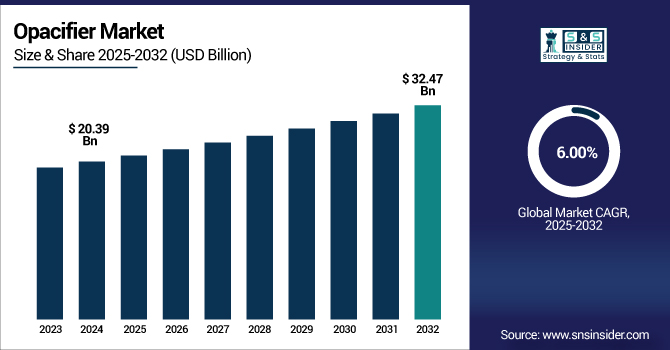

Austin, July 11, 2025 (GLOBE NEWSWIRE) -- The Opacifiers Market Size was valued at USD 20.39 billion in 2024 and is expected to reach USD 32.47 billion by 2032, growing at a CAGR of 6.00% over the forecast period of 2025-2032.

Innovative applications and regulatory support propel demand for opacifiers in coatings, cosmetics, and healthcare industries worldwide.

The opacifiers market is expanding rapidly, fueled by rising demand in paints, cosmetics, and healthcare applications. Titanium dioxide leads global usage due to its superior opacity and safety profile, supported by EPA data and capacity expansions by Chemours and Tronox. FDA approvals for cosmetic applications have further boosted adoption. Urbanization and infrastructure growth increase demand for durable, aesthetically enhanced coatings, while consumers recognize opacifiers’ benefits in sunscreens and wound care. Together, technological innovation and regulatory support continue to shape this dynamic and evolving market landscape.

Download PDF Sample of Opacifier Market @ https://www.snsinsider.com/sample-request/7755

The U.S. Opacifiers market is valued at USD 3.84 billion in 2024 and is projected to reach a value of USD 6.02 billion, with a market share of approximately 78%.

The U.S. opacifiers market is growing due to strong demand from the cosmetics and healthcare sectors, supported by FDA approvals and innovation in product formulations. For example, Chemours expanded TiO2 production in the U.S. in 2023 to meet rising demand in paints and healthcare products. Increasing consumer focus on product aesthetics and safety fuels market expansion.

Key Players:

- Tronox Holdings plc

- The Chemours Company

- Venator Materials PLC

- KRONOS Worldwide, Inc.

- Lomon Billions

- Tayca Corporation

- Ishihara Sangyo Kaisha Ltd.

- Arkema S.A.

- Dow Inc.

- Precheza a.s. (AGROFERT a.s.).

Opacifier Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 20.39 billion |

| Market Size by 2032 | USD 32.47 billion |

| CAGR | CAGR of 6.00% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • Rising green building regulations fuel demand for sustainable Opacifier in architectural coatings. • Surging electric vehicle production increases the need for lightweight Opacifier in composite plastics. |

If You Need Any Customization on Opacifier Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7755

By Product, Titanium Dioxide dominated the Opacifiers Market in 2024, with a 62.4% Market Share.

The dominance is due to titanium dioxide’s superior opacity, brightness, and chemical stability, making it the preferred choice across paints, plastics, and cosmetics. Key players like Chemours and Tronox boosted production, with Chemours expanding capacity by 15% in 2023 to meet rising demand. Its cost-effectiveness and versatility keep it ahead of alternatives like zinc oxide and zircon. Continuous R&D improving particle size and dispersion further strengthens its market position and drives widespread industry adoption worldwide.

By Application, the Paints & Coatings dominated the Opacifiers Market in 2024 with a 42.7% Market Share.

The dominance is due to strong demand from construction and automotive sectors, which need durable, high-opacity coatings. Infrastructure spending, especially across the U.S. and Asia-Pacific, has driven higher consumption of opacifier-based paints. Sherwin-Williams’ 2023 launch of enhanced opacity coatings shows industry focus on performance. Additionally, growing trends in low-VOC and eco-friendly paints incorporating opacifiers further support expansion. Though other applications like cosmetics and plastics are rising, paints and coatings remain the largest volume consumer.

By Region, Asia-Pacific dominated the Opacifiers Market in 2024, Holding a 36.4% Market Share.

The dominance is due to rapid industrialization, urbanization, and booming construction in countries like China, India, and Japan, driving demand for paints, plastics, and cosmetics that use opacifiers. Rising disposable incomes fuel consumer preference for premium products with enhanced aesthetics. Government-backed infrastructure projects and expanding automotive production add momentum. Local producers like Asia Pacific Titanium are investing in capacity expansions and tailored products, meeting diverse market needs and reinforcing the region’s leadership in global opacifier consumption.

Recent Developments

- In September 2024, Business Finland backed the CELLIGHT project led by VTT, Aalto University, and the University of Helsinki to develop cellulose‑based opacifiers as sustainable alternatives to titanium dioxide in paints, cosmetics, and coatings.

- In December 2024, PCC Group announced a new 340,000 MT/yr chlor-alkali facility at Chemours’ DeLisle TiO₂ site in Mississippi, ensuring a steady chlorine supply for opacifier production.

Buy Full Research Report on Opacifier Market 2025-2032 @ https://www.snsinsider.com/checkout/7755

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.