Austin, July 01, 2025 (GLOBE NEWSWIRE) -- Fusion Splicer Market Size & Growth Insights:

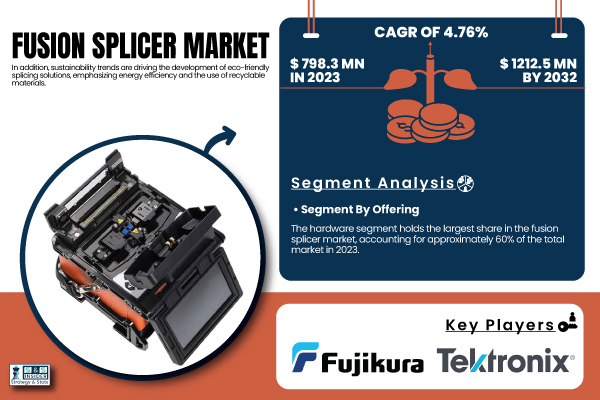

According to the SNS Insider Report, “The Fusion Splicer Market was valued at USD 798.3 Million in 2023 and is projected to reach USD 1212.5 Million by 2032, growing at a CAGR of 4.76% from 2024 to 2032.”

Fiber Infrastructure Boom and 5G Rollout Powering Fusion Splicer Market

The global fusion splicer market is growing, due to the increase in fiber to the home (FTTH) requirement. This boom is also augmented by government spending in high speed broadband, especially in the emerging markets. Improvements in splicing technology have placed a greater focus on cost effectiveness, which has resulted in fusion splicers becoming affordable for companies of all sizes. Sustainability The trend for sustainable solutions is also evolving product development by itself, featuring energy-efficient and recyclable solutions. Furthermore, with the increasing complications in fiber optic network deployments, the requirement for splicers is ever increasing. In the U.S., the market was valued at USD 185.43 million in 2023 and is projected to reach USD 220.34 million by 2032, reflecting consistent demand across industries.

Get a Sample Report of Fusion Splicer Market @ https://www.snsinsider.com/sample-request/6530

Leading Market Players with their Product Listed in this Report are:

- Fujikura (Japan)

- Sumitomo Electric (Japan)

- Tektronix (USA)

- Huawei (China)

- Fiberhome (China)

- Ribbon Communications (USA)

- Corning (USA)

- Yokogawa Electric (Japan)

- Optotec (Italy)

- Nokia (Finland)

- Nexans (France)

- 3M (USA)

- Northrop Grumman (USA)

- INNO Instrument (South Korea)

- Furukawa Electric Co. Ltd. (Japan)

- Fiberfox (China)

- Comway Technology LLC (USA)

- Multicom Inc. (USA)

- Emerson Electric Co. (USA)

- China Electronic Technology Instruments Co. Ltd. (China).

Fusion Splicer Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 798.3 Billion |

| Market Size by 2032 | USD 1212.5 Billion |

| CAGR | CAGR of 4.76% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software & Services) • By Alignment Type (Core Alignment, Cladding Alignment) • By Application (Telecommunication, Cable TV, Enterprise, Aerospace & Defense, Specialty) |

Purchase Single User PDF of Fusion Splicer Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6530

Key Industry Segmentation

By Offering

The hardware segment dominated the fusion splicer market in 2023, accounting for around 60% of the total share, owing to high demand for high-performance splicing machines that are required in fiber optics installations. Hardware features such as electrodes and fiber holders guarantee accuracy and low splice loss, for reliability - vital for the roll-out of 5G and expansion of FTTH.

The software segment is expected to grow rapidly through 2032, driven by higher adoption of advanced functionalities including automation, real-time monitoring, and data management, to improve the splicing efficiency and accuracy.

By Alignment Type

In 2023, the core alignment segment held the largest share of the fusion splicer market at approximately 69%, due to its high accuracy, and low splice loss and is suitable for critical applications, such as telecommunications and FTTH. They provide precision alignment and replacement of the microfibers, which enables solution-based off-the-shelf components.

The cladding alignment segment is projected to grow fastest from 2024 to 2032, as it provides a cost-effective solution for low-complexity splicing tasks and, as results, it is becoming more popular in price-sensitive and emerging markets-where ultra-high precision is not a must.

By Application

In 2023, the telecommunications segment led the fusion splicer market with about 41% of total revenue, owing to surge in demand for high-speed internet and global 5G and FTTH deployments. Low-Loss, High-Performance Fiber Connections for Telecom Fusion splicing provides t he l ow-loss, high-performance, fibres needed to be deployed in telecom networks.

From 2024 to 2032, the cable TV and enterprise segments are projected to grow significantly driven by HD/4K content delivery and enterprise demand for fast, secure communications, core alignment is the necessary splicing method for ENCORE to ensure connection quality.

North America Leads While Asia-Pacific Emerges as Fastest-Growing Fusion Splicer Market

In 2023, North America held the largest share of the fusion splicer market at approximately 40%, owing to the well-established telecommunication infrastructure that resulted to a higher penetration of 5G and FTTH services. The fact that reliable, high-speed connectivity is in high demand in the region, combined with investments being made in broadband connectivity and major market players in the region highlight its prominence.

The Asia-Pacific region is poised to witness the fastest growth from 2024 to 2032, driven by strong China, Indian and South-East Asian telecom infrastructure build-out. Increasing demand for high-speed internet, 5G deployment, growing deployments of FTTH, and the surge in digital infrastructure investment, are anticipated to fuel strong demand for fusion splicing solutions in the region.

Do you have any specific queries or need any customized research on Fusion Splicer Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6530

Recent Developments:

- In Aug 2024, Fujikura has launched the advanced 45S Fusion Splicer, featuring simultaneous fiber preparation and dual heating technology for 30% faster splicing. 30% faster splicing. Its AI-assisted accuracy, Splice+ app functionality, and ease-of-use features makes it a sure contender for the most popular fiber-optic network deployment solution.

- In March 2025, Sumitomo Electric and 3M signed an agreement to offer EBO fiber interconnects for scalable, high-performance data centers. The link-up brings together 3M’s EBO technology with the fusion splicing know-how of Sumitomo producing fast, long-life connectivity.

Table of Contents - Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Fusion Splicer Market, by Offering

8. Fusion Splicer Market, by Alignment Type

9. Fusion Splicer Market, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.