Pune, June 26, 2025 (GLOBE NEWSWIRE) -- Server Market Size Analysis:

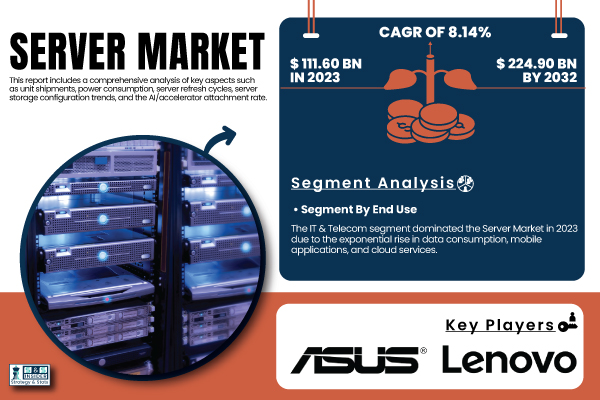

“The SNS Insider report indicates the Server Market size was valued at USD 111.60 billion in 2023 and is estimated to reach USD 224.90 billion by 2032, growing at a compound annual growth rate (CAGR) of 8.14% between 2024 and 2032.”

The U.S. Server Market was valued at USD 30.6 billion in 2023 and is projected to reach USD 61.7 billion by 2032, growing at a CAGR of 8.09% during 2024–2032.

Growth is driven by expanding cloud infrastructure, AI/ML workloads, and enterprise data center upgrades. Future demand will rise from edge computing, 5G deployment, and federal investments in secure digital infrastructure.

Get a Sample Report of Server Market@ https://www.snsinsider.com/sample-request/6580

Major Players Analysis Listed in this Report are:

- ASUSTeK Computer Inc. (ESC8000 G4, RS720A-E11-RS24U)

- Cisco Systems, Inc. (UCS C220 M6 Rack Server, UCS X210c M6 Compute Node)

- Dell Inc. (PowerEdge R760, PowerEdge T550)

- FUJITSU (PRIMERGY RX2540 M7, PRIMERGY TX1330 M5)

- Hewlett Packard Enterprise Development LP (ProLiant DL380 Gen11, Apollo 6500 Gen10 Plus)

- Huawei Technologies Co., Ltd. (FusionServer Pro 2298 V5, TaiShan 2280)

- Inspur (NF5280M6, NF5468A5)

- Intel Corporation (Server System M50CYP, Server Board S2600WF)

- International Business Machines Corporation (Power S1022, z15 T02)

- Lenovo (ThinkSystem SR650 V3, ThinkSystem ST650 V2)

- NEC Corporation (Express5800 R120f-2E, Express5800 T120h)

- Oracle Corporation (Server X9-2, SPARC T8-1)

- Quanta Computer Inc. (QuantaGrid D52BQ-2U, QuantaPlex T42SP-2U)

- SMART Global Holdings, Inc. (Altus XE2112, Tundra AP)

- Super Micro Computer, Inc. (SuperServer 620P-TRT, BigTwin SYS-220BT-HNTR)

- Nvidia Corporation (DGX H100, HGX H100)

- Hitachi Vantara, LLC (Advanced Server DS220, Compute Blade 2500)

Server Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 111.60 Billion |

| Market Size by 2032 | US$ 224.90 Billion |

| CAGR | CAGR of 8.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Segments | • By Product (Rack, Blade, Tower, Micro, Open Compute Project) • By Channel (Direct, Reseller, Systems integrator, Others) • By End Use (IT & Telecom, BFSI, Government & Defense, Healthcare, Energy, Others) |

| Key Growth Drivers | Rising demand for data centers and cloud computing is significantly driving the expansion of the global server market landscape |

Do you have any specific queries or need any customization research on Server Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/6580

By Product: Rack Segment Dominated, Open Compute Project Fastest Growing

The rack server segment held the largest market share of more than 51% in 2023 due to its versatility, space efficiency, and traditional usage across a broad range of data centers. Rack servers, the backbone of cloud data centers with high-density setups, modular upgrades, and easy maintenance.

The Open Compute Project is poised for the fastest growth during 2024–2032, with enterprises and hyperscale providers converging on open-source hardware standards. Ideal for their efficiency, flexibility, and affordability, OCP servers are quickly being adopted for modern data centers where rapid customization and deployment are essential.

By Channel: Direct Dominated, Reseller, Fastest Growing

Direct segment dominated the server market in 2023 and accounted for 44% of revenue share in 2023, mainly by big enterprises with custom configuration, long-term contract, and OEM technical support in a direct manner. This channel provides improved pricing, security , and service contracts.

The reseller segment is expected to witness the highest CAGR from 2024–2032, owing to increased traction from SMEs for bundled services, value-added solutions, and localized support. Resellers also serve as an important link between global OEMs and regional end-users by providing integration and after-sales services.

By End Use: IT & Telecom Dominated, BFSI Fastest Growing

Due to the enormous server deployments necessary to enable cloud infrastructure, network virtualization, and digital communication platforms, the IT & Telecom sector held the largest market share in 2023 and prevailed in revenue share. These sectors require scalable computing power to process large volumes of customer data, onboarding, and real-time traffic.

The BFSI segment is expected to grow at the fastest CAGR during 2024–2032, driven by digital banking, financial transactions over the internet, and the increasing need for cybersecurity. To provide secure access to data around the clock, financial institutions are going for exclusive server investments, enabling exceptional server performance and real-time processing.

Buy an Enterprise-User PDF of Server Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/6580

Regional Insights: North America Dominated, Asia-Pacific Fastest Growing

North America dominated the server market in 2023 and accounted for a significant revenue share, owing to the large cloud providers, strong IT infrastructure, along high data centre density of the U.S. and Canada. There are also government digitization initiatives and, of course, the tech-driven enterprises, which further strengthen the demand.

Asia-Pacific is forecast to register the highest CAGR during 2024–2032. The growth in the region is driven by digital transformation in developing countries, 5G rollout, and hyperscale data centre expansions, primarily in China, India , and Southeast Asia.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.