalized guidance, especially for specialized products. As insurers introduce more custom plans, tied agents play a vital role in delivering these directly to customers, offering convenience, brand trust, and one-on-one service that fosters loyalty and engagement.

By End Use, Landlords’ Segment Led the Home Insurance Market, Tenants’ Segment to Witness Fastest Growth

In 2023, landlords accounted for approximately 73% of total home insurance revenue. This dominance stems from the high value and risk exposure of rental properties, requiring comprehensive coverage for damages, liabilities, and income loss. Increasing demand for rental housing and regulatory compliance further bolstered landlord participation, making them a critical driving force in the home insurance landscape.

The tenants’ segment is projected to grow at a CAGR of 9.46% from 2024 to 2032, the fastest among all categories. Growth is fueled by increasing awareness among renters regarding personal property and liability protection. As urban rental markets expand and millennial and Gen Z populations mature, more tenants are proactively seeking renters’ insurance to mitigate risks from theft, fire, or accidental damage.

North America Led the Global Home Insurance Market, Asia Pacific to Experience Fastest Growth

In 2023, North America accounted for about 38% of global home insurance revenue, making it the leading region. This dominance stems from high property valuations, widespread homeownership, and a mature insurance ecosystem. Growing awareness of disaster-related risks such as hurricanes and wildfires has led to increased adoption of comprehensive policies, as homeowners seek reliable protection for assets in an economically stable and insurance-savvy environment.

The Asia Pacific home insurance market is projected to grow at a rapid CAGR of 10.12% from 2024 to 2032. This surge is driven by rapid urbanization, expanding middle-class wealth, and increased home construction across countries like China, India, and Southeast Asia. Government support for financial protection and insurers tailoring products to regional consumer needs are further propelling demand, making Asia Pacific the fastest-growing market in the coming years.

Buy Full Research Report on Home Insurance Market 2024-2032 @ https://www.snsinsider.com/checkout/6863

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.