Austin, May 28, 2025 (GLOBE NEWSWIRE) -- DNA Data Storage Market Size & Growth Insights:

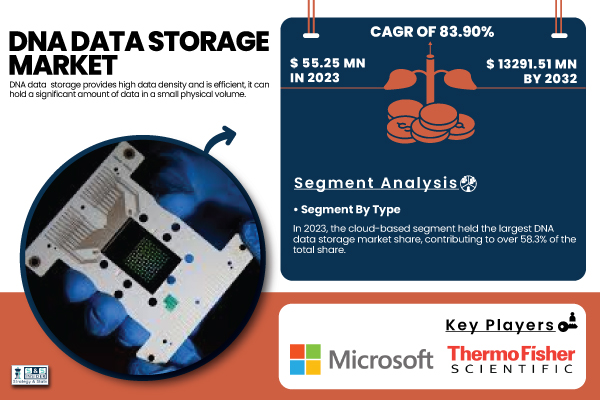

According to the SNS Insider,“The DNA Data Storage Market was valued at USD 55.25 million in 2023 and is expected to reach USD 13291.51 million by 2032, growing at a CAGR of 83.90% over the forecast period 2024-2032.”

DNA Data Storage Market Growth Driven by Digital Data Surge and Technological Advancements

The market for DNA data storage is growing rapidly as digital data has been growing exponentially, and traditional storage media cannot catch up. The stuff. “It’s about as dense as biological data storage gets,” the article reads, and that’s correct: You could store a petabyte of data in a gram of DNA, so it’s well suited to storing vast amounts of archival data. Major industries including biotechnology, healthcare, media, and government are requiring secure, intricate, and energy-efficient storage systems, and are driving market growth. Technological innovations on the DNA synthesis/sequencing/encoding front are rendering it more and more scalable and cost-effective.

The size of the U.S. DNAdata storage market was estimated at USD 15.78 Million in 2023 and is anticipated to grow at a CAGR of 83.56%.

Get a Sample Report of DNA Data Storage Market Forecast @ https://www.snsinsider.com/sample-request/6505

Leading Market Players with their Product Listed in this Report are:

- Microsoft (Project Silica)

- Twist Bioscience (DNA Data Storage Platform)

- Illumina (NovaSeq DNA sequencer)

- Thermo Fisher Scientific (Ion Torrent Genexus System)

- Catalog Technologies (Shannon DNA Storage Platform)

- IBM (DNA Fountain Coding Strategy)

- Helixworks (Digital DNA Drive)

- Iridia (Electrochemical DNA Writer)

- GenScript (gBlocks Gene Fragments)

- Quantum Corporation (DNA Archival Storage Research)

- Zymo Research (ZR DNA/RNA Shield)

- Oxford Nanopore Technologies (MinION Sequencer)

- Evonetix (Thermal Control DNA Synthesis Chip)

- DNA Script (SYNTAX Platform)

- Southwestern University & Microsoft Research Collaboration (Long-term DNA Archival Storage)

DNA Data Storage Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 55.25 Million |

| Market Size by 2032 | USD 13291.52 Million |

| CAGR | CAGR of 83.90% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Type (Cloud, On-premises) • By Technology (Sequence-based DNA data storage, Structure-based DNA data storage) • By End User (Biotechnology & healthcare, Banking & finance, Government & defense, Media & entertainment, Others) |

| Key Drivers | • DNA Data Storage Market Growth Driven by Digital Data Surge Sustainability and Technological Advancements. • Growing Demand for Sustainable Storage Drives DNA Data Storage Market Growth and Commercial Opportunities. |

Purchase Single User PDF of DNA Data Storage Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6505

Massive investments are being made by large companies, research organizations and government agencies, particularly in countries such as the U.S. and Canada, which are rapidly advancing the pace of innovation, lowering the cost of sequencing and boosting commercialization. Furthermore, the green and sustainable data centre is also fostering interest in DNA storage, as it consumes low energy for long-term preservation, which would make it a future-proof solution for the data challenges of massive computation.

DNA Data Storage Market Segmentation and Growth Trends by Type, Technology, and End User (2023–2032)

By Type

In 2023, the cloud-based segment dominated the DNA data storage market, accounting for over 58.3% of the total share, using the cloud as a data storage infrastructure is scalable and makes data storage remotely accessible to biotech companies, research centers, and companies. Cloud-based solutions provide scalability, reduced capital requirements and leverage of advanced analytics and AI for large-scale genomic, and archival data applications.

The on-premises segment is expected to grow fastest from 2024 to 2032, on account of demand for data security and customization as per the requirement, and for compliance with regulations. Markets like government, defense and finance prefer to keep their data on-premises to have more control and privacy and advances in local DNA storage hardware are making this possible.

By Technology

In 2023, sequence-based DNA data storage held the largest revenue share of 68.7%, due to technological maturity and known ability to store high volume data with no loss by encoding binary in the nucleotides. This applicative technique has been extensively studied by tech companies, universities, and benefits from a high compatibility with current DNA sequencing platforms, which make it suitable for archival applications.

Structure-based DNA data storage is expected to grow fastest from 2024 to 2032. This emerging approach stores data in the three-dimensional structure of DNA molecules, offering higher storage density, faster read speeds, and potentially lower error rates, driven by advances in nanotechnology and molecular engineering.

By End User

In 2023, the biotechnology and healthcare segment dominated the DNA data storage market with a 38.6% share, owing to growing requirement for storing large volumes of genomics, clinical, and medical research data. DNA storage is perfectly suited for the needs of healthcare — long retention, precision and security particularly in an age of personalized treatment and genomic sequencing.

The government and defense sector is expected to grow at the fastest CAGR from 2024 to 2032, driven by increasing concern over data security, sustainability, and national data sovereignty. Governments are investigating DNA storage as a secure, tamper-proof method for storing classified or mission-critical information over the long term with no maintenance.

Do you have any specific queries or need any customized research on DNA Data Storage Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6505

Regional Overview and Growth Outlook of the DNA Data Storage Market in North America, Asia Pacific, and Key Global Regions

In 2023, North America held a 35.8% share of the DNA data storage market, due to strong Research and Development (R&D) infrastructure, advanced R&D in technology and applications of storage which was supported by the government, and private sector investment. The region is home to such major technology players as Microsoft and Twist Bioscience, making it a leader. An example of a practical prototype is Microsoft teaming up with the University of Washington to design a prototype for the automated DNA data storage. The U.S. National Human Genome Research Institute also funds synthetic biology research that promotes the development of DNA storage.

The Asia Pacific region is projected to experience the highest CAGR from 2024 to 2032, driven by prospects of increased investment in genomic biotechnology as well as digital infrastructure. China has the BGI Group driving genomic research, Japan is cultivating university-industry relationships, and India's growing biotech sector and government digital focus makes for a perfect environment for early adoption of DNA storage solutions soon.

Recent Developments:

- In Nov 2024, Trellis BMA is an advanced open-source DNA error correction algorithm developed by Microsoft Research to enhance the reliability of synthetic DNA data storage.

- In March 2025, IBM recently secured a patent for 4D printing technology that uses machine learning to control smart materials for precise transport of microparticles. This breakthrough enables dynamic, programmable materials with applications across advanced manufacturing and healthcare.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Storage Density & Efficiency

5.2 Technological Advancements

5.3 Data Integrity & Long-Term Reliability

5.4 Applications in Artificial Intelligence (AI) & Big Data

6. Competitive Landscape

7. DNA Data Storage Market Segmentation, by Type

8. DNA Data Storage Market Segmentation, by Technology

9. DNA Data Storage Market Segmentation, by End User

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Other Related Reports:

U.S. DNA and Gene Cloning Services Market to Triple by 2032, Reaching $3.53 Billion with 15.22% CAGR

U.S. Dominance in Genomic Research Fuels Surge in DNA Synthesizer Demand Across North America