Austin, May 26, 2025 (GLOBE NEWSWIRE) -- Diet Pills Market Size & Growth Analysis:

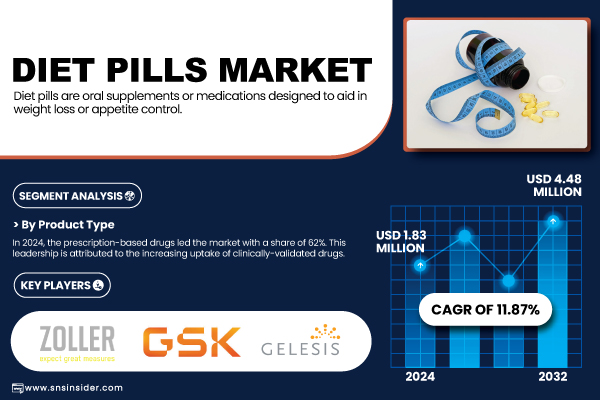

According to SNS Insider, the global Diet Pills Market size stood at USD 1.83 billion in 2024 and is estimated to reach USD 4.48 billion by 2032, with a CAGR of 11.87% from 2025 to 2032. Rising incidence of obesity and sedentary lifestyle on a global level is driving the need for easy to use and efficient weight management methods. Increasing consumer preference for non-surgical non-invasive weight reduction procedures along with growing concern of health hazards associated with obesity is the prediction that is contributing to this market.

Get a Sample Report of Diet Pills Market@ https://www.snsinsider.com/sample-request/3458

U.S. Diet Pills Market is estimated to be USD 0.44 billion in 2024 and is projected to exhibit a CAGR of 12.90% over the forecast period (2025-2032). In the U.S., the high uptake of prescription and metabolism-enhancing weight loss drugs, as well as growing OTC demand in drug stores and retail outlets, are driving growth in the U.S. market.

Market Overview

Diet pills are increasingly growing contoured on the background of increasing trend of obesity, diabetes, and other metabolic diseases worldwide. Worldwide estimates from recent global health data indicate that >40% of adults are overweight or obese, requiring immediate, effective weight-loss interventions. Diet pills present an attractive option to surgery and vigorous exercise.

The market too has gained traction with the expansion of healthcare access and with the introduction of digital health platforms, which provides for online consultations, prescriptions and consumer awareness about weight-loss treatments. The introduction of product innovations, including appetite suppressant/metabolism booster combination products, non-stimulant options or plant-based capsules, has increased consumer use in different demographic target groups, including the young and those in whom there may be contraindications to conventional treatment.

In an era of preventive health and wellness, diet pills are included in overall wellness programs.

Major Players Analysis Listed in this Report are:

- Iovate Health Sciences Inc.

- Zoller Laboratories

- Cortislim

- Nanjing Chang'ao Pharmaceutical Co.

- Vivus Inc.

- Orexigen Therapeutics

- GlaxoSmithKline Pharmaceuticals Ltd.

- Gelesis Inc.

- Herbalife International

- Amway Corp. and others in the final report

Diet Pills Market Report Scope

| Report Attributes | Details |

| Market Size in 2024 | US$ 1.83 billion |

| Market Size by 2032 | US$ 4.48 billion |

| CAGR | CAGR of 11.87% From 2025 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segment Analysis

By Product:

In 2024, prescription-based drugs held the largest share of the market at 62%, owing to clinical efficacy, regulatory backing, and physician trust in managing moderate to severe obesity. These drugs are often the first line of treatment for individuals with comorbidities like diabetes and hypertension. On the other hand, herbal remedies have emerged as the fastest-growing product segment. Their rise is driven by a global trend toward natural and plant-based healthcare solutions, especially among younger consumers and those wary of synthetic chemicals.

By Application:

Appetite-controlling pills accounted for around 48% of the market share in 2024, making them the dominant application. These pills are preferred for their ability to help regulate food intake and reduce binge-eating behaviors, which is common in sedentary urban populations. However, metabolism-boosting pills are seeing the highest growth rate. Consumers increasingly favor them for their perceived ability to burn calories efficiently, especially when combined with minimal physical activity, which aligns with the busy lifestyles of working professionals.

By Distribution Channel:

Retail pharmacies led the distribution channels with 53% of the market share in 2024. These outlets are accessible and trusted by consumers, offering both OTC and prescription-based diet pills. Meanwhile, hospital pharmacies are growing rapidly as healthcare providers increasingly prescribe weight loss medications in clinical settings. The credibility and availability of post-consultation guidance in hospitals make them the fastest-growing channel.

Need Any Customization Research on Diet Pills Market, Enquire Now@ https://www.snsinsider.com/enquiry/3458

Diet Pills Market Segmentation

By Product Type

- Prescription-Based Drugs

- Over-the-Counter Drugs

- Herbal Supplements

By Application

- Metabolism Raising Pills

- Fat Blocking Pills

- Appetite Controlling Pills

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Drug Stores

Regional Analysis

Asia Pacific dominated the global diet pills market in 2024, driven by rising obesity rates in densely populated countries like China and India, growing disposable income, and rapid urbanization. The regional market benefits from both traditional medicine integration and increasing acceptance of Western pharmacological treatments.

North America emerged as the second-largest regional market, fueled by the high prevalence of obesity, strong pharmaceutical infrastructure, and widespread insurance coverage for prescription weight-loss medications. The U.S. market, in particular, is witnessing a surge in consumer spending on lifestyle-enhancing drugs and an increase in online pharmacy adoption.

Recent Developments

- In March 2025, Eli Lilly reported successful mid-stage trials for orforglipron, its once-daily oral weight loss drug. The pill demonstrated significant weight reduction, potentially rivaling injectable GLP-1 therapies.

- In April 2025, Pfizer halted development of its oral weight-loss candidate, danuglipron, due to adverse side effects in Phase 2 trials, indicating market risks in oral anti-obesity drug development.

- In November 2024, Nature’s Way released SlimBiotic Naturals, an herbal diet supplement containing green coffee bean extract and garcinia cambogia, entering the fast-growing plant-based pill market.

- In September 2024, PhenQ introduced PhenQ PM, a nighttime fat-burning formula to complement its popular daytime version, appealing to 24-hour weight management consumers.

Statistical Insights and Trends Reporting

- Over 1 billion adults were overweight, with more than 650 million classified as obese worldwide. This demographic forms the core consumer base for diet pills.

- North America accounted for over 40% of global prescription diet pill sales, driven by advanced healthcare infrastructure and favorable regulatory support.

- The number of diet pills sold annually is projected to nearly triple from 1.2 billion units in 2020 to over 3.4 billion units by 2032, with strong demand from Asia Pacific.

- Consumer out-of-pocket expenditure on weight-loss supplements and prescription pills accounted for 65% of total spending in emerging economies due to limited insurance coverage.

- Online sales of diet pills witnessed a 45% year-on-year growth, especially in urban markets, due to increasing e-commerce penetration and discreet delivery services.

Buy a Single-User PDF of Diet Pills Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/3458

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Obesity and Overweight Prevalence (2024), by Region

5.2 Diet Pills Consumption and Usage Trends (2024), by Region

5.3 Prescription vs. OTC Diet Pills Trends (2021–2032)

5.4 Consumer Spending on Weight Management Products, by Region (2024)

5.5 Internet & E-Commerce Sales Trends for Diet Pills (2021–2024)

5.6 Regulatory Trends and Product Approvals (Recent Years)

6. Competitive Landscape

7. Diet Pills Market by Product Type

8. Diet Pills Market by Application

9. Diet Pills Market by Distribution Channel

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Related Reports

U.S. Anti-Obesity Drugs Market Set to Soar, Reaching $10.28 Billion by 2032 at 24.07% CAGR.

Global Weight Loss Drugs Market to Skyrocket to $50.26 Billion by 2032, Growing at 43.73% CAGR.

Weight Loss Supplements Market to Hit $161.03 Billion by 2030, Growing at 16.9% CAGR.

Weight Loss Devices Market Forecasted to Reach $8.50 Billion by 2032, Growing at 6.60% CAGR.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.