Austin, July 11, 2025 (GLOBE NEWSWIRE) -- Parametric Insurance Market Size & Growth Insights:

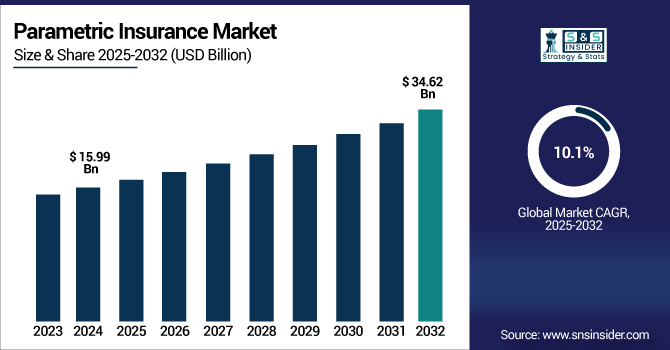

According to the SNS Insider Report, “The Parametric Insurance Market was valued at USD 15.99 billion in 2024 and is expected to reach USD 34.62 billion by 2032, growing at a CAGR of 10.1% over the forecast period of 2025–2032.”

Parametric Insurance Builds Traction as Quick, Data-Based Substitute for Traditional Coverage

The parametric insurance industry is thriving in the new age as a solution to the limitations of conventional insurance, including its speed and simplicity, as well as its ability to bridge financial recovery periods. Whereas conventional models depend on specific investigations of loss times, parametric insurance triggers payments on the basis of pre-determined data such as levels of rainfall, temperature, or wind.

The U.S. is at the forefront of the global market thanks to its developed tech market, regularly occurring climate-driven disasters, a strong insurance culture, and the competitive insurer-tech collaborations in the country. Increasing expectations for fast, transparent claims payments also continue to create momentum for the U.S.'s dominant role in this space.

Get a Sample Report of Parametric Insurance Market @ https://www.snsinsider.com/sample-request/6893

Leading Market Players with their Product Listed in this Report are:

- AXA

- AIG

- Allianz

- Aon

- Berkshire Hathaway Specialty Insurance

- Chubb

- Lloyd of London

- Marsh & McLennan

- Munich Re

- Swiss Re

Parametric Insurance Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 15.99 Billion |

| Market Size by 2032 | USD 34.62 Billion |

| CAGR | CAGR of 10.1% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Insurance Type (Index-Based Insurance, Weather-Based Insurance, Catastrophe Bonds, Other Parametric Insurance Types) • By Application (Agriculture, Property and Casualty, Energy, Other Applications) • By Deployment Model (Cloud-Based, On-Premise, Hybrid) • By Use Case (Risk Mitigation, Index Tracking, Catastrophe Response, Other Use Cases) |

Purchase Single User PDF of Parametric Insurance Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6893

Key Segment Analysis

By Insurance Type

The Index-Based Insurance market was the largest segment in 2024; it accounted for 35% of the revenue share. It is for its efficacy and scalability, particularly in agriculture- and disaster-prone regions, that BRAC has come to dominate. Swiss Re and AXA initiated index-based agricultural and climate products. Weather-Based Insurance is the largest and growing at a CAGR of 12.3%. It is driven mainly by a rise in weather volatility, gradually stimulating demand from aviation, construction, and energy. Firms such as Munich Re and Chubb have developed custom-made weather protection services using a mix of historical weather data and artificial intelligence-based forecasts to cover optimal risk.

By Deployment Mode

The Cloud-Based segment held the largest market share of 46% in 2024. Cloud applications are often preferred because they are scalable and capable of real-time computation. Firms from AXA to Aon use cloud-based analytics for managing global portfolios and instant payouts based on sensor and satellite data. The on-premises market, conversely, which is relying more on data security, especially in regulated industries such as defense and finance, is growing at a CAGR of 12.31%.

By Application

The agriculture sector emerges as the lead sector 32%, given the urgent requirement for timely assistance against droughts, floods, and crop failures. Satellite and data tools such as NDVI make it possible to monitor conditions in individual fields as they are unfolding. The Energy sector is projected to grow consistently with the CAGR of 11.9%, due to increasing exposure that renewable infrastructure faces towards climate anomalies. Insurers such as Lloyd’s have developed policies for wind and solar coverage that guarantee revenue flow during periods of low production.

By Use Cases

Large Enterprises dominate with 68% of the market, protecting themselves from global risk using parametric models. Giants, including Aon and Swiss Re, are providing bespoke solutions to supply chain disturbances and extreme weather risks. In the meantime, SMEs are getting up to speed, expanding at a striking CAGR of 24.7%. Firms such as Arbol and Skyline Partners are putting parametrics in the hands of small businesses using intuitive digital platforms.

Global Parametric Insurance Market Expands Rapidly, with North America Leading and Asia Pacific Emerging as Fastest-Growing Region

North America leads the parametric insurance market at 38%, primarily due to mature tech infrastructure, frequent climate events, and quick uptake of cutting-edge insurance models there, particularly in the U.S. Asia Pacific is expected to experience the fastest growth CAGR of 14.8% as it faces increased climate risks in its countries; India, China and Japan with India integrating parametric solutions into pubic insurance programs. Europe is growing steadily, with strong regulation and technological innovation, such as Munich Re’s products triggered by satellite. Latin America & the Middle East, and Africa are the developing economies, where nations like Brazil, Mexico, U.A.E, and South Africa have adopted parametric insurance based on big data for better disaster recovery, along with the help of global insurers such as Swiss Re and Zurich.

Do you have any specific queries or need any customized research on Parametric Insurance Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6893

Recent Developments

- September 2024 – AIG cements its leadership position in the parametric insurance space with new products responding to emerging climate risks. The firm emphasised the role of parametrics in delivering fast financial relief in the aftermath of disasters, as well as the potential to provide support for longer-term resilience in affected communities.

Table of Contents - Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Parametric Insurance Market, by Insurance Type

8. Parametric Insurance Market, by Application

9. Parametric Insurance Market, by Deployment Model

10. Parametric Insurance Market, by Use Case

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.