Austin, July 03, 2025 (GLOBE NEWSWIRE) -- Graphic Processor Market Size & Growth Insights:

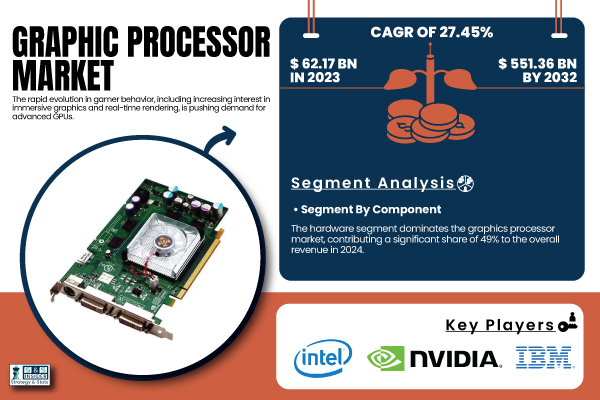

According to the SNS Insider Report, “The Graphic Processor Market was valued at 62.17 Billion in 2023 and is projected to reach USD 551.36 Billion by 2032, growing at a CAGR of 27.45 % from 2024 to 2032.”

Powering the Digital Frontier with Gaming, AI and Geopolitical Shifts in the GPU Market

The Graphic Processor Market is rapidly growing on account of increasing requirement for high performance GPUs across gaming, AI, data centers, and edge computing. Competitive gaming and open-world games are seeing GPU innovation focused on lifelike graphics and real-time rendering. At the same time, AI workloads especially deep learning and inference are often accelerated with GPUs. Compact solutions such as mobile and external GPUs are driving expansion in consumer and enterprise markets. Security, along with improvements to thermal reliability are also strengthening the position of GPUs in high-end systems.

In U.S the market was Valued USD 10.94 billion in 2023 and is projected to reach USD 99.03 billion by 2032, reflecting a slightly higher CAGR of 27.70%. Even with expansion, U.S. tariffs on goods from China and Vietnam are likely to interfere with supply chains and increase the price of GPUs, but the CHIPs Act will help bolster U.S.-produced hardware and create a more consistent long-term path to market growth.

Get a Sample Report of Graphic Processor Market @ https://www.snsinsider.com/sample-request/6748

Leading Market Players with their Product Listed in this Report are:

- NVIDIA Corporation (USA)

- Advanced Micro Devices Inc. (AMD) (USA)

- Intel Corporation (USA)

- Qualcomm Technologies Inc. (USA)

- Samsung Electronics Co. Ltd. (South Korea)

- Imagination Technologies Group plc (UK)

- VIA Technologies Inc. (Taiwan)

- Matrox Electronic Systems Ltd. (Canada)

- IBM (USA)

- ARM Limited (UK)

- Silicon Integrated Systems Corp. (SiS) (Taiwan)

- Broadcom Inc. (USA)

- Xilinx Inc. (USA).

Graphic Processor Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 62.17 Billion |

| Market Size by 2032 | USD 551.36 Billion |

| CAGR | CAGR of 27.45% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Type (Integrated, Discrete, Hybrid) • By Deployment (On-premise, Cloud) • By Application (Consumer Electronics, IT & Telecommunication, Healthcare, Media & Entertainment, Others) |

Purchase Single User PDF of Graphic Processor Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6748

Key Industry Segmentation

By Component

In 2024, the hardware segment leads the graphics processor market with a 49% revenue share, fuelled by increasing demand for high-end GPUs in gaming, AI and datacenters. Graphics cards are important components for fast delivery of complex visuals and computation in industries.

The services segment is set for the fastest growth through 2032, driven by an explosion in the GPU-as-a-Service (GPUaaS), cloud gaming, edge computing, and machine learning which provide a scalable, pay-asyou-go solution without the large initial investment in hardware.

By Type

In 2023, integrated graphics dominated the graphics processor market with 54% revenue share, on demand for value and power efficiency. Integrated GPUs (IGP) are built into the CPU itself and are used in laptops, desktops, as well as mobile computers for playing everyday uses such as media playback and 3D applications not requiring complex computations.

The hybrid graphics segment is set to grow fastest from 2024 to 2032, as devices start to employ dual GPU setups to balance power efficiency and performance – great for gaming notebooks, ultrabooks and mobile workstations processing demanding AI and graphics workloads.

By Deployment

In 2023, the cloud segment led the graphics processor market with 52% of total revenue, due to the adoption of cloud gaming and AI workloads, as well as edge processing. Both consumers and businesses are drifting towards cloud based software solutions due to the features like scalability, flexibility and cost savings.

As cloud-based AI and gaming demand powerful GPU support, this segment is set to grow rapidly from 2024 to 2032, boosted by rising investments in cloud infrastructure and GPU-powered services.

By Application

In 2023, the consumer electronics segment led the graphics processor market with 39% revenue share, due to increasing GPU penetration in smartphones, tablets, smart TVs, and wearables, in 2023. Growth is driven by increased desire for high-quality visuals in gaming, streaming and AR as 4K/8K display adoption grows.

From 2024 to 2032, the media and entertainment segment is projected to grow fastest, due to rising demand for streaming, VR/AR content and esports, as well as real-time rendering and immersive, high-definition visual experiences.

Accelerating Innovation and Immersion Across Continents in the Global GPU Market

In 2023, the Asia-Pacific region led the global graphics processor market with approximately 45% revenue share, owing to high technology proliferation, a widespread gaming population, and strong electronics manufacturing bases observed in China, Japan, South Korea, and Taiwan. These are countries that are at the core of both GPU advancement and semiconductor manufacturing. Growth is being propelled by increasing demand for high-end gaming, mobile and digital content, as well as encouragement by the government — including its “Made in China 2025” program.

North America is expected to be the fastest-growing region from 2024 to 2032, driven by pervasive AI and machine learning, fast autonomous vehicle development and cloud computing. With major GPU players like NVIDIA, AMD, and Intel and growing esports and data center usage, the region is driving rapid GPU adoption.

Do you have any specific queries or need any customized research on Graphic Processor Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6748

Recent Developments:

- In May 2025, Intel debuted three new Xeon 6 Performance-cores with Priority Core Turbo technology to improve GPU-accelerated AI workloads. One of those processors, the Xeon 6776P, is now being used to fuel NVIDIA’s latest DGX B300 AI system, designed to serve large-scale AI workloads.

- In March 2025, Qualcomm announced three new Snapdragon G-series chips — G3 Gen 3, G2 Gen 2 and G1 Gen 2. The G3 Gen 3 is headlined by support for Unreal Engine 5 Lumen as well as Wi-Fi 7 for up to 30% faster CPU performance.

Table of Contents - Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Graphic Processor Market, by Component

8. Graphic Processor Market, by Type

9. Graphic Processor Market, by Deployment

10. Graphic Processor Market, by Application

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.