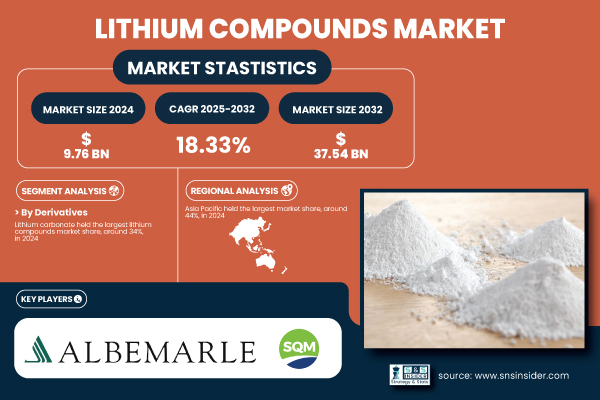

Austin, June 17, 2025 (GLOBE NEWSWIRE) -- The Lithium Compounds Market Size was valued at USD 9.76 billion in 2024 and is expected to reach USD 37.54 billion by 2032, growing at a CAGR of 18.33% over the forecast period of 2025-2032.

Global Lithium Compound Demand Surges Amid Battery Adoption, Supply Chain Expansion, and Strategic Mineral Policy Support

The Lithium Compounds market is expanding rapidly, driven by rising demand from EV batteries, pharmaceuticals, and personal care. Global lithium production grew from 204,000 t in 2023 to 240,000 t in 2024, reflecting an 18% surge. The U.S. saw EV sales nearly double from 2021 to 2022, boosting domestic demand. USGS reported a 21% rise in non-U.S. lithium output in 2022. Favorable U.S. policies supporting critical minerals further enhance supply chain resilience, propelling the market toward significant growth through 2032.

Download PDF Sample of Lithium Compounds Market @ https://www.snsinsider.com/sample-request/7135

The U.S. Lithium Compounds market is valued at USD 1.69 billion in 2024 and is expected to reach USD 7.19 billion by 2032 and grow at a CAGR of 19.84% over the forecast period of 2025-2032.

The US Lithium Compounds market is expanding due to the EV battery supply chain boosting, driven by the Inflation Reduction Act incentives and the USGS identification of vast domestic reserves. Companies like Livent and Lithium Americas are scaling up extraction and processing capacity to meet growing demand.

Key Players:

- Albemarle Corporation

- SQM

- Ganfeng Lithium Co., Ltd.

- Livent Corporation

- Tianqi Lithium Corporation

- Nemaska Lithium

- Lithium Americas Corp.

- Mineral Resources Limited

- Orocobre Limited (Allkem)

- AMG Lithium

Lithium Compounds Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 9.76 Billion |

| Market Size by 2032 | USD 37.54 Billion |

| CAGR | CAGR of 18.33% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • Growing Use of Lithium Compounds in Consumer Electronics and Mobile Devices Drives the Market Growth. |

If You Need Any Customization on Lithium Compounds Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7135

By Derivatives, the Lithium Carbonate Segment dominated the Lithium Compounds Market in 2024 with a 34% Market Share.

The dominance stems from widespread use as a primary precursor in lithium-ion battery cathode formulations such as NMC and LFP, essentials in EV mass production. Government and industry sources note a 21–18% increase in lithium production from 2022 to 2023–24 to meet battery-grade carbonate demand. Major producers like Albemarle, SQM, and Livent are expanding brine and spodumene operations in Argentina and Australia while investing in North American processing facilities to ensure feedstock supply. USGS data underscores battery use driving over 70% of lithium use globally. Hence, lithium carbonate’s central role in the global battery supply chain secures its market share leadership.

By End Use Industry, Li-ion Batteries dominated the Lithium Compounds Market in 2024 with a 26% Market Share.

Li-ion batteries led the Lithium Compounds market in 2023 due to rising EV adoption and grid storage needs. U.S. EV sales nearly doubled from 2021 to 2022, while global lithium consumption surged 29% in 2024. Battery-grade lithium carbonate and hydroxide are crucial for NMC and LFP cathodes. Major producers across China, Europe, and North America are expanding cathode plants. Strategic investments from automakers and battery firms continue to boost lithium compound demand, solidifying Li-ion batteries’ market dominance.

By Region, Asia Pacific dominated the Lithium Compounds Market in 2024, Holding a 44% Market Share.

Asia Pacific dominated the Lithium Compounds market in 2023 due to abundant lithium resources and major investments in battery and cathode production, especially in China, Japan, and South Korea. Regional governments support EV growth through subsidies and infrastructure. The region accounts for over 70% of global lithium-ion battery capacity and 34% of lithium carbonate demand, per USGS. Leading players like CATL, Panasonic, and LG Energy Solution drive a strong local supply chain from refining to application. China’s dominance in supply and demand solidifies the region’s market leadership.

Recent Developments

• In April 2025, Pure Lithium partnered with Kingston Process Metallurgy to scale its lithium metal anode production, aiming to validate its Brine to Battery process for future pilot and commercial applications.

Buy Full Research Report on Lithium Compounds Market 2025-2032 @ https://www.snsinsider.com/checkout/7135

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.