Austin, June 27, 2025 (GLOBE NEWSWIRE) -- NAND Flash Market Size & Growth Insights:

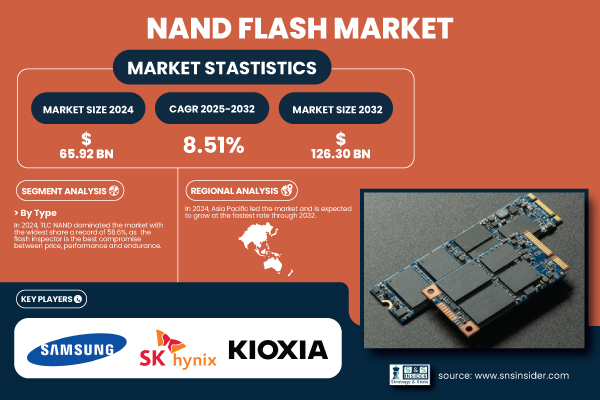

According to the SNS Insider,“The NAND Flash Market size was valued at USD 65.92 billion in 2024 and is expected to reach USD 126.30 billion by 2032, growing at a CAGR of 8.51% over the forecast period 2025-2032.”

Surge in NAND Flash Demand Driven by AI, 5G, and High-Performance Storage Needs

The NAND Flash market is witnessing robust growth, fueled by surging demand for high-performance, energy-efficient storage across smartphones, data centers, and SSDs. The rapid expansion of AI, 5G, and IoT ecosystems is driving the need for smarter, denser, and faster memory solutions. Technologies like 3D NAND and QLC architecture are enhancing storage capacity, speed, and reliability while reducing power consumption and cost per bit. In 2024, global NAND shipments exceeded 400 billion GB, with over 85% based on 3D NAND, reflecting strong industry adoption. Average smartphone NAND density has reached 256 GB, with premium models offering 512 GB+. Additionally, growth in edge computing, automotive electronics, and enterprise storage systems, along with continued innovation in fabrication and packaging, are accelerating market momentum.

Get a Sample Report of NAND Flash Market Forecast @ https://www.snsinsider.com/sample-request/3874

Leading Market Players with their Product Listed in this Report are:

- Samsung

- SK hynix

- Kioxia

- Western Digital

- Micron

- Intel

- YMTC

- ADATA

- Kingston

- Corsair

NAND Flash Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 65.92 Billion |

| Market Size by 2032 | USD 126.30 Billion |

| CAGR | CAGR of 8.51% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Type (SLC (One Bit Per Cell), MLC (Two Bit Per Cell), TLC (Three Bit Per Cell), QLC (Quad Level Cell)) • By Structure (2-D Structure, 3-D Structure) • By Application (Smartphone, SSD, Memory Card, Tablet, Other Applications) |

Purchase Single User PDF of NAND Flash Market Report (20% Discount) @ https://www.snsinsider.com/checkout/3874

Key Industry Segmentation

By Type

In 2024, TLC NAND held the largest market share at 58.6%, favored for its balance of price, performance, and endurance, making it ideal for smartphones, laptops, and data center SSDs. Its proven reliability and wide availability support its continued dominance.

From 2025 to 2032, QLC NAND is projected to witness the highest CAGR, driven by increasing demand for high-capacity, cost-effective storage. Offering greater data density by storing four bits per cell, QLC is gaining traction in AI workloads, edge computing, and cold storage within hyperscale data centers.

By Structure

2D NAND remains a vital segment, projected to grow at the highest CAGR from 2025 to 2032, driven by demand in cost-sensitive applications like embedded systems, USB drives, and industrial electronics. Its simple architecture, low cost, and stable performance make it ideal for reliable memory in mature nodes. Advancements in controllers are further expanding its role in emerging markets

By Application

In 2024, smartphones held 38.0% of the NAND flash market, driven by rising demand for high-capacity, high-performance storage to support 5G, AI features, high-resolution cameras, and rich multimedia. This demand has led to wider adoption of TLC and UFS-based NAND modules.

From 2025 to 2032, SSDs are expected to grow fastest, fueled by expanding data center, cloud, and AI-driven workloads.

Global Regional Trends Shaping the Future of the NAND Flash Market

In 2024, Asia Pacific dominated the NAND flash market with a 43.6% share and is set to grow at a 9.03% CAGR through 2032, driven by strong semiconductor manufacturing, rising device demand, and supportive government policies—especially in China.

North America benefits from AI, data centers, and cloud expansion, led by the U.S.’s advanced semiconductor ecosystem.

Europe’s steady growth is fueled by applications in EVs, ADAS, and industrial automation. Latin America and the Middle East & Africa are gaining traction through increased digitalization, mobile device adoption, e-commerce, and smart city projects, supported by growing cloud demand and government-driven digital transformation. These regional developments collectively propel the global NAND flash market forward.

Do you have any specific queries or need any customized research on NAND Flash Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/3874

Recent News:

- In June 2025, Legacy NAND Shortage Triggers Price Spike, Boosting Profits for Chipmakers Legacy NAND flash prices have surged sixfold due to supply shortages, allowing chipmakers like Macronix to profit from discontinued older chips, mirroring the DDR4 phase-out crunch.

- In Feb 2025, NAND Flash Prices Fall Sharply as Supply Glut Forces Production CutsNAND flash prices are plunging due to oversupply and weak PC and smartphone demand, prompting chipmakers to cut factory output and realign production with shrinking forecasts.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. NAND Flash Market Segmentation, by Type

8. NAND Flash Market Segmentation, by Structure

9. NAND Flash Market Segmentation, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.