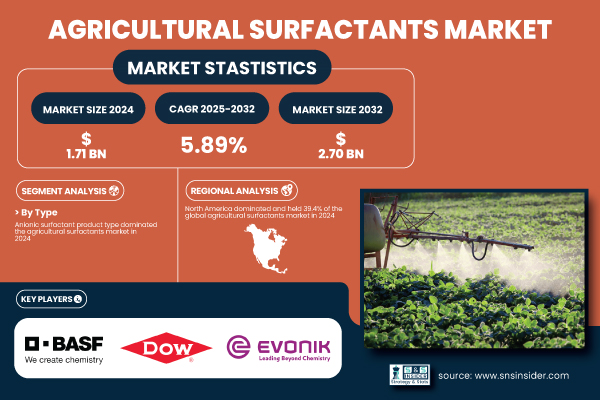

Austin, June 18, 2025 (GLOBE NEWSWIRE) -- The global agricultural surfactants market was valued at USD 1.71 billion in 2024 and is projected to reach USD 2.70 billion by 2032, growing at a compound annual growth rate (CAGR) of 5.89% from 2025 to 2032.

The growth is a result of increasing global demand for effective and sustainable practices in agriculture. The rising population worldwide worsens the demand to enhance crop productivity to feed the world. Application of agrochemicals such as herbicides, insecticides, and fungicides are gaining popularity within farmers making them seek surfactants that will improve the application of these products. These additives allow agrochemicals to spread on plant surfaces, stick to them well, penetrate deep into the plant for maximum absorption and minimum wastage. In addition, the growing adoption of precision farming & integrated pest management techniques will also drive the market for the surfactants that improve the activity of agrochemicals.

Download PDF Sample of Agricultural Surfactants Market @ https://www.snsinsider.com/sample-request/7404

The U.S is dominating the North American agricultural surfactants market with the largest market share of approximately 60% and a market value of USD 402.66 million.

It is due to the U.S. having several market participants operating in the agrochemical and surfactant manufacturing space that helps provide market accessibility to superior quality products and to fuel the innovation of surfactant formulations. The prevalence of surfactant-rich agrochemicals that are often used on a large scale for the agricultural production of commodities like corn, soybeans, and wheat exacerbates the situation.

Key Players:

- BASF SE

- Dow Inc.

- Evonik Industries AG

- Clariant AG

- Solvay S.A.

- Croda International Plc

- Stepan Company

- Huntsman Corporation

- Helena Agri-Enterprises, LLC

- Nufarm

Agricultural Surfactants Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 1.71 billion |

| Market Size by 2032 | USD 2.70 billion |

| CAGR | CAGR of 5.89% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • Extensive Adoption of Precision Farming Technologies Necessitates Specialized Surfactant Integration. • EPA’s 2024 PFAS Detection Method Elevates Surfactant Safety Compliance in Packaging Operations. |

If You Need Any Customization on Agricultural Surfactants Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7404

Market Segmentation

By Type

Anionic surfactants dominated the agricultural surfactants market in 2024. The primary reason behind the market leadership of anionic surfactants on the agricultural surfactants market in 2024 is their superior wetting and spreading properties. The ability to break the surface tension of water makes these surfactants useful for pesticides, herbicides, and fungicides, as they can be spread more evenly and stick closer to plants of various kinds.

By Substrate Type

Synthetic surfactants led the agricultural surfactants market with a share of 68.7% in 2024. It is due to their cost-effectiveness, availability, and high performance across a wide range of agricultural applications. These surfactants are chemically constructed and have functionalizing features that offer stable performance and high solubility, stability, and compatibility in a wide range of agrochemical formulations, including herbicides, insecticides, and fungicides.

By Application

The herbicide segment accounted for the largest market share in 2024 at 49.6%, as herbicides are widely used across cereals, grains, and oilseeds to combat weed growth. Surfactants improve the penetration and absorption of herbicides in plant tissues, enhancing their efficacy and reducing the need for repeated applications.

Regional Analysis

In 2024, North America accounted for the largest share of the global agricultural surfactants market, 39.4%, which can be attributed to the advancement of agricultural practices, high use of agrochemicals, and the presence of the majority of key players who are actively engaged in the agriculture industry. The crop farming environments in the region, primarily in countries such as the U.S. and Canada, are vast, thereby, creating the need for cost-effective and efficient crop protection products, which is further creating demand for various types of surfactants that are used in pesticides, herbicides, and fertilizers for their excellence in performance. Moreover, the rising adoption of precision agriculture technologies has led to higher usage of adjuvants like surfactants to improve the efficiency of input utilization and to reduce the adverse environmental effects of agricultural inputs.

Recent Developments

- In May 2025, BASF SE launched a series of bio-based agricultural surfactants through its AgBalance initiative, which helps drive sustainable agriculture by enhancing pesticide efficacy and minimizing environmental impact.

- In January 2025, Evonik Industries AG expanded its agricultural surfactant manufacturing facility in Mobile, Alabama, USA by 30%, largely responding to environments fuelled by growing agricultural soap demand in the North America and Latin America markets.

Buy Full Research Report on Agricultural Surfactants Market 2025-2032 @ https://www.snsinsider.com/checkout/7404

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.