Austin, July 10, 2025 (GLOBE NEWSWIRE) -- Cognitive Supply Chain Market Size & Growth Analysis:

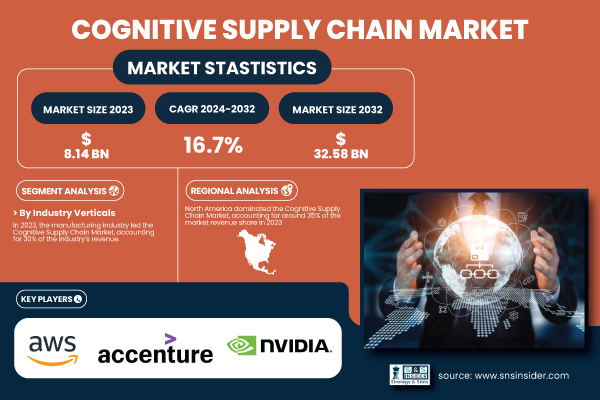

The SNS Insider report indicates that the Cognitive Supply Chain Market size was valued at USD 8.14 billion in 2023 and is projected to reach USD 32.58 billion by 2032, growing at a CAGR of 16.70% from 2024 to 2032.

In the U.S., the Cognitive Supply Chain Market was valued at USD 2.01 billion in 2023 and is projected to reach USD 7.13 billion by 2032, growing at a CAGR of 15.11% during 2024–2032. Expansion is propelled by early adoption of AI, strong digital infrastructure, and an increased need for supply chain transparency. As enterprises around the country look to automate, create more resilient, and implement predictive analytics into their logistics operations, the future looks bright.

Get a Sample Report of Cognitive Supply Chain Market@ https://www.snsinsider.com/sample-request/6859

Major Players Analysis Listed in this Report are:

- IBM Corporation (IBM Sterling Supply Chain Suite, IBM Watson Supply Chain Insights)

- Oracle (Oracle Fusion Cloud Supply Chain Management, Oracle Supply Chain Planning Cloud)

- Amazon Web Services (AWS) (AWS Supply Chain, Amazon Forecast)

- Accenture plc (Accenture Intelligent Supply Chain Platform, myConcerto Supply Chain Suite)

- Intel Corporation (Intel Supply Chain Optimization Tools, Intel AI for Supply Chain Analytics)

- NVIDIA Corporation (NVIDIA AI Enterprise, NVIDIA Omniverse for Logistics)

- Honeywell International Inc. (Honeywell Forge Supply Chain Suite, Honeywell Connected Logistics)

- C.H. Robinson Worldwide, Inc. (Navisphere Vision, Navisphere Optimizer)

- Panasonic (Panasonic Supply Chain Solutions, Panasonic Logiscend System)

- SAP SE (SAP Integrated Business Planning, SAP Digital Supply Chain)

- Microsoft (Dynamics 365 Supply Chain Management, Azure AI for Supply Chain)

- Kinaxis (Kinaxis RapidResponse, Kinaxis Maestro)

- Anaplan (Anaplan Supply Chain Planning, Anaplan Demand Planning)

- Infor (Infor Supply Chain Planning, Infor Nexus)

- Manhattan Associates (Manhattan Active Supply Chain, Manhattan Demand Forecasting)

Cognitive Supply Chain Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 8.14 billion |

| Market Size by 2032 | US$ 32.58 billion |

| CAGR | CAGR of 16.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

Segment Analysis

By Deployment: On-Premise Dominates While Cloud Leads in Growth

The On-Premise segment dominated the market in 2023. It accounted for 66% of revenue share, due to higher security, data control, and compliance requirements among the large enterprises, particularly in manufacturing and BFSI verticals. Historically, these industries have operated in silos of in-house infrastructure to manage private supply chain data.

The Cloud deployment segment is expected to register the fastest CAGR during 2024–2032. Due to their inherent scalability, low cost of ownership, and ubiquitous accessibility capabilities, Cloud computing technology is ideally suited for SMEs and businesses operating in multiple geographies. Along with this structural trend towards remote work and the need for real-time collaboration tools, cloud adoption is being boosted.

By Enterprise Size: Large Enterprises Dominate, SMEs See Rapid Growth

The Large Enterprises segment dominated the market in 2023 and accounted for 68% of revenue share, as these organizations invested significantly in cognitive technologies at an early stage and often require complex and multidimensional supply chain orchestration activities. Such organizations are using AI to lower logistics costs, improve forecasting accuracy, and improve supplier networks.

SMEs are projected to grow at the fastest CAGR from 2024 to 2032 during the forecast period, attributed to the growing availability of low-cost SaaS-based cognitive platforms. That gives smaller companies access to sophisticated analytics and automation without needing to invest heavily in infrastructure, letting them better compete in global supply chains.

By Automation Used: IoT Dominates, ML Grows Fastest

The Internet of Things (IoT) dominated the automation segment in 2023 and accounted for 45% of revenue share, owing to its significant role in providing immediate insight into the location of assets, inventory levels, or simply the health of machines to identify when predictive maintenance occurs. Here, IoT devices are generating the foundational data that all AI algorithms build off of across the supply chain.

The Machine Learning (ML) segment is set to grow at the highest CAGR through 2032, owing to greater implementation of predictive analytics, risk detection, and adaptive learning over ML models by organizations. ML also enables businesses to continuously improve their capabilities to fine-tune forecasts and speed up responsiveness across operations.

By Industry Verticals: Manufacturing Leads, Logistics Grows Fastest

The Manufacturing sector accounted for the largest market share of more than 30% in 2023, as it was the first one to implement AI and cognitive automation in production and supply. Cognitive tools for inventory optimization, demand forecasting, and supplier risk management help manufacturers.

The Logistics and Transportation segment is forecasted to grow at the fastest pace during the forecast period due to increasing e-commerce demand and last-mile delivery optimization and fleet intelligence solutions. Players of this segment are targeting investments in AI for optimizing route planning, route visibility for shipments and reduction in fuel cost.

For A Detailed Briefing Session with Our Team of Analysts, Connect with Us Now@ https://www.snsinsider.com/request-analyst/6859

Cognitive Supply Chain Market Segmentation

By Deployment

- Cloud

- On-Premise

By Enterprise Size

- SMEs

- Large Enterprises

By Automation Used

- Internet of Things (IoT)

- Machine Learning (ML)

- Others

By Industry Verticals

- Manufacturing

- Retail & E-commerce

- Logistics and Transportation

- Healthcare

- Food and Beverage

- Others

By Region: North America Dominates, Asia-Pacific Emerges as Fastest Growing

North America held the largest market share of more than 35% of revenue in 2023, due to the presence of robust technological infrastructure, rapid adoption of AI across major industries, and some of the leading market vendors, including IBM, Microsoft, alongside Oracle. Further, the focus of this region on supply chain resilience and regulatory compliance is also supporting the market growth.

Asia-Pacific is poised to register the fastest CAGR through 2032. Countries like China, India, and Japan are witnessing a surge in demand due to rising industrialization, growing retail and manufacturing sectors, and increasing government initiatives to embrace AI in supply chains.

Recent Developments – 2024

- May 2024: IBM launched an AI-enhanced cognitive supply chain suite aimed at boosting real-time logistics analytics.

- March 2024: Oracle introduced an updated version of its SCM Cloud integrating generative AI features.

- February 2024: SAP partnered with NVIDIA to integrate cognitive AI models into its supply chain systems.

Buy a Single-User PDF of Cognitive Supply Chain Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/6859

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Cognitive Supply Chain Market by Deployment

8. Cognitive Supply Chain Market by Enterprise Size

9. Cognitive Supply Chain Market by Automation Used

10. Cognitive Supply Chain Market by Industry Verticals

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.