Pune, June 24, 2025 (GLOBE NEWSWIRE) -- IoT Insurance Market Size Analysis:

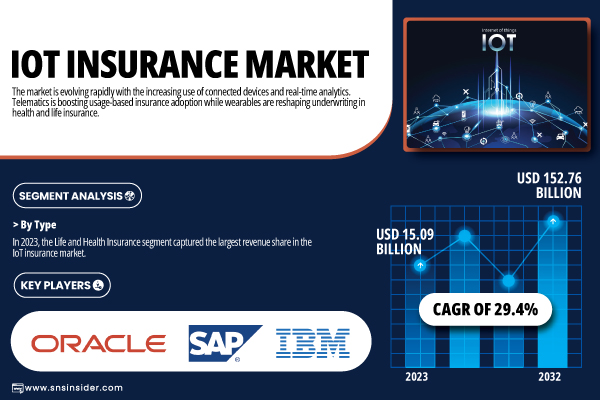

“According to SNS Insider, the global IoT Insurance Market was valued at USD 15.09 billion in 2023, expected to surge to USD 152.76 billion by 2032, with a CAGR of 29.4% from 2024 to 2032.”

The U.S. IoT Insurance Market was valued at USD 4.14 billion in 2023 and is projected to reach USD 35.8 billion by 2032. Growth is driven by high adoption of telematics, smart home devices, and wearable health tech in insurance applications.

The market is expected to grow at a CAGR of 27.13% (2024–2032), fueled by AI integration and demand for personalized, data-driven policies.

Get a Sample Report of IoT Insurance Market@ https://www.snsinsider.com/sample-request/6558

Major Players Analysis Listed in this Report are:

- Oracle Corporation (Oracle Insurance Policy Administration, Oracle IoT Cloud)

- SAP SE (SAP Leonardo IoT, SAP S/4HANA for Insurance)

- IBM Corporation (IBM Watson IoT Platform, IBM Cloud for Insurance)

- Microsoft Corporation (Azure IoT Hub, Microsoft Cloud for Financial Services)

- Intel Corporation (Intel IoT Platform, Intel SDO (Secure Device Onboard))

- Telit Communications PLC (Telit IoT Platform, Telit deviceWISE for Insurance Telematics)

- Capgemini SE (Capgemini Insurance Connect, Capgemini IoT Solutions for Insurers)

- Cognizant (Cognizant Intelligent Insurance Operations, Cognizant IoT Assurance Platform)

- Cisco Systems Inc. (Cisco Kinetic for Insurance IoT, Cisco IoT Threat Defense)

- Accenture PLC (Accenture Connected Insurance Platform, Accenture IoT Insights)

- Verisk Analytics Inc. (AIR Worldwide [catastrophe risk modeling], Verisk Telematics for Usage-Based Insurance)

- Wipro Limited (Wipro HOLMES IoT, Wipro Insurance Analytics Suite)

- Google LLC (Google Cloud IoT Core, Google Cloud for Insurance)

- Synechron, Inc. (Synechron InsurTech Accelerator, Synechron IoT-Driven Insurance Solutions)

IoT Insurance Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 15.09 Billion |

| Market Size by 2032 | US$ 152.76 Billion |

| CAGR | CAGR of 29.40 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Segments | • By Component (Solution, Services) • By Type (Life and Health Insurance, Property and Casualty Insurance, Others) • By End-use (Automotive and Transportation, Healthcare, Agricultural, Retail and Commercial, Others) |

| Key Growth Drivers | Increasing Adoption of Connected Devices Across Insurance Sectors Drives Growth of the IoT Insurance Market |

Do you have any specific queries or need any customization research on IoT Insurance Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/6558

By Component: Solutions Dominate While Services Drive Implementation Growth

The solutions segment dominated the IoT Insurance Market in 2023 and accounted for 66% of revenue share. Insurers need an integrated platform to collect data, generate real-time analytics, and perform risk modeling. Telematics systems, wearable trackers, and AI-powered dashboards that assist in dynamic underwriting and predictive claims are among them. Insurers need to focus on digital transformation and hence, scalable, module-wise IoT solutions.

The services segment is expected to register the fastest CAGR during the forecast period, due to the composition of services like consulting, integration, and support. This growth is further propelled by the increasing number of requests for customized implementation and analytics carried out after the deployment. In such markets, there is also a need for expertise in getting IoT frameworks aligned with existing IT systems amongst most SMEs. These two segments together form an important part of scaling IoT insurance capabilities around the globe.

By Type: Life & Health Insurance Leads While Property & Casualty Accelerates Rapidly

Life & Health Insurance segment dominated the market in 2023 and accounted for a significant revenue share, due to its high adoption of wearable devices and mobile health tracking, which helps to collect real-time health-related data. This data is used by insurers for personalized policies and early risk detection, thereby improving underwriting accuracy and enabling preventive care initiatives. The demand in this category is fueled by growing wellness-driven incentives as well as the aging population.

Property & Casualty Insurance is the fastest-growing type, through such proactive alerts and incident prevention, these technologies tend to reduce the risks associated with insurance claims. Rising urban IoT infrastructure and demand around sensor-integrated insurance further support strong, dynamic, and sensor-enabled risk assessments in the personal and commercial property line of business, which is driving healthy market momentum.

By End-use: Automotive & Transportation at the Forefront, Healthcare Gaining Pace

The Automotive & Transportation sector dominated the market in 2023 and accounted for 27% of revenue share, supported by the IoT insurance ecosystem resulting from the adoption of telematics, along with vehicle tracing and driver behavior monitoring. The main idea behind UBI is to stimulate safe driving because low claim frequency is always the best scenario. Even Fleet operators take advantage of real-time data to reduce operational risk.

The Healthcare sector is witnessing the fastest growth due to enhanced utilization of connected health wearables, remote monitoring devices, and wellness apps. These tools enable insurers to better measure health risk and to provide preventive plans. While digitization may have taken a backseat at the time, the appetite for data-centric and personalized insurance coverage is marking an upward growth curve with each passing day that passes.

Buy an Enterprise-User PDF of IoT Insurance Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/6558

By Region: North America Leads the Market with Strong Infrastructure and Adoption

North America dominated the market in 2024 with 38% of revenue share in 2023, supported by well-established digital infrastructure, early telematics adoption, and strong partnership between insurers and tech. Connected devices allow U.S. and Canadian insurers to price auto, health, and property coverage to a level of detail never possible before.

Asia-Pacific registers the fastest CAGR owing to the rapid urbanization, increasing method of wearable usage, and expanding insurtech ecosystems in the region. The government in countries such as China, India, and Japan is investing in smart city projects and digital healthcare, creating an ecosystem that enables IoT-based insurance models. demand for preventive coverage and government policies that are friendly, you know, all of which are favoring the growth in this market. Both regions are a model for how advancing technology and digital inclusion inform the future of insurance around the world.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.