Austin, May 28, 2025 (GLOBE NEWSWIRE) -- Microcarriers Market Size & Growth Analysis:

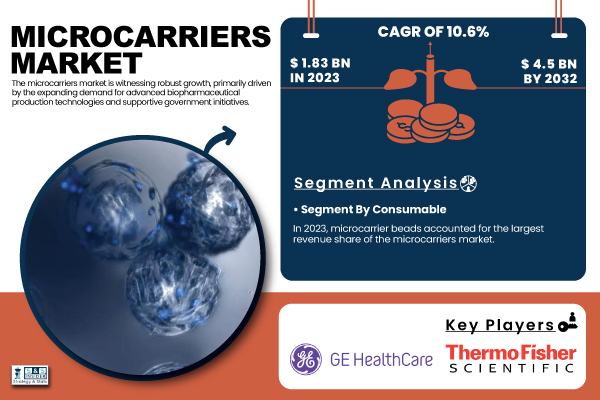

According to recent market analysis, the Global Microcarriers Market size was valued at USD 1.8 Billion in 2023 and is projected to reach USD 4.5 billion by 2032, expected to grow with a significant annual growth rate of 10.6% over the forecast period 2024-2032. The U.S. Microcarriers Market is witnessing robust growth, fueled by rising demand for cell-based vaccines, regenerative medicine, and scalable bioprocessing technologies across the biotech sector.

Get a Sample Report of Microcarriers Market@ https://www.snsinsider.com/sample-request/3837

The microcarriers market is witnessing significant expansion due to the convergence of several key factors.

The market is expanding due to the rising demand for cell-based vaccines and treatments as well as developments in cell culture technologies. The biopharmaceutical industry's focus on developing innovative treatments for chronic diseases, including cancer and autoimmune disorders, has increased the need for efficient large-scale cell production methods. Recent government initiatives and regulatory support have further bolstered market growth. For instance, in May 2024, Sartorius and Sanofi announced a partnership to develop and commercialize a platform for streamlining downstream bioprocessing operations, enhancing efficiency in biopharmaceutical production. This collaboration reflects the industry's commitment to improving microcarrier-based bioprocessing technologies. The U.S. Food and Drug Administration (FDA) has been actively supporting the development of cell and gene therapies, which rely heavily on microcarrier technology. In 2023, the FDA approved several new cell-based therapies, highlighting the growing importance of microcarriers in advanced therapeutic production.

The microcarriers market is poised for substantial growth, driven by technological innovations, increasing demand for biopharmaceuticals, and expanding applications in cell therapy and regenerative medicine. As the industry continues to evolve, collaborations between key players and ongoing research and development efforts are expected to further propel market expansion and innovation in the coming years. The pharmaceutical industry has seen a surge in demand for cell-based therapies, driving the need for efficient microcarrier systems. In 2023, over 362,600 hospitalizations occurred due to infectious diseases, highlighting the urgent need for scalable vaccine production methods. Governments and private organizations are investing heavily in healthcare infrastructure and R&D, creating lucrative opportunities for market players. For instance, the WHO projects that regenerative medicine technologies could reduce global healthcare costs by 15% by 2030, emphasizing the strategic importance of innovations like microcarriers.

Major Players Analysis Listed in this Report are:

- Thermo Fisher Scientific (Dynabeads, Thermo Scientific Microcarrier)

- GE Healthcare (Cytodex, Microcarriers for Cell Culture)

- Merck Group (Millicell, Cellvento)

- Lonza Group (CliniMacs Prodigy, Procell)

- Corning Incorporated (Corning CellBIND, Corning® Microcarrier Beads)

- Cytiva (Gibco™ Microcarriers, Microcarrier Beads)

- FUJIFILM Irvine Scientific (CellMax, Cellartis)

- Roche Diagnostics (Roche Cell Culture, AccuGen)

- Becton, Dickinson and Company (BD) (BD Falcon Microcarriers, BD Cell Gro)

- Sartorius AG (Sartocell, Sartorius Cell Culture Media)

Microcarriers Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.8 billion |

| Market Size by 2032 | US$ 4.5 billion |

| CAGR | CAGR of 10.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segment Analysis

By Application

In 2023, the biopharmaceutical production segment dominated the market and accounted for the largest market share 69%. This growth is propelled by the rising demand for vaccines, monoclonal antibodies, and biosimilars. The global COVID-19 pandemic highlighted the critical need for scalable vaccine production platforms, with microcarriers playing a pivotal role. Advances in microcarrier-based systems, such as single-use bioreactors and advanced cell culture media, are driving efficiencies in biopharmaceutical manufacturing.

By End-User

In 2023, the Pharmaceutical and biotechnology companies segment dominated the market, accounted a 42% revenue share. These organizations are leveraging microcarriers to scale up production processes for cell-based products. Increasing investments in R&D and strategic collaborations between industry players and academic institutions are further bolstering this segment. For example, in 2023, Pfizer announced a $500 million investment in expanding its biologics manufacturing capacity, emphasizing the adoption of microcarrier-based technologies.

Microcarriers Market Segmentation

By Product

- Consumables

- Media

- Serum-based Media

- Serum-free Media

- Other Media

- Reagents

- Microcarrier Beads

- Cationic Beads

- Collagen-coated Beads

- Protein-coated Beads

- Untreated Beads

- Other Microcarrier Beads

- Other Consumables

- Equipment

- Bioreactors

- Single-use Bioreactors

- Stainless-steel Bioreactors

- Culture Vessels

- Filtration and Separation Equipment

- Cell Counters

- Other Equipment

By Cell Type

- Stem Cells

- Hematopoietic Stem Cells (HSCs)

- Mesenchymal Stem Cells (MSCs)

- Induced Pluripotent Stem CELLS (iPSCs)

- Other Stem Cells

- Immune Cells

- T-Cells

- NK Cells

- Other Immune Cells

- Other Cell Types

By Application

- Biopharmaceutical Production

- Vaccine Production

- Therapeutic Production

- Regenerative Medicine

By End-use

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations & Contract Manufacturing Organizations

- Academic & Research Institutes

Buy a Single-User PDF of Microcarriers Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/3837

Regional Analysis

North America dominated the global microcarriers market, accounting for around 45% of revenue share in 2023. The region's leadership is attributed to its advanced healthcare infrastructure, significant investments in biotechnology research, and the presence of major pharmaceutical companies. The U.S. market, in particular, has seen rapid growth due to increased utilization of microcarriers for cell-based vaccine manufacturing and advancements in cell production technologies. In 2023, the U.S. NIH allocated $2.5 billion for biopharmaceutical and regenerative medicine research, creating a conducive environment for market growth. Additionally, the presence of key industry players and advanced manufacturing facilities in the U.S. and Canada ensures a steady supply of innovative microcarrier solutions.

Asia Pacific region is growing with a significant growth rate over the forecast period of 2024-2032. Countries like China, India, and Japan are experiencing significant growth due to increasing investments in the biopharmaceutical sector and government initiatives supporting biotech research. Countries like China and India are witnessing substantial investments in biopharmaceutical production and regenerative medicine. For instance, China’s 14th Five-Year Plan emphasizes biotechnological advancements, while India’s Biopharma Mission aims to establish the country as a global hub for biopharmaceutical innovation.

Recent Developments

- In August 2023, Astellas Pharma Inc. and Poseida Therapeutics, Inc. announced a strategic partnership to advance cancer cell therapy, reflecting the increasing demand for microcarriers in the U.S. because of the growing number of chronic disease cases.

- In 2023, Lonza Group partnered with Moderna to scale up mRNA vaccine production using advanced microcarrier-based systems. This collaboration highlights the increasing reliance on microcarriers to meet the surging demand for COVID-19 vaccines and other biologics.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Drug Volume: Production and usage volumes of pharmaceuticals.

5.4 Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients.

6. Competitive Landscape

7. Microcarriers Market by Product

8. Microcarriers Market by Cell Type

9. Microcarriers Market by Application

10. Microcarriers Market by End-use

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Related Reports

Single-use Bioprocessing Market to Soar to USD 100.9 Billion by 2032, Driven by 15.9% CAGR Growth

3D Cell Culture Market Forecast to Reach USD 4.0 Billion by 2032, Growing at 12.4% CAGR

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.