Austin, July 01, 2025 (GLOBE NEWSWIRE) -- Soft Contact Lenses Market Size & Growth Analysis:

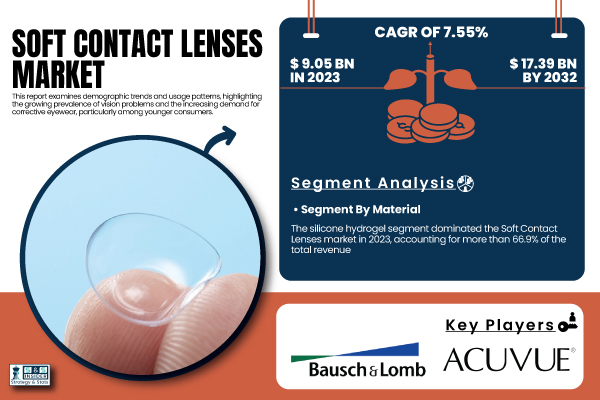

According to SNS Insider, the global Soft Contact Lenses Market was valued at USD 9.05 billion in 2023 and is projected to reach USD 17.39 billion by 2032, growing at a CAGR of 7.55% over the forecast period (2024–2032). The market is being propelled by the increasing prevalence of vision disorders such as myopia, hyperopia, and astigmatism—conditions that have surged due to digital screen exposure and evolving lifestyle habits.

Significant advancements in contact lens materials, especially in silicone hydrogel and moisture-retaining technologies, have enhanced oxygen permeability, comfort, and hydration. This makes soft contact lenses a preferred alternative to traditional eyeglasses, particularly for consumers with active or on-the-go lifestyles.

Get a Sample Report of Soft Contact Lenses Market@ https://www.snsinsider.com/sample-request/5640

Market Overview:

Soft contact lenses are medical devices worn directly on the cornea to correct refractive vision errors or for cosmetic and therapeutic purposes. These lenses are now designed with high oxygen transmissibility, UV protection, and blue light filtration, significantly improving eye health outcomes. Consumer demand is rapidly shifting toward daily disposable lenses, which offer improved hygiene and comfort through single-use wearability.

In parallel, the rise of e-commerce channels and subscription-based models has expanded access to contact lenses across all demographics. The ability to browse, customize, and receive lenses at home has made online platforms a strong growth catalyst for the global soft contact lenses market.

Major Players Analysis Listed in this Report are:

- Bausch + Lomb Inc. - UltraSoft, SofLens, BioTrue ONEday, PureVision

- Acuvue (Johnson & Johnson) - Acuvue Oasys, Acuvue 1-Day Moist, Acuvue Oasys for Astigmatism

- Alcon Vision LLC - Air Optix, Dailies, FreshLook, Precision1

- Carl Zeiss AG - Zeiss Contact Lenses

- CooperVision Inc. - Biofinity, Proclear, Clariti

- Essilor International - Varilux, Crizal (focused on eyewear, some contact lens offerings)

- Hoya Corporation - Hoya Contact Lenses

- Menicon Co., Ltd. - Menicon Z, Menicon PremiO, Menicon Soft

- SEED Co., Ltd. - SEED 1day Pure, SEED Toric

- Contamac Ltd. - Zen Lens, Optimum

- Ciba Vision (now part of Alcon) - Focus Dailies, Focus Night & Day, AirOptix

- Ginko International Co., Ltd. - Ginko Color Contact Lenses

- SynergEyes, Inc. - Duette Hybrid Lenses

Soft Contact Lenses Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.05 billion |

| Market Size by 2032 | US$ 17.39 billion |

| CAGR | CAGR of 7.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

Segment Analysis

By Material

The silicone hydrogel segment controlled the market for soft contact lenses in 2023 and commanded more than 66.9% of total revenue. Silicone hydrogel lenses have greater oxygen permeability, which creates more comfort in the eyes and minimizes dryness, leading to their widespread adoption among customers who wear contact lenses for a long duration of time. These lenses' prevention of corneal hypoxia has prompted adoption, especially among customers who have active lifestyles.

The hydrogel market, though expanding, is growing at a slower rate than for silicone hydrogel lenses. Hydrogel lenses are highly water-filled, which means they are comfortable but restrict oxygen transmission. They thus become less popular for extended wear.

By Design

Spherical soft contact lenses dominated the market in 2023 with the highest market share. They are mostly applied to correct prevalent refractive defects like myopia and hyperopia, and thus they are a standard for consumers. Their uncomplicated structure and low price make them popular in the market.

The toric lens segment will grow at the highest rate during the forecast period. Toric lenses are specially developed to address astigmatism, a condition present in a large percentage of the population. Improvements in the technology of toric lenses have enhanced their stability and comfort levels, which makes them more attractive to customers.

By Usage

Daily disposable lenses captured the maximum market share in 2023 with a share of more than 29.8% of total revenue. They provide better hygiene because they are thrown away after one use, avoiding infection and discomfort due to protein deposition. Due to their ease of use, they have been the first choice among travelers, sportspersons, and those with hectic schedules.

Disposable lenses, such as bi-weekly and monthly replacement lenses, are expected to have the highest growth rate. They offer a compromise between cost and convenience and are thus a favorite among long-term contact lens wearers. Advances in technology have enhanced the durability and moisture content of disposable lenses, leading to their increased adoption.

By Application

Corrective lenses led the market in 2023, with a share of over 42.6% of overall revenue. The increasing incidence of refractive errors, combined with growing awareness regarding vision correction, has greatly driven this segment. Corrective lenses are most commonly used by people afflicted with myopia, hyperopia, and astigmatism, hence being the most sought-after category.

The cosmetic lenses segment is predicted to increase at a greater pace during the forecast period. Growth in the aesthetic enhancements demand for colored and decorative lenses is leading to an upsurge in this segment. Cosmetic lenses are being used for fashion and beauty by younger customers, especially across Asia-Pacific.

By Distribution Channel

The retail segment dominated the highest revenue share in 2023, with over 45.2% of the market. Pharmacies and optical stores remain the main distribution channels since they provide professional fitting and instant product availability. The trust element that comes with buying products in person has assisted this segment in retaining its dominance.

The e-commerce segment is likely to experience the highest growth. Online websites provide an extensive range of lenses at reasonable prices, drawing in a larger number of consumers. Subscription plans, virtual try-ons, and home delivery services have simplified online shopping. Moreover, higher digital marketing initiatives by top contact lens brands are also driving the use of e-commerce as a preferred selling channel.

For A Detailed Briefing Session with Our Team of Analysts, Connect with Us Now@ https://www.snsinsider.com/request-analyst/5640

Soft Contact Lenses Market Segmentation

By Material

- Silicone Hydrogel

- Hydrogel

By Design

- Spherical Lens

- Toric Lens

- Multifocal Lens

- Other Lens

By Usage

- Daily Disposable

- Disposable

- Frequently Disposable

- Traditional (Reusable) lenses

By Application

- Corrective

- Therapeutic

- Cosmetic

- Prosthetic

- Lifestyle-oriented

By Distribution Channel

- E-commerce

- Eye Care Professionals

- Retail

Regional Analysis

North America accounted for 37.9% of the market for soft contact lenses in 2023, due to high vision correction solution awareness and availability of prominent industry companies. Rising cases of myopia and astigmatism among the youth have stimulated the need for sophisticated contact lenses. High disposable income and the ready availability of high-end eye care products have also augmented the stronghold of the region's market.

The Asia-Pacific region is likely to experience the highest growth as the population there becomes increasingly myopic at a very fast pace, especially in nations such as China, Japan, and India. Contact lenses are in greater demand as more customers increasingly focus on eye care and look for convenient alternatives to eyeglasses. Larger e-commerce platforms and growing product accessibility have also helped in boosting the market growth in this region. Moreover, government-driven vision care promotional activities and awareness programs for eye health are poised to drive long-term market growth.

Recent Developments

- August 2024 – Cooper Companies announced a revenue increase, with its contact lens division surpassing expectations, leading to an upward revision in annual profit forecasts.

- July 2024 – UK researchers received a USD 2.604 million grant to develop a "bandage" contact lens designed to aid in eye damage repair using corneal epithelial cells.

- June 2024 – Bausch + Lomb launched INFUSE for Astigmatism daily disposable lenses in the U.S., enhancing its product lineup for astigmatic patients.Bottom of Form

Buy a Single-User PDF of Soft Contact Lenses Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/5640

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Soft Contact Lenses Market by Material

8. Soft Contact Lenses Market by Design

9. Soft Contact Lenses Market by Usage

10. Soft Contact Lenses Market by Application

11. Soft Contact Lenses Market by Distribution Channel

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.