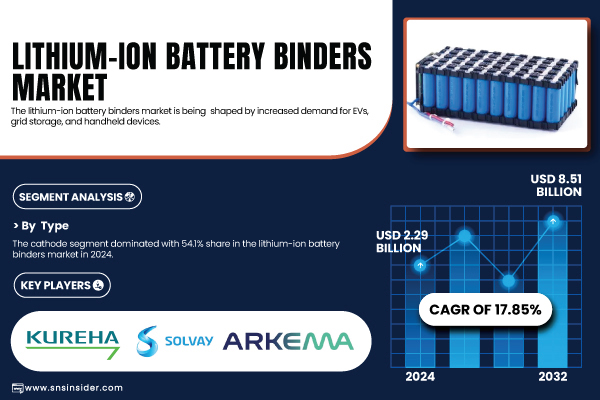

Austin, June 16, 2025 (GLOBE NEWSWIRE) -- The Lithium-ion Battery Binders Market Size was valued at USD 2.29 billion in 2024 and is expected to reach USD 8.51 billion by 2032, growing at a CAGR of 17.85% over the forecast period of 2025-2032.

Surging Battery Innovation and Sustainability Push Binder Technologies into the Spotlight Across EV and Energy Sectors

The Lithium-ion Battery Binders Market is witnessing robust growth due to rising EV adoption, energy storage needs, and environmental mandates. Between 2022 and 2024, the U.S. Department of Energy committed over USD 2.8 billion to boost domestic binder manufacturing. A shift toward water-based binders and investments by Solvay and BASF in advanced PVDF and SBR materials highlight this trend. With production volumes projected to surge 160% by 2030, the market is poised for significant expansion through the decade.

Download PDF Sample of Lithium-ion Battery Binders Market @ https://www.snsinsider.com/sample-request/7220

The U.S. Lithium-ion Battery Binders market is worth USD 333.9 million in 2024, and with a market share of 71%.

The US Lithium-ion Battery Binders market is growing swiftly, driven by EV incentives under the Inflation Reduction Act and innovations from firms like 3M and Celanese in PVDF-based binders, enhancing battery performance, energy density, and lifespan, while expanding applications across electric vehicles, electronics, and energy storage systems.

Key Players:

- KUREHA CORPORATION

- ZEON CORPORATION

- Solvay

- Arkema

- Synthomer PLC

- DAIKIN INDUSTRIES, Ltd.

- Asahi Kasei Corporation

- Sumitomo Chemical Co., Ltd.

- Mitsui Chemicals, Inc.

- UBE Industries Ltd.

Lithium-ion Battery Binders Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 2.29 billion |

| Market Size by 2032 | USD 8.51 billion |

| CAGR | CAGR of 17.85% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • Surging Federal Investments in Domestic Battery Supply Chains Enhance Market Competitiveness. • Rapid Electric Vehicle Adoption Fuels Demand for Advanced Binder Materials. |

If You Need Any Customization on Lithium-ion Battery Binders Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7220

By Type, Cathode dominated the Lithium-ion Battery Binders Market in 2024 with a 54.1% Market Share.

The dominance is driven by the increasing demand for higher energy density lithium-ion batteries, especially in electric vehicles and portable electronics. Cathode binders improve mechanical stability and electrochemical performance, critical for high-capacity batteries. Companies like BASF and Arkema have introduced innovative cathode binder solutions that enhance battery cycle life and safety. The growing focus on nickel-rich cathodes in EV batteries further boosts cathode binder demand, reinforcing this segment's dominance.

By Material, Polyvinylidene fluoride (PVDF) dominated the Lithium-ion Battery Binders Market in 2024 with a 39.5% Market Share.

This dominance is attributed to PVDF’s excellent chemical resistance, thermal stability, and strong adhesion properties. PVDF is widely preferred in battery manufacturing for its ability to maintain electrode integrity during charge-discharge cycles. Leading battery manufacturers such as Tesla and LG Energy Solution rely heavily on PVDF-based binders in their lithium-ion batteries. Continuous R&D efforts on PVDF copolymers are expanding its application scope, supporting this segment’s leadership.

By Application, the Electric Vehicles (EV) dominated the Lithium-ion Battery Binders Market in 2024 with a 47.6% Market Share.

The surge is fueled by accelerating EV adoption worldwide. The demand for durable, high-performance batteries has increased the requirement for advanced binders to improve battery safety and lifecycle. Automakers such as Ford and General Motors have scaled up EV production, driving binder demand. Additionally, federal subsidies and emission regulations encourage EV uptake, positioning this segment as the largest in the lithium-ion battery binders market.

By Region, Asia Pacific dominated the Lithium-ion Battery Binders Market in 2024, Holding a 48.2% Market Share.

The region’s leadership stems from its role as a global manufacturing hub for lithium-ion batteries, with China, Japan, and South Korea hosting major battery producers like CATL, Panasonic, and LG Chem. These countries invest heavily in binder R&D to enhance battery performance for electric vehicles and consumer electronics. Favorable government policies, infrastructure development, and a growing EV market have further accelerated binder consumption. The presence of raw material suppliers and competitive manufacturing costs also bolster Asia Pacific’s market dominance.

Recent Developments

• In June 2025, BASF expanded U.S. production of Licity anode binders to enhance EV battery performance and strengthen its local supply chain.

Buy Full Research Report on Lithium-ion Battery Binders Market 2025-2032 @ https://www.snsinsider.com/checkout/7220

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.