Austin, May 30, 2025 (GLOBE NEWSWIRE) -- ALD Equipment Market Size & Growth Insights:

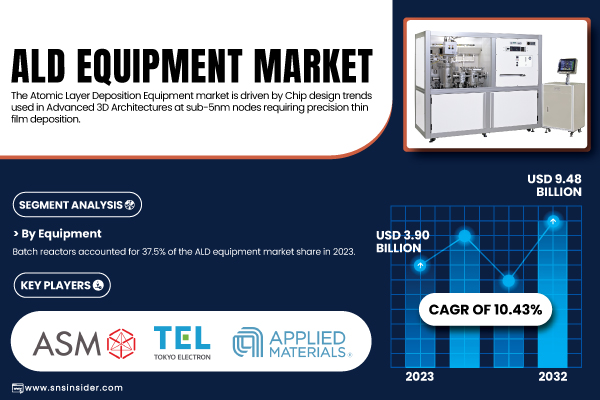

According to the SNS Insider,“The ALD Equipment Market Size was valued at USD 3.90 Billion in 2023 and is expected to reach USD 9.48 Billion by 2032 and grow at a CAGR of 10.43% over the forecast period 2024-2032.”

Increasing Demand for Advanced Semiconductor Technologies Fuels ALD Equipment Market Growth

The Atomic Layer Deposition (ALD) equipment market is rapidly expanding is growing because of the increasing requirement for newer more advanced semiconductor nodes, 3-D packaging as well as for miniaturization of chips. ALD allows for extremely thin film deposition for advanced device scaling and high aspect ratio for 3D structures, such as those found in NAND and FinFETs. It is being driven by high utilizations in the corporate fab and heavy investments in foundry expansions ranging from CHIPS Act to semiconductor development in Asia and Europe. Currently being pursued is the applications of ALD to novel technologies such as MEMS, sensors, and quantum computing.

Get a Sample Report of ALD Equipment Market Forecast @ https://www.snsinsider.com/sample-request/6689

Asia Pacific Leads ALD Equipment Market While North America Poised for Rapid Growth

In 2023, Asia Pacific accounted for 42.5% of the ALD equipment market, due to region’s dominance in the semiconductor industry with large foundries and chipmakers such as TSMC, Samsung, SMIC, investing significantly in the advanced deposition processes. Resolving the next-generation nodes of 5nm and 3nm for FinFET and the GAA transistor-type nodes would not be possible without ALD tools for material deposition control.

North America is expected to witness the fastest growth from 2024 to 2032, buoyed by rising investment in domestic semiconductor industry. The U.S. CHIPS and Science Act is driving earlier new fab ramps, and new fab build outs, with the investments in ALD tools by companies such as Intel and Global Foundries.

ALD Equipment Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 3.90 Billion |

| Market Size by 2032 | USD 9.48 Billion |

| CAGR | CAGR of 10.43% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Equipment (Batch reactors, Single-wafer reactors, Spatial ALD reactors, Remote plasma ALD reactors) • By Deposition Method (Plasma Enhanced ALD, Thermal ALD, Spatial ALD, Power ALD, Others) • By Film Type (Metal film, Oxide film, Sulfide film, Nitride film, Fluoride film) • By Application (Computing sector, Data centers, Consumer electronics, Healthcare and biomedical, Automotive, Energy & power) |

Purchase Single User PDF of ALD Equipment Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6689

Comprehensive Analysis of the ALD Equipment Market by Equipment, Deposition Method, Film Type, and Application

By Equipment

Batch reactors held 37.5% of the ALD equipment market share in 2023 due to their ability to process multiple wafers simultaneously, making them ideal for high-throughput applications like memory device fabrication. They are well-established in semiconductor manufacturing for producing uniform films on many wafers in parallel.

By Deposition Method

Thermal ALD dominated the market in 2023 with a 41.3% share, mainly because it is widely used in the production of semiconductor devices, as well as oxide on memory and logic chips. It is preferred for the traditional high volume applications because of the ease, the high quality conformal films with uniform composition at low temperatures, and the scale-up of the process.

By Film Type

Oxide films held 39.5% of the ALD equipment market in 2023, driven mostly by their critical use in CMOS semiconductor production for gate oxides, passivating layers and dielectrics. Oxides such as alumina (Al 2 O 3 ) and hafnia (HfO 2 ) have been appreciated for their thermodynamic stability, high electrical performance, thermal stability, and conformality and are thus vital for memory, logic, and advanced packaging.

By Application

In 2023, the computing sector dominated the ALD equipment market with a 30.4% share, driven by the rising demand for high-performance processors, GPUs, and memory chips used in servers, PCs, and AI/ML applications. ALD technology is crucial for enabling advanced logic nodes and 3D structures that support faster, smaller, and more efficient computing devices, making this sector a major growth driver for ALD innovations.

Leading Market Players with their Product Listed in this Report are:

- ASM International

- Tokyo Electron Limited

- Applied Materials Inc.

- Lam Research Corporation

- Veeco Instruments Inc.

- Beneq

- Picosun

- Oxford Instruments

- Kurt J. Lesker Company

- CVD Equipment Corporation

- Forge Nano

- Encapsulix

- Ultratech (Division of Veeco)

- SENTECH Instruments

- SÜSS MicroTec

Do you have any specific queries or need any customized research on ALD Equipment Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6689

Recent Developments:

- In Feb 2025, Lam Research launched advanced ALD equipment in Korea for highly accurate thin film deposit in 3D NAND volume production. It uses molybdenum instead of tungsten to enhance semiconductor performance and efficiency in response to AI-focused demand.

- In May 2025, Beneq’s Transform ALD tool qualified for high-volume production of GaN power devices by a leading Asian manufacturer, providing scalable, high-yield GaN applications with advanced plasma-enhanced and thermal ALD processes for best-in-class interface engineering

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. ALD Equipment Market Segmentation, by Equipment

8. ALD Equipment Market Segmentation, by Deposition Method

9. ALD Equipment Market Segmentation, by Film Type

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion